Second course offering open

The following article covers original course offering as well as Systems Academy 2 (SA2) which is now open. Admission is based on applying and participating in a discovery session with your coach if your application has been successful.

Systems Academy information: Quant Systems – Systems Academy Overview

You can apply here: SA2 Application Information

Introduction

Systematic trading is much more than trading based on a pre-determined algorithm. There are many parts in a trading system, and trading systems design of the system itself is only the strategic component of a trading program.

Let’s illustrate its impact using an example. Although there are no secret trading strategies, meaning strategies are known and freely available, why can’t most traders trade at least one strategy with a big enough position size so that the profits are meaningful and life changing?

The answer is simple: Risk of Ruin. Everyone understands that there is a real risk of losing their trading account, which worries them into trading small or not at all.

Systems Academy is a one-year program with the goal of taking intermediate to advanced traders through a comprehensive trading systems design and development program and teach them how to develop robust trading systems to trade systematically. But it doesn’t stop there and moved on to teach the student how to incorporate systems into a trading program and build a trading business.

The program is designed to teach you a very unique skillset that only few advanced professional traders possess.

As part of this program, you will learn how to reduce the risk of ruin of your systems to such a small percentage number that it is practically eliminated, yet maximize your system’s edge so that your returns are meaningful.

You will define the limits and criteria based on who you are and the goals you want to achieve and learn to develop your own systems to achieve those goals. In other words, your trading becomes “winning by design”, with consistency, and at almost no or very little stress to you. We believe trading is a pursuit of happiness, so stress and inconsistency have no place in it.

Furthermore, the Systems Academy program guides you to put together a trading program. Most courses teach you strategies. A trading strategy is 1/5th of a trading system and a trading system is 1/5th of a trading program. So in reality, a strategy is 1/25th of what is required for consistent success as a trader. We will show you everything that is required through step-by-step methods and pre-made templates. It will take your trading up into the same realm as institutional trading and help you devise a trading program that suits your lifestyle and goals.

You will validate, with our help, the trading program you have developed, and put it in the market for live trading, but only after you have ascertained its success through comprehensive testing using the scientific method.

Watch the video below for more details (duration 1 hr 12min):

Top 10 problems solved through systematic trading

These are the primary reasons traders resort to systems instead of discretionary trading:

- Predictable Performance:

Systems are tested before they are put into production. Testing reveals the operational envelope of the system, so its performance characteristics are known before the first trade is put on.

- Safety of a Proven Strategy:

The trader proves the core strategy is viable during the test phase of system development process, so when the system goes online there is no doubt about the outcomes.

- Lower Workload:

Systems do all the analysis for the trader and result in much simpler trading processes and reduced workload.

- Increased Productivity:

Systems increase trader’s efficiency which automatically result in higher productivity as trader’s resources are freed up to be used in other areas, such as developing more systems, or implementing the same ones in new markets.

- Removal of Psychological and Emotional Barriers:

Some traders simply cannot execute discretionary methods well due to emotional and psychological barriers. Other traders need the clarity that research brings about before they can pull the trigger. Still others, cannot manage trades well and exit too early or too late. Systems solve all these issues by relieving traders from making a judgement call on each bar. They remove the burden of judgement that usually results in more joyful trading and ultimately trader’s happiness.

- Increased Capital Efficiency:

The system design process clearly defines risk. The risk management component of a trading system allows traders to trade full position size because risk and performance characteristics of the system are both known, resulting in optimal capital utilization and efficiency.

- Diversification while Scaling Up:

Systems reduce the work load on the trader, allowing him to scale up his trading operation into more markets while trading several systems in each market.

- Delegation of Duties:

Systems allow trading tasks to be delegated because the trading algorithm is documented with clear rules, which eliminate the need for a judgement call. So anyone with minimal training should be able to execute system’s signals.

- Automation:

Advanced traders with computer programming skills use fully automated systems to disengage themselves from trade execution and management tasks that allows them to trade multiple markets simultaneously.

- Sustainable High Performance over the Long-term:

Systems are the basic tool for ushering in sustainable high performance. High performance is defined as above average performance over the long term. Systems achieve high performance through consistency, diversification, time efficiency, and optimal capital efficiency. In other words, systems turn traders activities from the state of an expert craftsman into an industrialist businessman. It has the same effects of expanded scale and efficiency of an industrial manufacturing plant that produces lots of physical products with consistent quality. In the case of trading, systems produce lots of quality trades efficiently.

Systems Academy program goal

Our goal is to take you by the hand and lead you on to complete independence, so that you can take trading ideas and turn them into robust trading systems on your own. Then incorporate them into trading plans that help you achieve your financial goals.

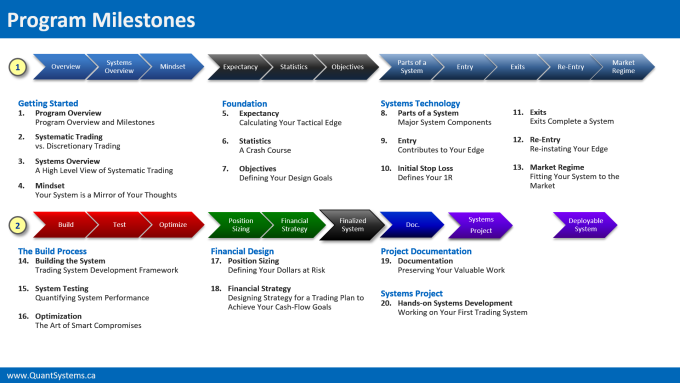

Systems Academy program milestones

Systems Academy assumes the student is already familiar with trading and has some live trading experience. The program begins with an overview of systems followed by building a solid foundation for the tools and techniques required for system development. It then gradually digs deeper into parts of a system, the design process, the build process, and testing and optimization.

