Market Overview: Weekend Market Update The Emini reversed up from an extreme parabolic wedge sell climax. The 1st leg up of the short covering rally could last several weeks. In a few months, it might reach 2,800 – 3,000. Traders should expect a trading range for a couple months and probably all year. The bond […]

Emini coronavirus crash should bounce soon

Market Overview: Weekend Market Update The Emini continues to sell off with no sign of a bottom. It might have to test 2000 before a strong short covering rally will begin. The bond futures market has pulled back from an extreme buy climax. Traders expect a trading range for several months. The EURUSD Forex market […]

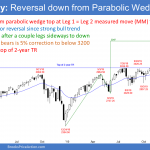

Emini strong short covering rally after March parabolic wedge bottom

Market Overview: Weekend Market Update All major indices are now in bear markets. But, the Emini started to reverse up from a parabolic wedge sell climax on Friday. There will probably be a strong short covering rally for the next 2 weeks. The bond futures market has had the most extreme buy climax in its […]

Emini searching for end of 1st leg down

Market Overview: Weekend Market Update The Emini is in an early bear trend on the daily chart and probably the weekly chart. The bulls want a double bottom with last week’s low. However, the best the bulls can probably get over the next several weeks is a trading range. There is at least a 50% […]

Emini has 30% chance of 30-50% correction from coronavirus pandemic

Market Overview: Special weekend report about the 2020 selloff Containment of the coronavirus probably will not work. A vaccine is the realistic solution, but that is many months away. This could be the worst pandemic since the 1918 flu, which killed 50 million people. The Emini sold off strongly this week. Traders should expect a […]

Emini February rally might be bull leg in trading range

Market Overview: Weekend Market Update 30 year Treasury bond Futures market:Testing October high, but wedge rally The 30 year Treasury bond futures has rallied in February to near the August all-time high. However, the rally comes after 4 consecutive bear bars on the monthly chart (not shown). When that is the case, there is usually […]

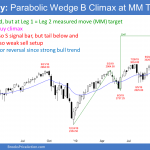

Emini testing 3400 but possible minor wedge top

Market Overview: Weekend Market Update The Emini has rallied strongly for 2 weeks, but the rally might be a bull leg in the January trading range. However, there is currently only a 30% chance that February will reverse back down to the low of the month in the final 2 weeks. The bond futures market […]

January is minor sell signal on Emini monthly chart

Market Overview: Weekend Market Update There is now a minor sell signal on the Emini monthly chart. The Emini is down 4%. Two weeks ago, I said it would probably fall at least 5%, starting within 3 weeks. It started 3 days later. Friday’s Bear Surprise Bar makes it likely that the Emini will fall […]

Emini profit taking and 5% pullback after January buy climax

Market Overview: Weekend Market Update The Emini reversed down on Friday. This might be the start of a 5% correction, but there could be one more brief new high first. Bond futures are reversing up but the rally will probably form a lower high. The EURUSD Forex market is trying to resume its 2 year […]

Emini 5% correction could begin in 3 weeks

Market Overview: Weekend Market Update The Emini is accelerating up and it is above the top of the daily, weekly, and monthly bull channels. There is a 60% chance that 5% correction will start within a few weeks. The 30 year bond futures market is oversold and will probably bounce over the next couple weeks. […]