BPA trading room Q&A: March 30, 2016

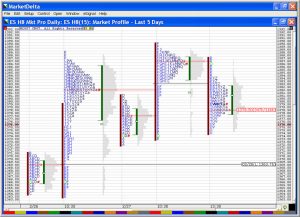

Market profile is a popular trading system for many and Al was asked whether or not he uses it in his trading.

Audio duration: 4min 12secs

Market profile not for everyone!

Somebody asked about market profile. Do I use market profile in my trading? I spent a week with Peter Steidlmayer back — I think 1988 or something, early on. He was getting a lot of publicity then about market profile trading. I think it’s a stupid idea, and I probably lost $3,000 trading that week. I don’t remember. I lost a lot of money. And he was standing right there over my shoulder, and I just think it’s a dumb idea. I think it’s a bad way to portray price action.

Somebody asked about market profile. Do I use market profile in my trading? I spent a week with Peter Steidlmayer back — I think 1988 or something, early on. He was getting a lot of publicity then about market profile trading. I think it’s a stupid idea, and I probably lost $3,000 trading that week. I don’t remember. I lost a lot of money. And he was standing right there over my shoulder, and I just think it’s a dumb idea. I think it’s a bad way to portray price action.

There are many ways to portray it. You can use point and figure charts that portrays it; you can use a line chart; you can use a dot chart. To me, most traders use some form of candle charts. Institutional traders — a lot of them use just line charts. You can use a DOM; that portrays price action as well. But I personally think market profile — you’ll lose money if you do it. To me, I say this — and I apologize in advance: It’s so easy to make money off a five-minute chart that — a day like this, I probably see 40, 50, 60 trades on a day like this. Obviously, I don’t take them all, but why would I ever use anything else? Where else can I see that many trades? I know Richard is listening in and he likes using the DOM (Depth of Market), but I see far more things on a five-minute chart than I could ever see on the DOM or any other kind of chart. Just listen to me all day long; I’m just talking about what the market is telling me it’s probably going to do.

If market profile works for you…

So let me say one other thing about market profile. If a person likes using the market profile chart and if a person’s consistently making money and they’re really happy doing it, I think they should do it. I think if a person likes indicators, or bands, or tick charts, or volume charts, or one-minute charts, or 15-second charts, or hour charts, and they’re happy, and they’re consistently making money, they should do it. If they like oscillators, same thing, right. To me, if you’re making money as a trader, you deserve admiration and respect because you’re doing a wonderful thing. You’re doing something hard and you’re doing it really well, and then if you’re happy doing it, that’s even so much better.

If this is your career, you have to like what you’re doing. You have to come into the day every day. You just can’t wait to get started. So part of what you do as a trader is you explore; you try different things; you try market profile; you try indicators; you try one-minute charts; you try 60-minute charts, but you just got to find where you’re comfortable and you got to find where you can make money. However, to me it does not matter what you do.

Make money doing what you love

I talked to you about what I do. This is my personality. However, anybody who consistently makes money deserves a lot of admiration in anything. If you own a commercial cleaning business and you have guys emptying trash cans at night, if you do a really good job you deserve a lot of admiration. And if I had an office building, I’d want to hire you. You would make me happy. You would be making my life easier. So anybody who does anything well — synchronized swimming, one of the dumbest sports in the world — if somebody does it really well, I’m going to admire what they’re doing. It doesn’t matter. If anybody’s doing anything well, I’m going to admire it because it takes a lot of hard work to do something well, and if it makes you happy — and if you’re doing anything well, just about anything in life, people will pay you. There will be enough people out there, there will be enough demand for anything. So if you do anything well in life — run a restaurant, run a dry cleaner, a grocery store, a shoe repair shop — anything, it doesn’t matter — a website — if you do it well, people are going to pay you. You’re providing a service and you’re — to me, you’re a valuable member of society.So back to trading, if you use market profile, or bands, or any indicators or anything, and you’re consistently making money, and you’re happy, what else can you ask for from a career? That’s your goal. Find something that you like and have it be very profitable.

Al Brooks

Information on Al’s Online day trading room

Thanks for this Al (and Richard)! This was really one of the funniest and most enjoyable Ask Al’s I think I’ve ever listened to!

The advice contained within is profound too; indeed, where else can one find so many logical, profitable trades apart from a five minute candlestick chart?

Hi Al, Do you have the same opinion of Volume Profile ? I find it to be a useful adjunct to “traditional” price action analysis.

Hi Michael,

I believe I can answer Ok for Al on this one. Al does not use volume profile and likely has same opinion, although would not get the ‘dumb’ label perhaps as it less complex and shows potential support and resistance Ok.

If you follow my DOM link above you will find the order flow software that I use in conjunction with price action. The volume profile is part of this. This is what Al is referring to above when he quotes me. I find it very useful but it does add significant time to get into. I will do a guest blog one day showing how I use price action and order flow together. Works well for me.

Richard

I have noticed that Al seems to be getting more liberal lately with his using of “dumb”, “stupid”, etc. It’s great! Hysterical!

Good Notice! Good Eye.

But it is NOT Great! It is not good for Al and its gospel.

I like Al genuinely.

I studied Market Profile for a year or two. It did not help me to make money, so it is “Stupid” and “dumb”.

I studied BPA since June 2009 with 4 books (3 time re-reading) 1 Course (2 time watching), One and half year in the BPA trading room, I have NOT made money yet. ( “I don’t remember. I lost a lot of money”), So is it “Stupid” and “Dumb”?

Market Profile is a genuine DISCOVERY. It helps to view the internal mechanism of the markets, I was amazed by the discovery when I studied.

After Al’s claims, I studied again last night. I still amazed.

I was equally amazed by BPA and Al’s FOCUS.

Hi Al,

Do you use monte carlo simulation for your options trading or other derivatives related trading?

I read all the books by Nassim Nicolas Taleb, and he used it as his favorite tool to define an edge in what he called it “a randomize market”. His style of trading is different from you, since his style is to captures black swan events (extreme low probability events) for extreme high payout with frequent small losses.