To successfully complete the above steps, we required our students to do at least one system development project as they lean the concepts. So, the program has a strong hands-on emphasis on actually doing the work and helping students learn by doing.

Once the trader has built a robust system, the program then moves on to designing a robust financial strategy for that trading system, which will enable the trader to meet their cash-flow objectives.

Format

Systems Academy is an online course supported by live group coaching, assignments, and project work to teach you a rare and highly sought after skillset.

You will learn the system development process, trading system technologies, and skills by walking through the steps yourself through project work which helps you learn by doing.

This is a hands-on program and requires active participation.

What is included

This program consists of the following components:

- Systems Academy online course

More than 30 hours of recorded videos and over 400 slides.

- Systems Project

You will work on developing at least one trading system with your coach. If you like to do more, we encourage and support you.

- Frameworks and Templates

A complete set of frameworks and template used in system development, so that you can be absolutely clear on each and every step necessary to develop robust trading systems successfully.

- Group coaching

Weekly calls with industry veteran traders with a combined experience of more than 50 years, who have founded hedge funds and ran institutional trading departments.

- Bonuses:

- Bonus 1

Systems Portfolio

A collection of fully tested trading systems that you can use as templates and examples to develop your own systems from or just use to trade

- Bonus 2

Ali’s ground-breaking Breakouts Research

A comprehensive research whitepaper from Ali’s extensive work on breakouts with detailed statistics and probabilities of different breakouts and how each one can be used to build a trading system. Prior SA2 students have used this information to build high performance trading systems, including one of our students who manages an multi-hundred-million dollar institutional fund.

- Bonus 3

Systems Academy Code

A collection of innovative price-action based algorithms coded for TradeStation and MultiCharts platforms that could be used for learning how to write correct code for price action analysis, research, as indicators for live trading, or core concepts for further system development. Ali spent most of 2023 to put this module together. It is the result of over a decade of his trading and programming experience. This collection of software is easily worth more than the price of the SA2 program as other companies sell each piece of such software for thousands of dollars.

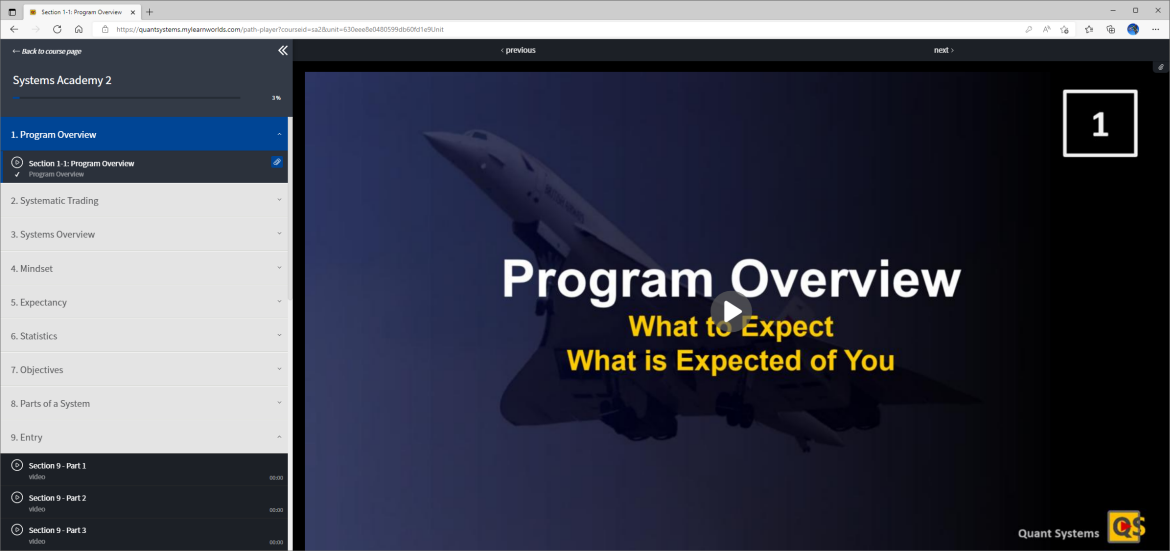

The e-Learning Experience

Here is how you will get access to the content. The screenshot below shows the course player. On the left hand side you see all the sections which you can open to view individual lessons, downloads, and support material. Videos are recorded in High Definition format and the audio is mastered for noise removal and frequency adjustment using the latest AI audio editing and enhancement technology.

The Coaching Experience

Ali, who is also the Systems Academy program creator, teaches most parts of this program. He is known to be an exceptional instructor with students raving about his teaching style. Please make sure you watch the example video of our Pro Trader Mentoring session to experience his teaching style for yourself (link at the bottom of this page) and also watch the two additional free videos below.

This year we have two other coaches, Brad Wolff and James Regan, who are both top graduates of the Systems Academy and bring a wealth of knowledge and experience to this year’s program. Please see below for more details.

Who is Systems Academy for?

