Market Overview: Weekend Market Update The Emini had a Bear Surprise breakout this week. Traders expect lower prices over the next couple weeks. The bond futures market reversed last week’s selloff. It is back in the middle of its 3 month trading range. Traders expect more sideways trading, even if the market rallies next week. […]

Emini might test 2019 close and February 24 gap

Market Overview: Weekend Market Update The Emini is rallying in a strong buy climax and it is testing the 2019 close. There is no top yet. Traders will buy the 1st 1 – 3 day pullback. Bond futures broke below the ii pattern on the monthly chart. Traders expect sideways to down trading for many […]

Emini is in Sell Zone between 3,000 and 3,150

Market Overview: Weekend Market Update The Emini should test 3,100. But it is in the Sell Zone. In the next couple months, it will more likely retrace about half of the 2 month rally than break to a new all-time high. The bond futures monthly chart has consecutive inside bars after a reversal down from […]

Emini oscillating around April high, just below 3,000 – 3,100 sell zone

Market Overview: Weekend Market Update The Emini should continue a little higher, but 3,000 – 3,100 is the Sell Zone for at least a 10% pullback. The monthly bond futures chart has an ii Breakout Mode pattern after an extreme buy climax. It will likely be mostly sideways in a tight range for several more […]

Emini should test 2600 in June but might test 3000 first

Market Overview: Weekend Market Update Traders should expect the Emini to fall to 2600 in June. However, there is a 50% chance that it will rally to the 200 day moving average and 3,000 first. Bond futures have been in a tight trading range for 8 weeks. They should fall to the March 18 low […]

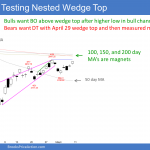

Emini traders expect small break above April nested wedge

Market Overview: Weekend Market Update The Emini reversed down from a nested wedge top on the daily chart a week ago. However, this week rallied strongly and it is testing the top of the wedge. It will probably trigger the buy signal on the monthly chart before there is a pullback to 2600. The near-term […]

Emini nested wedge buy climax in April but minor monthly buy signal

Market Overview: Weekend Market Update The Emini is turning down from a nested wedge rally on the daily chart. This week is a good candidate for the start of a 2 – 3 week pullback. The bond futures market has been sideways for 8 weeks after an extreme buy climax. It will probably be in […]

Emini V bottom wedge rally testing February close

Market Overview: Weekend Market Update The Emini has rallied strongly for 4 weeks. The bulls are trying to reach the February close to erase the entire March selloff. The rally has a wedge shape, which means it is a buy climax. But traders will buy the 1st 2 – 4 week pullback. The bond futures […]

Emini wedge rally to 50% retracement of coronavirus crash

Market Overview: Weekend Market Update The Emini has reversed up strongly for 3 weeks. There is no top yet. However, the rally is probably a bull leg in what will become a trading range. Traders should expect a 2 week bear leg to begin by the end of the month. Bond futures had a blow-off […]

Emini 2nd leg up to 2706.00 after March sell climax

Market Overview: Weekend Market Update The Emini will probably form a higher low after the extreme sell climax in March. The 1st target is 2706.00, which is 20% down from the high. Last week is a sell signal bar on the weekly chart. But there will probably be buyers below its low for a 2nd […]