The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Back on 1/23/2023, Al marked a sell at new HOD with a blue box after SPBL touched MA for the following reasons:

Today was also SPBL that did a 20GB MA touch and new HOD so was 70% expectation of profit taking but B50,51 didn't look good so waited and still sold a bit prematurely on 55. It had a significant tail and I believe there was a possibility of one more push up that could've created a nested wedge and a complex top. When 56 FT closed strong I assumed that's actually where most bears will sell so measured a 1:2 from that bar instead and rode it down to the start of BLCH ~B26.

Hope this was interesting to some. Looking forward to replies for feedback and development.

Cheers,

CH

________________________________________________

Hi, guess it is correct to manage it like this if you want to trade it like stop order trading.

But we had so much limit order trading, where its common to get trapped out of trades.

In hindsight you can argue: trading range, so better to go for quick profits but live not easy to see, cause somehow you and I expected the trend to continue.

Hi Mr. Carpet,

I believe your decision was reasonable. However, I think that in terms of trade management, consistency with one's chosen approach is crucial. If you decide to take a go-to-Walmart trade, then stick to that plan and really set it and forget it. If you're quick to exit, then you should be ready to quickly get back in.

Easier said than done, yes, but as Mr. Brooks said somewhere, uncertainty will always exist for traders. With the benefit of hindsight, I can see that the 34 was a big bull bar with a small body, while the 35 entry bar further disappointed the bulls and trapped them.

I found an example from the Encyclopedia that I believe is similar in terms of management: "If the exit is above the bull bar, S again..."

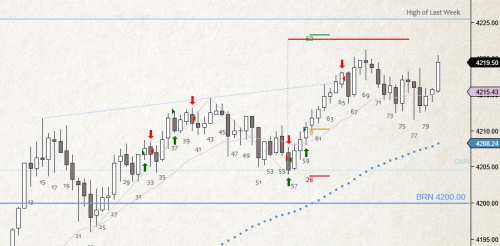

Would like other's opinions on this trade I took today: buy above 58, stop below 56, target 1:2 near MM leg1=leg2 very close to High Of Last Week magnet. The reason I exited early was because it was going "too well". All 9 cc bull bars and I exited at TL thinking too climactic and a steep PB was imminent (and bears did try it). Al also mentions in the Trading The EOD videos that a BTC that starts too early in the day isn't likely to continue into EOD either. Instead I would've liked to have seen a couple weak bear bars giving the bulls a chance to rest on the way up instead of something this strong and already 3rd leg up in big wedge. Thoughts?

Exit by trailing stop below 65 or couple points below would be better, if 65 was climactic then it might be better to exit on close (uniform bar sizes since 57). Your exit was good enough since the trade made more that two times your actual risk or one times initial risk, which is the minimum.

Should have taken it myself but wanted a pullback to a higher low to buy.

Great trade and intuition! Bulls who bought the wedge had around 2 times their risk if they put their SL below 57 and near TL - "computers plan those things in advance" as Al often says!

Earlier point for exiting: into strentgh of 62 - getting climatic and at TL

Some homework for you :).

Part of this comes down to analysis, and a portion to your trading plan. Do you both swing & scalp, swing, . . . it matters for decisions such as this.

Exiting because of channel trendline is fear of losing profit. Trendlines can be drawn all over the place and thus may become too subjective of a decision process. You will find when Al discusses trendlines and effects around them there is a "within 5 bars" timing criteria. This should indicate that they are not the best "right now decision boundaries". Also note, the push is strong enough for a 2nd attempt, with bulls potentially coming back in at the 50% area as there wasn't an exhaustion move. Horizontal trendlines are a little more stable marking rejection, especially in efficient markets. Note, the rule of 2 attempts may be applied against them in many situations and thus gets back to counting L1, L2, etc.

What are stronger metrics? Measured moves [23-43] reflected from 56, target movements (20 points (from 56) and that is approximately in the same place but target movements are about how profits are claimed by automated machines and behavior). Also, the [52-55] trading range reflected above the breakout/decision point. Finally exhaustion bar/gift (didn't happen). Gift bars can be used because long and endless pullbacks often happen from them.

If one is using one of the more robust metrics above for taking profit on the swing, then your plan process is more robust.

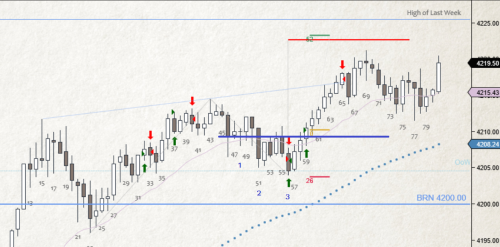

Why did that move happen? This may also reflect in your actions. It is heavy short covering as well as institutional buyers and everyone is in agreement that prices are going higher. That is what bar 61 is all about. Please review the graphic. You will see a decision line where bulls have been repeatedly rebuffed, but note the weak bear wedge [48,51,57] with overlap. 58 is the test of the inflection point. 59 is the initial breakout which pulled back into the range. . . . Face off time! 60 is the breakout test and confirmation and into other resistance, accounting for its upper tail . . .and then. . . magic. We're going up. Bears had enough opportunity.

The question becomes whether you swing (which allows for the 1st reversal - bar 56), or take the swing profit at a target. These are aspects you will need to define within your plan. If you have several contracts, you may simply exit a portion at the 20 points/measured move, etc and swing the remainder into the end of day.

Nice having a good profit. This is just to consolidate and template consistent actions. Hopefully helpful and good trades to you!