Systems Academy is for intermediate to advanced traders who have live trading experience. It is for those who have come to the realization that the trading game is won by design and are now ready to learn how to design for success.

Years ago, I (Ali) wanted to sign-up in a high caliber program such as Systems Academy that is put together and taught by traders not gurus, but couldn’t find any. This program has been developed over a long period of time, as I read books, programmed and tested each concept, and added it in when I was satisfied that it works and it is useful.

I have studied the material regulators in the US and Canada require professionals to learn to get certified, such as Series 3 in the US and the CIM course in Canada. Unfortunately, none of them contribute in any meaningful way to becoming competent traders or system developers.

My goal was to have a comprehensive program to train future employees who are seen as professionals by the regulators but in reality are not traders yet. It raised the need for in-house training that actually works. So, we developed this program for our own staff, and later on decided to open it up to eligible students who share our passion for systematic trading and excellence.

You have an unprecedented and unique opportunity to work directly with professional traders who have a proven track record of success in their careers plus many years of experience.

Are you ready for it?

Student’s success criteria

We are looking for serious candidates who are ready to work on developing a unique set of skills that will set them apart from the majority of traders, even professionals. We spend the time to find talented and committed individuals who can both learn well and contribute to our exclusive community.

We expect our students to work diligently on the course material, come to our sessions prepared, and to work on their projects enthusiastically. This is not a program for someone who wants to watch videos and learn something. The program is very hands-on and requires active participation.

It is obvious that this is not a get-rich-quick program. Systems Academy is for those who want to build wealth and long-term financial independence using the stock market as their vehicle of choice, and need professional level guidance to get results without wasting time. They understand the importance of this goal and are willing to commit themselves to achieve it in the shortest amount of time possible, learn to perform efficiently, and with high quality.

Students’ Experience

A high attendance rate speaks to students’ experience. Compared to the e-learning industry standards, Systems Academy program has enjoyed an off the charts sales record since its release (version 1, taught in classrooms) which has carried over to now. The program has so far sold out before we could interview all of our interested candidates, resulting in a waiting list for our annual enrollment.

Read our clients’ testimonials: click here

Make sure you watch our Trader Development video series on YouTube: click here

The admission process

Systems Academy is an advanced high value program. To ensure the right candidates are admitted into the program, there is a three-step admission process:

- Step 1: Application

You will fill out and submit an online application form. If your application is successful and you meet the admission criteria, you will be invited to a zoom or phone interview.

- Step 2: Interview

The interview process is an opportunity for both of us to ask questions, discuss your personal circumstances, goals, and roadblocks in order to see whether Systems Academy is a good fit for where you are in your development journey. If we both see there is a good fit, you will be offered admission at the end of the interview.

- Step 3: Commitment letter

You will sign a commitment letter to work on your assignments and projects upon admission into the program.

The SA2 program is now open. You can submit an application at: click here

Systems Academy program cost

Systems Academy cost and value proposition is as follows:

- Systems Academy will cost between $15,500 and $19,500, for the first year. The exact cost will be announced when the program is ready for launch, depending on how many students express interest and cost factors not yet fully clear to us.

- It could be purchased by going through the admission process that is by invitation only.

- If you cannot complete the program in one year or need more time to develop more systems and still need continued support, you can buy additional support time on monthly basis for $499, which is much less than the first year’s cost because at this stage you will be working on your projects and likely require less day to day support.

- You will have lifetime access to the course material as long as the Internet exists.

Version one of Systems Academy was sold to a select group of private investors for $30,000 a seat. The current version:

- Is expanded more than 200% based on the lessons learned from version 1.

- Is more comprehensive, with more than double the number of slides.

- It comes with several high value bonuses such as a package of complete systems that you can use as templates and build upon or just use them outright.

- Is powered with the most high value new addition, which is the Financial Strategy Module that shows how to reduce risk of ruin without blunting your systems edge.

- Comes with hands-on project and coaching so that you can develop your first system successfully.

We are delivering at least 500% more value at less than half the cost of the original release.

Value proposition of Systems Academy

- You get to work with an expert who will spend about 200 hours in the course of a year on your improvement. About 80 – 100 of those hours is in a live session and the rest is spent reviewing your project work, communicate by email, and giving you direct feedback. The cost of the program comes to less than $100 an hour for that expert’s time, if we consider the value of the courseware itself, zero.

- The SA2 process, based on what we have seen from past students, speeds up your improvement and saves you about 3-5 years of time. What is the value of 3-5 years of your life?

- We install systems in your trading that allows you to trade six figure and larger accounts with safety.

- You will learn professional level knowledge and acquire skills that very few traders have. You cannot learn this material by becoming a certified professional asset manager. I have studied those courses myself. SA2 is about hedge fund level knowledge and skills.

- I walked this path alone, and it took me over a decade, plus reading more than 200 books, and travelling internationally to work with other experts, paying tuition fees in the range of $25 to $50K, multiple times. Do you have that kind of stamina and resources to do it alone?

- Access to the SA2 library of software, I have developed and coded for professional trading.

- Finally, SA2 is a hands-on course and you graduate with at least one working system, if you do the work. The process of building that system under supervision will ensure your knowledge becomes a timeless skill, so that you can build new systems on your own.

- SA2’s goal is to create independent thinkers in this field, who do not follow anyone.

Who are the coaches?

We created this program as part of our corporate training for our staff. You will work with the authors of this program directly, Ali Moin-Afshari and Kirk Cooper, who are also hedge fund co-founders, managers, and professional traders.

