The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi

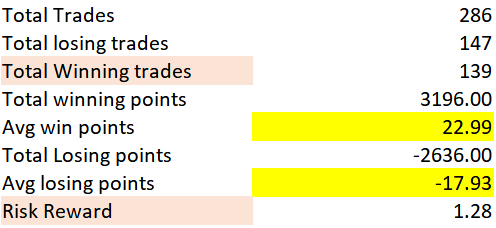

I am seeking some suggestion on what profit factor to look for? Currently I am unable to achieve more than 1.2/1.3 in backtesting over 4 years data and 300 sample size, which is giving me marginally profitable in backtest. Can someone suggest if there is an optimal but reasonable number to look for please? struggling to achieve more than 1.2/1.3 whichever way I test it. thanks.

Some more data to add from test:

Hi Bidy,

Please share with us more about your strategy such as screenshots of a few sample trades with plan and management described. Without knowing more about how you trade it's hard to pinpoint areas for improvement.

Thanks!

CH

Hi Carpet

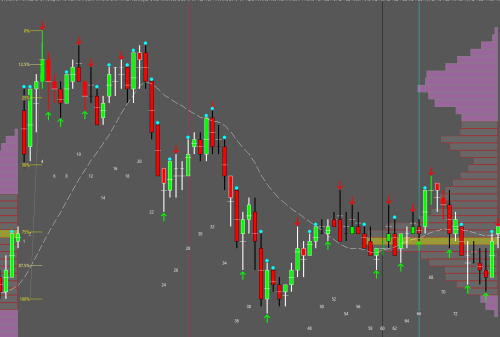

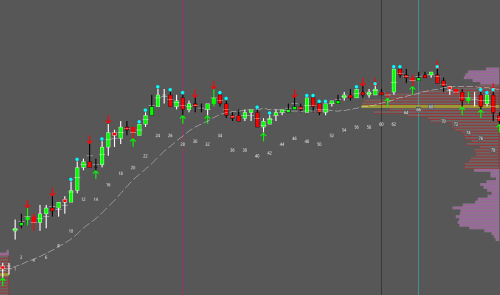

Please find scrnshots of sample trades, trying to enter breakout and then pullback but I don't enter at h1,h2 etc instead I look for another breakout on 2nd/3rd leg. I have tried different initial stops i.e below swing low or below breakout bars (2 nos) . No significant improvement.

Trade management is mostly trailing the stops below major low/high.

Please let me know if any other clarification required?

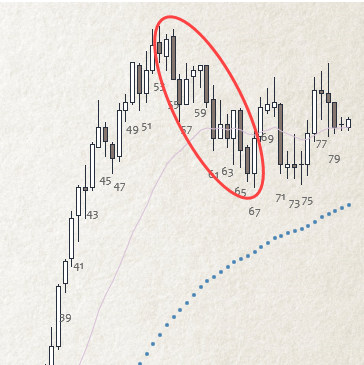

Short entry after bar 35-

Long entry after bar 46

Hi Carpet,

did you get a chance to look at it? thanks

Regards

Bidy

Hi Bidy,

Profit Factor = total win amount 3196 / total loss amount 2636 = 1.21

Profit Factor Alternate = (0.486*22.99) / (0.51*17.93) = 1.22

Target Profit Factor you want to go for is > 1.75 and ideally around 2 and not greater than 4.

Review your trailing stoploss strategy. Are you really trailing it behind prior major higher lows in a bull trend, for example, or tightening it behind minor pullbacks in fear of losing the profit and getting stopped out too early? This could lead to not be earning enough to offset the losses.

Review your losses. Are you taking losses passively by letting the stoploss get hit regardless of how the market moves after entry or actively by taking a smaller loss earlier if there's suddenly a strong reversal against you?

I think juggling how much you let the winners run vs how well you minimize losses is what's going to help you improve your strategy.

Also take a look at Payoff Ratio = avgwin 22.99 / avg loss 17.93 = 1.28 (needs at least 1.3)

Hope that helped,

Cheers!

CH

______________________________________________________

Hi Carpet

Many thanks for the reply, could you please give some examples of “Review your losses. Are you taking losses passively by letting the stoploss get hit regardless of how the market moves after entry or actively by taking a smaller loss earlier if there's suddenly a strong reversal against you?” What you mean by this statement? And what I should do to manage the trades appropriately? Thanks.

Br//Bidy

Hi Bidy,

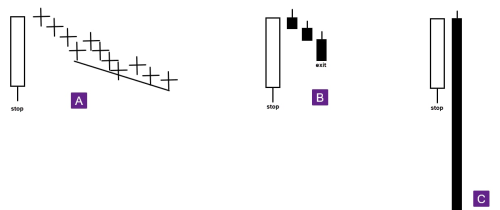

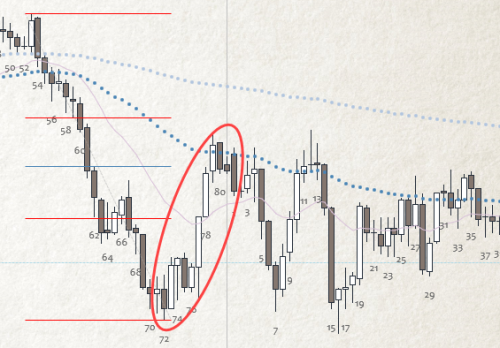

Here is a hypothetical extreme example. If bought big bull BO bar then A has a weak PB with many dojis, bars not closing below prior bars, tails etc, that maybe ends up a W into DB which is a buy setup. It's a very weak PB so probably best to rely on stoploss and see what happens. But B has strong cc bears increasing in size likely leading to more legs down. Even bulls who limit bought 50% PB probably won't stay around long enough anyways. I would exit below the strong bear bar. And C is why the use stoplosses in the first place 🙂

Many thanks Carpet, understood now.

Hi Carpet,

Trying to bring back this thread to life and few more queries please-

After some testing and live trade I think taking losses passively by letting the stoploss get hit regardless of how the market moves is a problem for me.

1.If above example is extreme could you please provide another example of these 3 scenarios which is more reasonable?

2.Also there is there any idea you can share pls so that I can mechanically quantify big or medium bars in above example?

Some more examples:

Here a weak 3 legged push (or alternatively 3, then one more for wedge BO failure) against a much stronger bull leg so low probability of becoming a bear trend even if goes again below 67.

Here a strong bull push against bears that went beyond 50% PB. This reduces chances of strong bear trend continuing even if pushes below 72 again during retest and more likely will evolve into a TR.

What is big and what is small is subjective and best discussed on a case by case basis with examples. So you can post more charts here to discuss as you come across them. We all just hope that after seeing enough charts we can tell what the majority of other traders (and their algos) are thinking about what is weak and what is strong.

Hope that helped,

CH

______________________________

BPA Telegram Group

thanks for the response.