The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

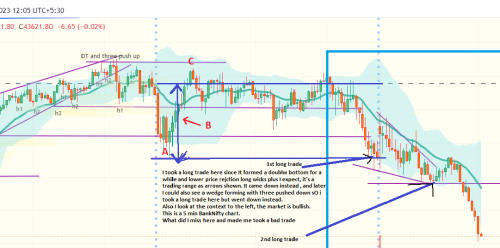

Bull channel = Bear flag, downside break likely. Wedge top, TL break, potential MTR short.

Even after taking the first long trade, you should have had the opportunity to get out quickly with a small loss.

For the second long trade, strong bear trend, last 30 or so bars below the MA, first reversal likely to be minor. Only sell.

Thanks for the explanation, I am still learning. Yes it's a bull channel and eventually it would have broken. I saw a double top highlighted to the left and a micro 3 push up in a wedge but following that day, the next day was tight trading range and when the price came down a bit lot of times it happens that it comes down the TR for a while and goes up and that's what I thought here and took the first trade and the second trade I took when I saw the price was struggling to do down and it looked like a small downward sloping wedge when it was out of TR. Since the context to the left was a bull trend going for couple of days strongly so I was expecting this a short Bull Flag in a Bull Trend.

You mentioned about last 30 bars closing below the EMA, but the reversal gave a bullish closing above the EMA so my interpretation was this could well be the final leg down of a Bull Flag in a Bull Trend as majority of the reversal attempts fail.

Here is the context to the left just an fyi to show you the bull trend

I'll greatly appreciate any further explanation.

Thanks

Re. the second long trade, did you take it at the beginning of the minor reversal or when the price closed above the MA?

If the former, then my previous comment stands.

If the latter, then this was the first close above the MA since many bars, so 20-gap bar and was going to attract more selling by bears.

Re. the first trade, your best case is you're buying in the middle of a TR and there is resistance above (prior high), and the worst case is your're buying after a downside break of a bull channel which could go all the way to the start of the channel.

Yes I took at the beginning of the minor reversal. Thanks for explaining the second point.

While the price is in a trading range, as per the AL's book you should look to buy low and sell high. That low where i took the first trade was a double bottom if you see to the left where the first low was made after the bull reversal. I didn't see that as a breakout instead i took it as TR and I took the entry which was a doji next follow through was bad but when I saw the big long wick 3rd bar after the doji, I thought it's reversing. May be i should i have got out at the bad follow through.

Depends on where you bought for the first trade.

If you took the first trade at A, then you're buying at the bottom of a TR, so potentially an OK scalp, although I wouldn't buy so soon after seeing that massive bear bar. But let's say you bought at A, it's still a profitable scalp if you get out at B.

Similarly, if you sell at C for a scalp, it's a valid trade.

Buying at B however is buying in the middle of the TR. You could still get out either breakever or with a small profit even as you see price stalling. The main thing is, all these trade were scalps, because you're in a TR. You cannot hold through PB here.

Following that reversal. Now I have taken a long entry, is this fair trade? If yes then ideally at what point I should look to take the profit or should I look to see if it creates a double top which would be a full reversal of the bear leg or trendline break/wait for pullback ? My SL is below H2.

Thanks

Thanks makes sense, that was a nice explanation 🙂

Following that reversal. Now I have taken a long entry, is this fair trade? If yes then ideally at what point I should look to take the profit or should I look to see if it creates a double top which would be a full reversal of the bear leg or trendline break/wait for pullback ? My SL is below H2.

Thanks

What you marked as H1 is the HH MTR signal, so I'd have bought there. Buying at H2 is also fine, but bull bars are shrinking and tails appearing, so I'd exit if things go sideways from here. I can always re-enter.

Thanks

I’m a beginner too. I have made similar trades.

1st trade - reasonable entry point but no signal bar and no follow through. Exit immediately for small loss. Consider short entry or stand aside.

2nd trade - would want to see solid buying pressure, then a retest of minor low, with more buying pressure and follow through. Not there so no trade.