Ali has more than 20 year of experience as an IT professional and more than 15 years of experience as a trader, with over a decade of full time trading experience. His work on developing unconventional systems through first principals and out of the box thinking provided the technological foundation for a new startup firm in Canada. He has written more than four million lines of code for these systems.

Kirk has more than 30 years of experience in finance, working in all levels of institutional trading. He has held C-level executive positions with major international financial institutions, managed trading teams, and co-founded two hedge funds, one of which was bought by Fiera Capital, the largest hedge fund in Canada with over $180B assets under management.

James Regan is one of SA2 top graduates who has done stellar work in coding and system design. James brings a lot of educational and training expertise along with his computer programming and system development skills. View James’ video interview: Click Here

Brad Wolff is another one of SA2 top graduates who is an expert in price action trading and an active contributor to Brooks Trading Course content, trading room coach, and trainer. Brad is one of the few top traders in the world who excels in price action trading. He is a licensed investment management professional.

Quant Systems

QuantSystems.ca is our website dedicated to helping traders take the next step in their professional development, which is systematic trading.

The focus of my work is to help serious traders who have already mastered the basics and have graduated from the beginner level with about 2 years or more of trading experience, to fast track to advanced or even professional levels. That is why we do not offer anything at the beginner level.

Dr Brooks worked with me directly and that collaboration reduced the decade it took for him to become a professional trader to half for me. I am doing the same for others now and our history with our past clients show that we have been able to still reduce that period further down to one quarter, or about 1-2 years.

Frequently Asked Questions

Who has gone through this program before?

Prior to public release, we have only offered this training once before to a private group of investors who paid three time more for it than the price we are currently offering the program. Last year was the first public offering of SA2 and we achieve graduation rates 500% above the online education industry norms. 50% of students became consistently profitable, some trading 7, 8, and 9 figure accounts both on the personal and institutional sides. Please view our Trader Development playlist on YouTube to see some their results: click here

What if I cannot finish the program in 1 year?

You will not lose access to your course material and bonuses. At that point, you have the option of extending your coaching by purchasing extensions.

Do I need to travel?

Absolutely not. We work remotely with students all over the world.

Do I need to know computer programming?

No, but if you already know computer programming, we can help answer your questions. We encourage everyone to at least develop their first system using other computation methods, such as Excel to gain a deeper understanding.

Do I need to have a strong math background?

No, but you must be comfortable with high school level math. We have made the process as simple as possible without heavy math, but you must be able to solve simple equations and read simple math notation.

Do I have to know statistics?

No. We prefer a very basic familiarity with general probability concepts such as the bell curve, but Systems Academy program covers everything that is needed including a module on statistical topics that are directly used in systems testing. We have streamlined and simplified the process so that you don’t have to learn heavy statistics.

How much time do I need to have?

It depends on your background, education, and experience, but in general you should be able to dedicate at least 10 hours a week for one year, possibly more.

What kind of performance should I expect from a trading system?

It depends on the system and your objectives. There are systems that win 70% or more and generate a lot of trades, and on the other hand, there are systems that win 40% of less and keep you in a trade for months. We will work with you to find what is right for the trader who you are, so that you can reliably and comfortably trade the system that you build.

How much capital is recommended?

Considering the time and effort you will put into this program, you will most likely have a six figure trading (or retirement) account, to be worth your investment. We have had students who trade five figure accounts but that is mostly for learning and building experience.

How long does it take to become a systematic trader?

It depends on your educational background, experience, and time and effort you put into learning these skills. It also depends on what you want to achieve. For example, one of the systems Ali has developed, took him five years and only the signal generator part went from 250 lines of code in version 1 to over 4000 in version 34, but that is an institutional grade system and one that is built on unconventional methods, so it needed extensive research and new technology development. In general, you should be able to gain a good grasp of the skills after completing a few systems projects on your own, which typically takes about 1 to 2 years or so.

What is the greatest challenge in this work?

It is understanding who you really are as a trader and what your true limits are. For example, someone might think they are OK with a system that produces 21% drawdowns but makes 55% profits a year, only to find out that after a 10% drawdown they are so nervous that they can’t execute on systems signals.

How many systems do I need to develop?

In general you need at least three non-correlated systems to get a smooth equity curve. We recommend 4 to 6 however, if you are a fully systematic swing trader, that work as a portfolio of systems that manage your portfolio of assets. If you are a day trader, you will need at least two non-correlated systems.

How much work is there once I have my portfolio of systems?

It depends on the nature and number of systems in the portfolio. A day trading system is obviously very involved, but a group of systems that work on daily bars generally need about 15 to 30 minutes of your time per day and about 2 hours during the weekend to prepare for the new week. This is assuming you stop the development work and only run those systems.

Can I just get your systems and start trading them?

We do not recommend it. Numerous studies and trials have shown that traders can trade the system they have developed themselves better than someone else’s system. It is theoretically possible, but you will likely find that your psychology gets in the way of proper execution of systems developed by someone else and ruins the system’s edge due to all kinds of mistakes.

Is there a money back guarantee?

Yes, if you complete your assignments and finish and submit your project and are still unsuccessful in generating consistent returns, we will refund your tuition. If you do not complete the program or do not finish your projects, you do not qualify for our money back guarantee. There is also no trial period. You know this is right for you if you are ready. This guarantee does not cover human factors of trading. If, for example, you develop a valid system and for emotional or psychological reasons cannot trade it well, we can’t help you since we are not psychologists, we are technical traders. This case is not covered by the money back guarantee because the work product of the course was achieved.

