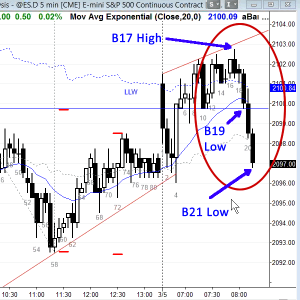

BPA trading room discussion: March 5, 2015

Discussion during webinar after potential first leg of bear channel was forming at about 08:11 PST. Al talked about trade management – in particular position sizing considerations – for traders who were scalping or swinging a trade from the start of the bear leg.

Audio duration: 2min 45sec — Scroll down for image

Audio transcript

17 ticks below the 17 low – 18 ticks now. I think you definitely have to take at least part off, if not all off if you did short up there (top of bear leg).

Think about this for a second. Let’s say a trader shorted up here (B16 close), and they took a big enough position size so that they could risk 2 points. Now let’s say their stop is still up here (above B17). So now they are risking 4 points. What do they do? They have to reduce their position size. Their maximum risk on a full position is 2 points, and now their stop is 4 points away, they have to reduce their position size.

And the institutions trade that way as well. They have a maximum risk on every trade, and once it is exceeded they reduce their position size. And that’s what causes pullbacks, that’s why you have a strong move and then you get a pullback. It’s because you have a lot of institutions with big open profits but the stop is now far away. So their risk is big and they have to get down to a position size that is appropriate for that risk.

Let’s say you get a little pullback, and then the bears short again on the resumption down. Well, then once you get a new low you have a new stop that is not as far as the current stop, so then you can be back to trading a full position. So whenever you get your magic number, like 4 points, double, so the stop is 4 points away, especially on a day like this where you get a lot of two-sided trading, you are going to get profit taking because the stop is up here (top of bear leg). Instead of 2 points you are now risking 4 points and you cannot trade a full size if you are now risking 4 points.

You can say, “Well Al it’s not really my money. It’s somebody else’s money. I bought up here so my account size is really from over here.” No, the money is in your account and as soon as it is in your account, every tick is yours. Every tick you lose is yours – it’s your money. It drives me angry when I hear people who claim to be experts talk about “oh, you are trading other people’s money with a big open profit.” No, it’s your money. To me it never matters where you enter. All that matters is the current price and the current price action. So it does not matter whether you shorted up here (B16/17), you shorted there (B19), you shorted there (B20), you manage all of those trades the same.

If you are scalping you have already scalped out. If you are swing trading, it does not matter if you sold right here (B21 Low). The management is still the same, if you took that trade for a swing, your swing stop is up here (above B20). If you shorted over here for a swing (below B17), your swing stop is up here (above B17). So it does not matter where you entered, your management is based upon the current price action.

Al Brooks

Information on Al’s Online day trading room

ok thanks Al,

but here I think everybody agree that actual risk is above B17 high. I don’t have TradeStation but it looks like the 2* target is during B20. Though since B19 is at a natural low (low of B11 + MA) it is a good place to take partial profit.

I suspect that you are using the term differently from me. The initial risk is to above the 17 H, but the actual risk is less.

The point is you said that actual risk is the one on which everybody agrees and it sound obvious in this case it is B17 high. Apparently for you it is the high of B16 and I don’t understand why it is B16 High (in that case it could be B18 high or B19 high which would reduce even more the take profit level)?

I am sorry if I sound a bit tedious by insisting (though it is not my purpose being tedious 🙂 ) but it is still not clear for me (and it raise a lot of polemics on the forum).

thanks,

Pascal.

i may have made a typo somewhere. the initial risk is above 17. once 19 closed, traders were confident of more down. at that moment, they discovered that they only had to risk 1 tick above 18 to not have been stopped out. Everyone agrees at that point that the actual risk was to 1t above the 18 high. I hope this helps.

I see, but that means you trailed immediately the SL above B18 after B18 closed which doesn’t give much room for the PA to have a lower high.

ok, thanks!

Hi Al,

I am not sure to understand. shorting below B17 is a countertrend trade and as such, a trader should wait for 2 times the risk before taking profit. wouldn’t be better to move the stop lose above B19 high (or even 1t above B17 low) when B19 is closing and to take partial or full profit during B20 at 4 point profit (since the initial risk is around 2 points)???

thanks.

Using risk as a guide to take profits is a good mathematical approach. Actual risk is more important than initial risk because everyone agrees on actual risk, but that is not always the case with initial risk (although it is clear here). In that example, if a trader sold the 16 close and used a stop about 8 ticks higher, and now had 16 ticks profit, his reward is about 2 times his risk and he should take some or all off. If a trader instead sold below 17, his actual risk was 5 ticks and he should take some profit at around 10 ticks profit. I agree that tightening the stop after 19 or 20 makes sense.

Hi Al,

If a trader sold below 17, his initial risk was 8 ticks but his actual risk is only 5 ticks. In this case, do we use the initial risk or the actual risk for the risk component of the trader’s equation: (probability of success) x (reward) > (probability of failure) x (risk).