The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi PA Gurus,

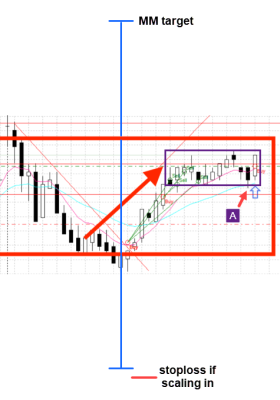

I took this as a Wedge Reversal and took profit with 2R.

Now it is the High 2 at the moving average. Should I long it again?

The reason that I think I should long:

- the previous trend is tight channel

- the square is a trading range, if it break the trading range, the potential profit is huge based on the measure move.

- As I took profit previous, I remember Al said if you cannot enter again, you should not leave the market. Then I think I should enter the market again.

My question is

- whether I am too optimistic and ignore some risks? is it a real high Reward vs risk trade?

- If I long it which is the correct position to put stop loss?

- And should I take some profit at the previous high, which is 1:1 Risk/Reward position

Thanks in advance. Any advice will be greatly appreciated.

Namaste,

Here are some problems for the bulls I see that lower the probability of a successful breakout:

1) The market is currently in a TTR (purple box) near top of a larger TR so two obstacles they need to overcome. In any TR it's a 20% chance that a BO will succeed so need a very wide target like 2X of TR.

2) Bears just failed to break out of TTR at (A) and rejected at some EMA but now already at other side of TTR and signal bar (A) was bad: bad signal bars increase probability that price wil return to the BOP to retest it even if bulls attempt a BO. So can expect a potentially deep PB even after BO.

If taking a long anyway, I imagine two possible managements:

1) exit immediately if strong bear reversal bar because for context like this all the bears must be waiting for a failed bull BO so bulls need to be extra strong and have excellent BO+FT to negate all bear expectations.

2) other option is to scale in lower but the stoploss can't be at bottom of TR because that's where all the bulls will be waiting to enter. A good option would be a little farther than 2X MM in the opposite direction.

Hope that helped!

CH (not a guru)

_____________________________

BPA Telegram Group

Now it is the High 2 at the moving average. Should I long it again?

Yes, absolutely. The market turned AIL after the selloff. The rally is strong enough to get a 2nd leg, probably as a leg 1 = leg 2 MM. This is a H2 with a strong buy signal bar.

the square is a trading range, if it break the trading range, the potential profit is huge based on the measure move.

Yes, it is a large TR that is part of a bull channel, so in the grand scheme of things, one should expect a BO. However, the selloff(which created a wedge and after which you bought) broke a fairly major higher low(at the start of the box, I can't exactly mark it as I'm responding through my phone - if you need a clarification, do let me know).

Since, it broke a major higher low, you should expect some sellers above the highest high visible on the chart. So, MM based on the large box is still uncertain and would only be confirmed after seeing how strong the BO is actually is.

If I long it which is the correct position to put stop loss?

There are 2 ways to manage the trade(to me). One would be to buy above the H2 and place a stop below the lowest low among the H1 or H2. Second would be to place your stop all the time way below the bottom of the bull channel(which followed after the wedge) and trail your stop after there is a successful breakout following the H2.

The first way of management would require you to enter again after a strong setup if the market is still in AIL. The second one is if you don't want to manage your position too much. I prefer the first one.

And should I take some profit at the previous high, which is 1:1 Risk/Reward position

Yes, I would for the reason explained above. There would be some sellers waiting for at least a scalp. If the bear scalp above the high fails, I will enter again.

P.S. I forgot to mention, the only PA guru here really is Dr. Brooks. He doesn't post on the community forum.

Thanks mate. I learn a lot. I thought the BarA is a MTR and Then reversed by a Bullish trend Bar, which would cause the bears stop loss.

I think you are right the bullish setup is not perfect which will encourage bears to short higher. Then considering the big bearish trend bar on the left. Bears would definitely do this and cause deep PB.

Thanks again.

Namaste,

Here are some problems for the bulls I see that lower the probability of a successful breakout:

1) The market is currently in a TTR (purple box) near top of a larger TR so two obstacles they need to overcome. In any TR it's a 20% chance that a BO will succeed so need a very wide target like 2X of TR.

2) Bears just failed to break out of TTR at (A) and rejected at some EMA but now already at other side of TTR and signal bar (A) was bad: bad signal bars increase probability that price wil return to the BOP to retest it even if bulls attempt a BO. So can expect a potentially deep PB even after BO.If taking a long anyway, I imagine two possible managements:

1) exit immediately if strong bear reversal bar because for context like this all the bears must be waiting for a failed bull BO so bulls need to be extra strong and have excellent BO+FT to negate all bear expectations.

2) other option is to scale in lower but the stoploss can't be at bottom of TR because that's where all the bulls will be waiting to enter. A good option would be a little farther than 2X MM in the opposite direction.Hope that helped!

CH (not a guru)

_____________________________

BPA Telegram Group

Thanks mate, you are a guru in my heart.

You are right the bears wanted to create a low high and made a deep PB. It was a scalping opportunity.

As you mentioned it is a broad channel, I had better wait the price test the channel.

Thanks again.

Now it is the High 2 at the moving average. Should I long it again?

Yes, absolutely. The market turned AIL after the selloff. The rally is strong enough to get a 2nd leg, probably as a leg 1 = leg 2 MM. This is a H2 with a strong buy signal bar.

the square is a trading range, if it break the trading range, the potential profit is huge based on the measure move.

Yes, it is a large TR that is part of a bull channel, so in the grand scheme of things, one should expect a BO. However, the selloff(which created a wedge and after which you bought) broke a fairly major higher low(at the start of the box, I can't exactly mark it as I'm responding through my phone - if you need a clarification, do let me know).

Since, it broke a major higher low, you should expect some sellers above the highest high visible on the chart. So, MM based on the large box is still uncertain and would only be confirmed after seeing how strong the BO is actually is.

If I long it which is the correct position to put stop loss?

There are 2 ways to manage the trade(to me). One would be to buy above the H2 and place a stop below the lowest low among the H1 or H2. Second would be to place your stop all the time way below the bottom of the bull channel(which followed after the wedge) and trail your stop after there is a successful breakout following the H2.

The first way of management would require you to enter again after a strong setup if the market is still in AIL. The second one is if you don't want to manage your position too much. I prefer the first one.

And should I take some profit at the previous high, which is 1:1 Risk/Reward position

Yes, I would for the reason explained above. There would be some sellers waiting for at least a scalp. If the bear scalp above the high fails, I will enter again.