Why is systematic trading important?

It is the “one thing” that makes the difference between consistent long-term success and inconsistent results. It is the skillset that enables the trader to reduce their chance of ruin to an infinitesimally small value (practically almost zero) while maximizing the return on their edge. Most traders do not understand this concept and even when they do, they do not know how to implement it.

Bonus support videos

When I was getting started, I wanted to have an opportunity to take a look under the hood. I think you might feel the same, so I made these videos to show you exactly that.

In the first one (Systematic Mindset) I talk about a business-like and systems-driven approach to organizing your trading and show examples of my work in support of this approach.

The second video (Behind the Scenes) takes you on a tour of researching a concept, recording the results, and how the signals generated by the production-ready computer algorithm we did the research for, looks on a chart.

Clarifying Systems Academy process:

Many of you reached out to me by email asking about the system development process, so here is more information about our approach:

We will first learn systems theory, methods, and techniques used for system development.

But we do not start developing systems until you decide on your financial goals and objectives, first. At this point, you and I agree on what your first systems project should look like.

The work starts with your financial goals, then we work back to what needs to be done to meet them, considering who you are as a trader so that the solution is a good fit for you, the execution trader and the new system owner.

We are not looking for something that works, but rather a solution that helps you achieve your goals in a way that is actionable and doable by you.

These other parts are more important than the system itself. The system is only the tactical part of your financial strategy. I have explained this in the videos.

Once you have gone through a full cycle of Financial goals -> System objectives -> System design -> Build -> Test -> Live trading, under supervision, you have the skills and the experience to do this again for your next idea or project and now have earned your wings to fly solo.

Most of our work is on your project not on learning the science of systematic trading.

Hope this helps and makes sense.

Ali.

Hi Ali,

Can you provide details on how students will be conducting backtesting? I’m assuming it’s a manual process?

Also, will you provide feedback as students propose the trading strategy they want to test? For simplicity, let’s say I wanted to test a strategy that enters on 50% PB of a trend. Would you be able to say, “yeah, tried that already and it doesn’t have positive expectancy” or “this could work if you cancel trades when XYZ happens”, etc?

Since so much work goes into testing and optimizing each idea, your expert guidance on strategy ideas that tend to work and those that don’t would be huge value add. Helps avoid wild goose chases.

Quick backgrounder on why I ask. Last year I had a developer who was building me algos based on pretty much any idea I thought of. Fully automated trading. From idea to computer backtesting to live paper trade in about two weeks. Rinse and repeat. Accumulated gobs of data on multiple strategies really quickly.

But . . . none of them ended up being profitable in live trading, so I paused all work there. It was a bummer! Obviously, something I was doing wasn’t working and I need to learn more.

Back to my question about testing. Prior to having the developer and algo platform, I was backtesting the core strategy manually by eyeballing the charts for the signal and recording the outcomes in Excel.

So I’m used to the grind of doing whatever it takes to gather the data. But it’s painstaking work as you know.

Having you and Kirk pointing us the in right direction on strategy ideas based on your experience – before we head into the testing weeds – would be a key factor for me.

Thanks for your time!

Jeff

Jeff,

I do not advocate fully automated trading because it is difficult for most people to program correctly. Then there are the hidden costs of running it. It is more suited to a team setting with different expertise, who are well financed.

Most people even cannot code measurement techniques well. Look at all the code examples online. Most indicators are a about 100 lines of code or less. The ones I have programmed and use in live trading are at least 1000 lines and more and call functions that are 1000 lines or more, each.

There is a lot of detail to program to build a robust system. The programming effort increases as you lower your execution timeframe.

Then there is the trade management package, which is a complex system by itself. In the literature, the least amount of space is dedicated to this part of the system, yet in the code I have written it is usually the longest section.

For those reasons (and more) I encourage everyone to first learn to think systematically and get very familiar with techniques and systems technologies, then to build systems for manual execution, but put their most amount of effort into the financial design that governs those systems.

Now back to your question:

If you’re designing a system for manual execution, you are going to live with those trades. You will do yourself a favor by back testing at least some of the data by hand so that you get to understand what living with those trades looks and feels like. It is not wasted time, because while gathering data, you are also training your psychology to handle those trades and not get in the way, trying to save you.

It will also highlight things you’ve missed that you will never discover in automated back testing.

Once that is done and only if you’re a competent programmer, you can use a trading platform like Ninja, TradeStation, AMI Broker, or MultiCharts to back test.

I have written a lot of systems and still prefer to at least partially back test by hand, certainly in the initial phases when the rules are still being adjusted. The insights you gain are priceless and often result in exponential improvements to system rules you would have otherwise missed completely.

From a value point of view, writing a good system cannot be easy and quick. Nothing of great value is achieved that way, well, except maybe inheritance. 😉

Thanks Ali, that’s super helpful input.

Makes perfect sense, I learned a ton by doing manual backtesting and seeing how everything plays out on the chart.

To clarify about the other question: Will you be able to provide students in the program direct feedback on the strategies we’re exploring so that we can avoid rookie mistakes in the construction of the strategy?

Thanks!

Jeff

Thanks Jeff.

