The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Have you thought about choosing one particular set up and trading only that until you are consistently profitable?

Thanks for the reply! Yes, I have thought about that, but was hoping for a steeper learning curve by "trading what I see". I'm also not very good at sitting and watching the market, only looking for one setup. I must admit that I'm already very liking Al's "you can enter on almost any bar" approach. Currently, I'm only at my first pass in the trading course (at 14E right now). So I'll hope that thing's will get better once I have an overview of the course.

I'm thinking about focusing on scalping, since it seems like I'm doing better that way.

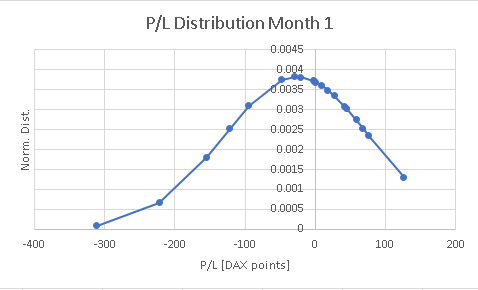

Failure analysis: W4, Thursday and Friday

Above, you can see the chart with all my trades from thursday and friday (refer to my previous posts for details!).

Here, I'm going to analyze my trades to prevent these mistakes from happening again:

Contributing factors:

- At work, so very little screen time and lack of focus

- Trading from phone, so little overview and oversight

- Rushing, since little time to trade

- Not beeing able to monitor trades and to manage them correctly

Main factors:

- Failing to recognize trading range (BLSHS!!)

- Failing to acknowledge 80% rule -> Betting on reversals and breakouts -> low probability

- Betting on breakouts, but using swing stops -> low probability + bad risk/reward

Lessons:

- If not enough time, don't trade or switch to higher timeframe (1h,2h etc.)

- Use computer screen to have overview

- Realize market is in TR -> BLSHS

As a positive side: If I'm able to loose 200 points with one trade, there should be no reason to not beeing able to make 200 points with one trade. But: Let profits run!

Please note: Monthly summary with P/L graph, gaussian distribution etc. will follow on monday, since last trade is still open.

I can recognize that you are basically on the same path I was 8 months ago, when I was just starting out with Al's course.

You say that you are not very good waiting for the market, well, then that is exactly where you should start. Wait for the market to show you exactly what it is you are comfortable trading. If High/Low 2's is your thing, just do that, if MTR's are your thing, just do that.

Taking lots of trades equals lots of losses, rather than taking 1 or 2 profitable trades and believing in the setup. WHEN, and I do me when I rush my trades I loose every single time, but when I just sit there (sometimes watching a movie on a second screen) and wait for a setup that feels good. I often make winning trades.

The real challenge is building up the confidence and patience to --> JUST SIT THERE and stare at the screen.

I went away from trading over the summer, taking a good long break. When I came back everything looked different. I spent time getting my setup exactly right. I started drawing in everything and deleting what did not become fact. I waited and waited and waited for trades and what I realised quickly was; that taking a single trade in a session was often far more profitable than trying to get in the market 4 times.

You only need a few points with the right risk to make a lot of profit.

I like that Al keeps saying that, where he is today, he only takes the fun trades. Well, there really is no need to take anything else. And you can find fun trades in trending markets as well as trading ranges.

My best advice to you is to take up a meditation practice and meditate before each session. That way you enter the session with a calm mind. If you during your meditation feel uneasy, probably you should not trade that day.

Short list of advice:

- Calm you mind before a session

2. Focus on trading, when trading, it is not a secondary thing you do

3. Wait for the market

4. Do not rush trades

@riembaus Thank you very much for your advice! I really appreciate it, that you took the time to write it down. This is the first time I'm able to exchange with other, more experienced traders.

Your advice sounds very good. I think I'll start with calming down before the session and limiting the number of trades. Do you think it makes sense to have a rule, so that I'm only allowed to take two trades a day?

Again, thanks for your advice!

You have to figure out your own process. If you KNOW that you are inpatient, you HAVE to train patience...

Here's something you could try. Miss trades, it is much easier to recover from a missed trade than it is to recoup lost capital. And it helps you get rid of FoMo and revenge trading. You get near perfect setups every day, so ask yourself just before you enter a trade, if you would take the opposite side of the trade you are about to enter. If you would, maybe just wait for a trade, where there is no way in hell, you would enter in the opposite direction.

