We always bank on our past experiences, especially if they have been successful ones, when confronted with a new task. In 2006, when I started teaching myself how to trade I fell back to my most recent learning experience that started in year 2000 – using visual learning as a tool to help control my trading behavior. Back then I decided to learn computer networking and to become a Cisco expert. It took more than four years, about 100 books, and an extensive home lab. The learning was so successful that it allowed me to not only start a new consulting business but also to emigrate to Canada without loss of seniority and eventually landed me a great job within the first three weeks of moving to Toronto. Nine months later I was able to move to freelance consulting. Naturally, when learning how to trade, I began reading a lot of books on trading, but this time also hired mentors, and signed up for classes. I guess you know how it goes: I took the long way to find price action trading is the best method.

I have a Masters degree in education and understand how learning takes place. It starts at the basics and goes around to come back to where you started. If you consider the process as a circular move, which started with the first basic concept learned, each repetition takes you back to where you started but at a higher level, like a spiral. Over time, with many repetitions, you accumulate more knowledge about the task at hand and gain depth of understanding. This is why reading something once is usually not enough to master it, especially if you still do not have enough background knowledge about that subject.

Moreover, different people learn in different ways. For example, I am a visual learner. Even when I read, my mind is creating pictures and linking them together in a big cloud over my head. Most of the time I use a paper pad to draw on while I read. During my networking studies, I drew thousands of diagrams, charts, and network protocol maps. It proved to me I will learn best if I continue to draw instead of taking notes. By the way, it is a proven fact that writing turbo charges any kind of learning because different neuro-pathways are activated simultaneously, this enhances the experience.

After reading Dr Brooks’ four books several times and watching the Brooks Trading Course videos many times I was still not fully grounded with the concepts. I could analyze any chart in great detail at the end of the day, but the knowledge was not readily available for trading in real time. The knowledge itself was offline. Situations like this point to gaps and disconnects between concepts already learned. The solution in my case was simple: start a new review and take visual notes – visual learning.

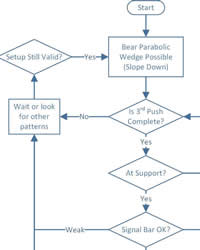

I had a career in IT and business management, so the best tool for me is the simple flow chart. Flow charts have the advantage of showing decision points and possible branching paths clearly. This is critical for day trading because traders do not have a lot of time to make decisions. The fewer the decisions, the faster the resulting action. After drawing a few flow charts I thought were the easy ones, I saw that even for trading a simple parabolic wedge for example, the trader must make at least seven major decisions and many more minor ones.

This means you need much more simulation, thinking, and practice in general to be able to perform in real time when you are also under stress.

The stress comes from three sources: the money at risk, market uncertainty, and lack of time. The effect of stress on human performance is known. It reduces the information processing capacity of the conscious mind. That capacity is only 7 to 10 simultaneous information elements when you are relaxed and drops to 3 to 5 under stress, or less. Also, for certain people, for example a three-digit number can be considered three elements instead of one number or a single element.

Stress also activates the “fight or flight” process. I am not going to discuss it in detail but it means you will do whatever you are doing faster and harder. In trading, it usually translates into making the wrong decision (due to reduced mental capacity) and trading it with bigger size quickly, not waiting for bars to close or signals to complete.

This is why day traders in training must train their sub-conscious mind to process signals and make trade decisions as much as possible. The sub-conscious mind has a greater capacity for information processing and does it faster than the conscious mind. Athletes, soldiers, pilots, firemen, ER doctors, network support engineers, policemen, and other professionals who must respond quickly under stress are all trained long and intensively for their minds and bodies to develop COEXes (COndensed EXperience), which is a psychological term for training your sub-conscious. For example, when you driving and at the same time talking to your friend in the car, COEXes you have formed to skillfully drive the car are controlling the car, allowing you to take your conscious mind off the driving task and allocate it to the conversation.

The key is to rehearse your actions after seeing a specific signal enough times so that signal recognition becomes instantaneous and responses become automatic. Therefore, it is possible to trade all day without getting much tired while at the end of the day you probably won’t exactly remember what you did to make the profits you made.

To get there, in my experience, there are only two ways:

- Trade for a long enough time to gradually build the experience through the years.

- Train actively to build the required COEXes, through:

a. Selecting the best mode of learning. For me that is visual learning.

b. Identifying exactly what are the trading signals you will take, exactly what decisions must be made, and what actions follow – this is very important.

c. Mental rehearsal: close your eyes and try to visualize chart patterns and what you will do in each case. In air force fighter pilot training, pilots call this exercise “chair-flying the mission”. It is a proven technique for rapidly building COEXes.

d. Simulation: now you fly the jet after having chair-flown your mission first. Run your simulation software and do limited practice on only those scenarios you mentally rehearsed.

e. Detailed analysis of your actions in review periods, or mission debriefing.

f. Active debugging of your COEXes to remedy bad behaviors.

g. Taking responsibility for all the above so that complacency does not take over (it will also prevent you from resetting your paper money account and feel smart about it).

h. Passion for what you do to prevent boredom.

i. Setting high enough standards to motivate you to keep the pace up.

Being a visual person and a visual learner, I like to see relationships between different information elements, decisions, and possible outcomes to train myself. It is required for structuring steps b and c above, and later on as a reference for debugging in steps e and f.

You might be different. But if you are like me, I hope the visual learning flow charts that follow in subsequent articles (one article/chart per BPA setup) will help speed up your learning and shorten your journey to becoming a professional, profitable trader.

Ali:

I have been wondering for long how to practice Al’s trading style. It is hard. You have given me a great idea. I sincerely thank you for this. I am going to try to visualize the way he reads charts and identifies pattern. I am having a hard time focusing on just one pattern.

If I have to, what would you recommend from your experience as the one pattern to start visualizing first?

Thanks again.

JayVee

I really enjoyed this article. As a software developer I understand how helpful flow charts/diagrams are in keeping focussed.

I first came across Al’s take on Price Action in Oct 2013 and have been a student ever since 🙂 I like Al’s honesty in that it will takes years to master trading whereas ‘system sellers’ seduce you by promising great riches with near zero effort required.

In the months before coming across Al’s material I developed a program to detect various candlestick patterns with the emphasis on ‘Pin-Bars’. It works a treat! However there’s SO much more involved as I discovered when trying to use it as a trading tool.

Then I came across Al’s site and watched his sample video where he states that he thinks “Candlestick patterns are a fraud”. I smiled to myself thinking “looks like I’ve just wasted 3 months” but nothing is wasted if its used to fuel progress!

After purchasing Al’s books/video course I now appreciate that what he said is true, trading is about context and setup, everything to the left!

I now concentrate on one market (UK100 as I reside in the UK) with NO indicators!

I’ve followed/traded this market for several months now and see the Price Action setups Al teaches regularly when I mark up my charts each evening. My challenge is as described in the above article: Identifying setups in real-time in and acting on them in a consistent manner.

To do this I need to train my sub-conscious as Ali described and the idea of flow charts resonates with me.

I look forward to Ali’s future articles and the flow diagrams that accompany them, meanwhile I’ll use the steps under 2 to actively develop my COEXes.

Phill.