Yes. If you look at the program milestones, the last one, number 20, is a systems project. This is the hands-on part of Systems Academy. I require everyone to develop at least one fully tested and ready for production system. Work on this project begins around the start of second track, when you’ve learned systems theory.

The idea is that you begin working on your first system while still learning. You will talk about your work or send in progress reports so that I can fix things and help you along the way.

I think when you have successfully finished the first one, you are in a good position to build the next one on your own and likely faster, too.

Thanks Ali.

Ali,

By the way, if you ever want a review of the instructional design of your training program, I’d be happy to help.

The overall course flow looks great, so you seem to already have a good handle on instructional design. And you’re in the second cycle of your course design, which is great.

But if you want a second set of eyes on the flow between the learning objectives > assessment method for demonstrating objective was reached > design of learning resources to help students succeed on the assessment . . . then I could be a good resource.

No charge. (And I promise I’m not just trying to get a free sneak peak. This is a legit offer.)

I’ve been a business professor for 16 years and co-created two applied Bachelor’s degrees (meaning they teach practice over theory). Plus big digital projects with major publisher. Corporate training program too (although that was a while back).

Instructional design is my specialty – especially for adult learners and especially for tangible skill building.

I’ve been so enriched by all the content and teaching that Al provides – at such a low price. This is me giving back.

No response needed here. You have my email if you’re interested.

Thanks,

Jeff

I will say straight up I feel and think Ali and Kirk are very genuine and very accomplished traders and gentlemen. I expect there is lots for me to learn, that’s always a great opportunity. One question I had related to indicators such as MACD, RSI etc (BTC students not typically big fans) but I see from the video systematic calculations have been used to enhance price action methods – that’s a relief.

I really hope the course progresses as it’s a fantastic opportunity to learn, try out ideas and improve one’s trading skills and find that elusive freedom.

Tom.

For fully manual discretionary trading, you don’t need any indicators. However, when we develop systems, we use computers to do part of the work. The computer must be able to measure and assess markets. This is done by an algorithm. You’re welcome to call it what you want, indicator, analysis technique (as TradeStation likes to call it), or something else.

Think about the old days that cars were hand-built. The craftsman’s skills, eyes and other senses ensured the quality of the product. In a modern robotic car factory, sensors and computer algorithms do the same for the robots who depend on processed data to work properly.

A trader who trades on a simple chart by hand is like that craftsman, and a systematic trader who runs algos, is like the modern car factory. The product is not going to be a hand build Rolls-Royce but it could be a decent BMW.

This topic is discussed in great detail in Section 2 of the Systems Academy program.

A trading system can scan the market and find trading opportunities. This is a form of industrializing your trading. Without some way to measure and compare, it would not be possible.

If a trader’s goal is to sit at a screen and trade on a single chart all day, there is no need for anything else. But if the trader is interested to trade many different symbols and hold positions longer, and not sit at a screen all day, then a system can be a great asset to help to automate the process to a good extent.

Finally, there are indicators and then there are indicators. I have written measurement algorithms that have zero lag and could be used even on 2 min and Tick bars.

My point is that deep understanding and good research plus a doze of creativity can go a long way. There are no limits and for someone with above average computer skills and the will to do it, there is an open field.

thanks Ali for a comprehensive answer. Correct I don’t want to spend all day, every day in front of the chart(s). I could do for a selected (active) market for 1 to 2 hrs per day but I also like the systems idea where the work is up front with a view to freeing up time later. Yes trading Al’s methods – a true craftsman approach which requires great skill and mental attitude – we study and learn constantly.

Hello Ali,

Is there any inclination to perhaps sell your code (specifically those color coded bars, min scalp calculator etc in your video), for us older technically challenged folks who desire a system and PA trading but are unable to code.

Hi Luke,

I am not planning to sell any one of my system. However, this question comes up frequently and I might make the signals available to traders in the future. Building the technology to do so, is a project in itself.

Using them correctly needs training, too. So, it is really not all that simple.

I can share my tools, however. The problem with that is the TradeStation AppStore has stopped admitting new developers because it is not a profitable part of their business. If there is enough demand, I might be able to negotiate with them to make an exception.

The other problem is what I explained in my response to Mike (see below). You can only trade well what is a good fit for you.

Some of the signals I trade are so scary that others will likely never be able to trade them correctly. Their psychology will force their hand to save them from a scary trade which in turn, will change a valid system by incorrect execution and turns it into a losing one.

The reason I can trade those scary signals is that I have done the research and proven to myself (i.e. at a subconscious level) those scary trades are safe and high probability winning entries, so my psychology brings up feelings of happiness, instead of fear, when the signal comes up and allows me to trade it correctly.

You see the difference. The real value is in doing the work yourself so that what you do is a close fit to your personality.

That is one of the reasons that motivated me to share this program with everyone.

Thanks Ali

Hi Ali, I am interested in your reading list from the books you have read and would recommend if you are willing to share. Thanks for sharing the intro/info videos on your training. I really like the way you have framed the course and your approach to systems trading.

Thanks,

I will put together a reading list, as many people have asked for it. Problem is that no single book is enough, as I explained below in my response to Mike.

Makes sense. Thank you! Maybe just your top 10 -20 list of most impactful.

Ali,

I’ve been trading for over 20 years. I’m way past “achieving the level of sophistication needed to appreciate systems”. I’ve used and created many tradings systems. They work great until they don’t. The market is constantly changing and these types of systems are nothing but optimized back testing. The best way to make money using them is to sell them!