@riembaus Thank you, this thinking could actually help me. Also, I realize that patience and discipline are not just a trading-thing. So I'm trying to practice patience and discipline in my day to day life.

@riembaus Well, I will to do what's necessary. It's about time after more than 3 years of failure!

Month 1 Summary

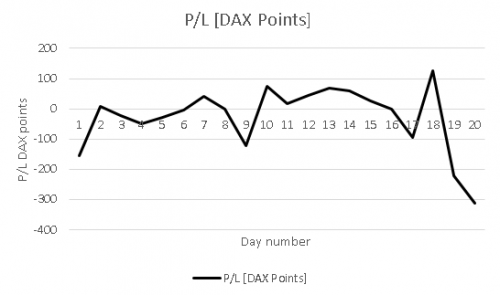

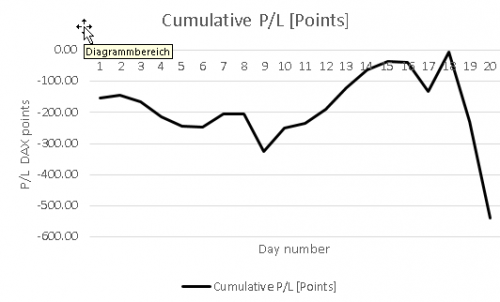

Please note: All graphs are based on EOD data (intraday swings are not shown).

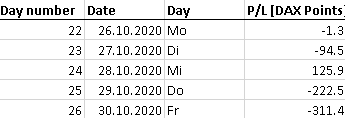

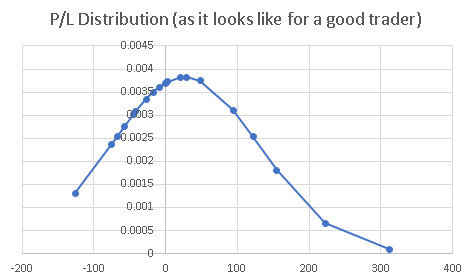

Graph 1: P/L Distribution Month 1: As you can see, the distribution of returns is heavily negatively skewed. This means, that when I make a profit, it is usally small compared to the losses. You can see that the graph has a large negative tail. So the probability is there for a very big loss. What you would want to see is of course the average beeing positive and a positive skewness. That would mean that you can effectively limit your losses, but you have that occasional big win that you trail up to 4,5,6,7 times your initial risk.

So this graph clearly shows, that I fail to let my profits run and fail to cut my losses. This is very bad, since one trade gone wrong will wipe out several positive trades (see W4: One bad trade was enough to wipe out an entire week's worth of profit!) Of course, this is also bad from a psychological standpoint.

Graph 2: P/L [DAX points]: Here, you can see my day to day returns.

Graph 3: Cumulative P/L [DAX points]: This graph shows the cumulative development of my returns. Also, note that we see a strong rejection from breakeven. While certainly only a contributing factor, it is plausible that some psychological effect was at play as I approached profitability. What I can say is that I was very excited as I reached profitability intraday. Then, I messed up.

Average daily P/L: -27.02 DAX points

Gross P/L: -540.4 DAX points

Note for traders just starting out: Please realize, that knowing a little bit about math and statistics does not make me money (obviously). So you do not have to know all this to be profitable. The reason that I'm posting this is, that I want to be able to pinpoint developments and back up all of that with actual data. So instead of relying on my feelings, I want to be able to say for ex.: "This month was way better, as I reduced my negative skewness etc...). Just the return curve alone is not the entire story.

Excel worksheets available upon request.

Will post the results for yesterday and today tomorrow. Preliminary results: Mo: -30.4 points, Tue: +95.7 points.

Edit: Decided against holding the short over night. Took quick profits.

Things are looking bleak again. Another day with -300 points. At this point, even though my losses are small in cash, I will switch to trading a demo account, as I'm unwilling to burn any more cash, before I have at least reviewed the course material once. Today I have again proven to myself that I have not changed a bit. So before I will waste any more money, I'll have to prove myself, that I'm able to be profitable in a demo account. Of course, it's not the real thing - I know too well - but maybe it will help me getting used to doing things properly.