I respect the work Al does because he lays out all his techniques in books and videos and does not ask for $10,000. Your presentation is slick and very impressive and will certainly draw the attention of some inexperienced traders. If you wish to establish real credibility then please provide a sampling of the systems you’ve created at Advanced Technical Methods Inc. and the real time results. Cheers.

Mike,

My plan for the Orlando workshop is to demonstrate discretionary rule-based systematic trading on the 5 min chart of ES futures, through live trading.

In my presentation, I will explain the technology behind one of the systems I have designed and use for trading, which is an algorithmic version of a discretionary price action trading concept, in order to show a robust system works on all instruments and time frames without the need for any optimization or constant tweaking.

I will also show test results and system performance statistics for that system.

So, you will see that system at work in live trading, then understand its technology and design philosophy, and finally see its performance data over a long period of time.

Unfortunately most system developers never succeed because they fall into the same traps you have experienced yourself. That is why I am motivated to share my knowledge and experience with others.

Why is that? because numerous studies have shown you can only trade what is a good fit and comfortable for you.

So, traders must design their own trading programs and adjust it for most comfort and maximum safety to have longevity in their careers. To do this well, you need a balanced amount of a lot of different things. First, you need to know what to take from the literature, then you must be able to put them together in the correct way, and finally to balance it out to fit you well.

That is a lot to ask and expect. Furthermore, if you are not shown how to do it, odds are you won’t find it in the huge pile of literature. Also, there is a major experience factor that cannot be found in books.

For example, I was fortunate to be able to work with Al directly an ask detailed questions several times a day to understand his thinking in depth, which was critical in enabling me to code some of the systems he runs in his mind for trading.

The major cost component of Systems Academy is my time. Had it been possible to read books and write good systems there would have been absolutely no need for this program.

The books are out there and I have read the same material everyone has access to. However, it is impractical to think I can write another 500 page book and suddenly change everything for everyone.

But it is possible to work closely with a talented and driven student for a year or so and guide them to their success in the way that works for that particular person.

This is why I spend a lot of time to ask question, write responses to quiz submissions, and personally interview everyone to find strong candidates. I hope it makes sense.

Finally, I am not looking for, nor am I interested in fame or credibility in the marketing sense of it. As an introvert trader, my work is its own reward and speaks for itself.

I can put it out there, but it is up to others to be open minded enough to see if it can help them as well?

Great opportunity, I’ve reviewed 2 videos, the 1 hour, 12 min and the 10 min 51 sec, the Behind the scenes 27 min 41 sec seems to link to the 1 hour, 12 min video, is there also a Behind the scenes 27 min 41 sec video available? otherwise, I enjoyed your presentation and look forward to learning more.

Thanks Ron,

The 3 videos are all on this page. The Introduction to Systems (1:12Hr) gives an overview and what systematic trading is all about. The Behind the Scenes (27min) video shows how a system is researched and tested, and the Systematic Mindset (10 min) video talks about a business-like approach to trading that uses systems to automate most tasks.

Hi Ali:

Program looks very interesting. I’ve taken the quiz and put myself on the wait list.

I’m noticing the same thing as Ron regarding the video. The Behind the Scenes video is linking to the 10 min 51 second Systematic Mindset video again.

Can someone check that embed? Really interested in watching that Behind the Scenes video.

Thanks!

Jeff

Scratch that – I refreshed the page and the correct video is now showing. All good! Thanks.

Why is this post here? This is nothing but an advertisement for another trading scam and is contrary to everything Al teaches and talks about. Somebody dropped the ball here.

Ali has been a student of Al’s for years and is presenting with Al Brooks in Orlando this year.

I am certain Al Books approved Ali posting this blog post on the website. This is not a scam ad.

I have known Ali for about a decade. He is a good person who is honest, thoughtful, smart, disciplined and consistently profitable.

He and I have different approaches, but similar perspectives. He has successfully programmed several of my concepts and lots of his own. I believe that many of you might find his insights to be interesting and helpful.

For me, doing a workshop with Ali will be fun. Also, I think many traders would find it worthwhile to see him scalp and me swing trade for a day.

If enough traders enjoy it, he and I might do a couple workshops a year for a year or two, and we might also do some live-trading online webinars as well. I know a couple other traders who would be interested in trading live at future workshops if enough attendees find the Orlando workshop helpful.

It will be sooooooo interesting to see you both trade live.

The missing link for me is seeing how you actually make the trade decisions. When watching the webinars, I was always asking myself:

– Did Al take this setup? Why or why not?

– When did Al add to losers?

– When did Al add to winners?

– When did Al bail early on the trade due to price action he didn’t like?

– When did Al go full Walmart method, let the trade play out, and possibly let his stop get hit? (if that ever happens)

Watching live trading will fill in a lot of these gaps that seem to be missing in my execution. Priceless.

Thanks!

Jeff

Jeff,

A critical decision making enabler is in-depth understanding of the concept of setup-trigger, which I explain in the above video on a chart.

The next important one, is what filter you will use to delay action. And what would the delayed action look like. Again, there is a situation where I show an example of that in the above video.

The better you define those two things in your trading plan, the easier it gets to not hesitate pressing the mouse button.

Beyond that, the final enabler (of quick action) is your research into the few concepts/setups/signals you prioritize to trade. Please see my responses to Mike’s and Luke’s posts, above.

So, you need three things:

1. Clarity on Setup/Trigger concept for all the price action concepts you want to trade.

2. Clarity on 1 (and maybe up to 3) filters for each one to delay entry, and what the delayed entry looks like.

3. Enough research to convince your subconscious mind your actions won’t wipe out your account.

The above summarized your success criteria, which means you also need clarity on the failure criteria. What will get you to cancel entry while waiting, and what will get you to exit an open position? You need clarity on those, too.

Thinking of markets as Ying-Yang. The Ying part is the 3-step process above, you need the yang part, too.

There is more, obviously, but if you do the above well you will be a long way ahead of a lot of discretionary traders.

As you see, this is thinking systematically. We breakdown a complex task into small, easy to define, easy to execute parts with clear input/outputs, then do nothing else unless information (i.e. price action data) could satisfy our input criteria, passes through our filters, and does not trigger the Yang (i.e. cancel) criteria, which really is the opposite setup/trigger for the person taking the other side of your trade.

Hope this helps.

Mike,

Every trader, no matter how discretionary in their approach, or what methodology they choose to trade, runs trading systems.

We are offering this program to relatively advanced traders who understand this and now feel the need for gaining a deeper understanding of systematic trading.

If you see no place in your trading for systems, I encourage you to continue trading and learning more until you achieve the level of sophistication needed to appreciate systems.

By the way, I helped Al in the production of the current online version (the new) BTC, by designing the slides, consulting on how to develop it best, and I am also the proof reader for Brooks Trading Course.

Ali,

The idea of systematic trading is intriguing for retailers but not sure if it’s successful with limited retail funds and that too with changing market dynamics at rapid phase like the recent high volatility swings that were rarely witnessed during events but now it’s becoming a normal norm, more fake breakouts with underlying supportive volume, more than twice or more points swing on a single 5min bar etc..all this means systems need frequent tweaking if not more drawdown?

Is this $10,000 course for us to learn on how to build a system trading strategy? Is it on any markets or only on US indices?How is it different than to many freely available algorithimic trading programs online?and if I’m going to share, record, document a high probable success strategy to the academy in excel for a year and I wonder why there’s a cost to this course when there’s a mutual benefit in it?

Kind regards

NK

Nagesh,

As I explain in the videos, Systems Academy Program’s focus is to teach you “how” to take an idea and develop it into a trading system. It is market and technology agnostic, meaning we teach the techniques not computer programming. Except the example systems, we do not give you pre-made algorithms (like the ones you mentioned), but encourage you to develop a system or a set of systems that fit you well, so that you can trade them without being hampered by psychological barriers.

Understanding “how” to record a strategy, “what” to do to fix is issues, and “how” to design a robust financial strategy for it, plus working with people who have done it for decades is the value proposition of this program.

Otherwise, you’re welcome to read the books and articles, and use online free resources to do it on your own, which is what I did. In my case, it took more than ten years to get it, but you’re probably younger and smarter, so hopefully it won’t take you that long.

Extremely interesting. Somehow I have this idea of a fully automated trading system back to my mind for the past few months by now… Patiently waiting to get more info on how such a goal could be achieved timely/efficiently. Operational challenges are needed to be addressed too.

Eli,

Systems Academy can show you how to design the idea into a system but it does not go deep into coding it, as I explain in the above videos. Writing software for a fully automated system is an advanced technical skill. Attempting to do both inside a 1 year program is setting ourselves up for failure. Hope that it makes sense.

Thanks Ali. So at the end of the process we still need to trade manually? No decisions and associated orders execution are being made by the system automatically on my trading platform? even not partially?

I think yes. As Ali said we would learn how to create a good back-tested, personally customized system, and the financial strategy to implement it successfully. Automating that system to trade by itself will require high level coding which that will need another 2 years (minimum) of learning coding specifically.

Eli,

Yes, that is your best bet. Sections 2 and 3 of Systems Academy explore that topic in great detail. However, it is possible to write fully automated systems, I simply do not think it is the best use of your time and energy.

Hi Ali,

I am interested and look forward to updates on the offering.

Thanks James

Hi Ali,

I am very much interested in this and looking forward to learning more.

Thanks Brad.

Ali,

The photo of you with your books, are you standing directly in front of Al’s four? I didn’t see them on the sides 🙂

Avi,

Yes, you are right. The photo was not taken intentionally, and by design, I am literally blocking all the “good stuff”!

Since this program is promoted in this website, and this is completely difference with PA trading, does it means that Al’s also recommended it for PA trader?

Danny,

Every successful trader, even the most discretionary price action trader, runs more than one system. They are in the mind of the trader however, sometimes at a subconscious level, and usually not documented, but they exist. They are categorized under rule-based discretionary systems and have a wide spectrum between how much rules they enforce and how much they allow trader’s discretion. This program, however, goes far beyond this simple explanation, as I explain in the above videos.

I realise this is an opportunity of a lifetime. Sadly, I am not an intermediate or advanced trader yet. Hopefully, this opportunity remains open in the future when my skill level aligns with the program demands. Trading using quantitative systems is already aligned with my personal goals and I am working hard on leveling up my trading skills. Thank you for this initiative.

While I am working on my trading skills, would you recommend something I can do in the meanwhile, so when the time is right, I can take a deep dive into the program you’re offering?

Thanks Abir.

Wish you great success in your work.