The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I have decided to try to post my trading results daily, so that

- I will remember better, what I have been doing, so that I can comment more and

- reduce the workload of posting everything on the weekend.

Week 3: Mo: All trades with chart

Daily P/L: +17.5 DAX Points

Detailed analysis: Because I had no time to trade in the morning, I noticed that instead of waiting for good trades, I FOMO'd into both trades today. For example, instead of waiting for a pullback to sell, I entered at the close of a bar, that could have easily been an exhaustive end of the bear trend and a false breakout from the trading range.

- Trade: Market was in old TR, so I bought at the bottom. As it started breaking below and accelerated, I eventually exited for a loss of -27.5 points.

- Trade: FOMO'd into an accelerating bear leg down away from the TR. I was lucky, as it didn't hit my SL, that was placed just above the bars that are market (in a red ellipse) on the chart. Eventually, the market broke lower and I exited as downward momentum stalled near the 200% MM. Profit: +45.0 points. After I exited the market bounced for a little amount and broke lower another 70 points. However, as we where nearing the session end, I decided to close the books anyway.

All in all, it was probably mostly luck, that I ended up in the green this day. Still, today together with Friday are my first two consecutively profitable days ever.

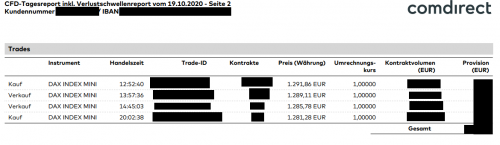

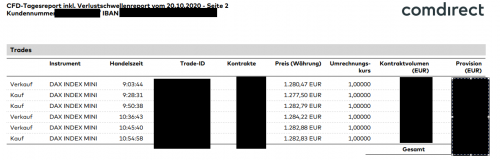

Here are the brokers statements for yesterday. I'll try to include them every now and then for credibility.

Verkauf = Short

Kauf = Long

Basically, you'll just have to look in the first column to see if I went long or short and then check the column "Preis", to see at what price the trade was executed. Then, go to the next row to see at what price I closed the trade.

So for example, the first trade: Kauf = Long at 12:52:40 for a price of 1291.86€ (note that in Europe, the decimal places are separated by "," and not by ".".)

Week 3: Tue: All trades with chart

Daily P/L: +44.6 DAX Points

Detailed analysis: Started trading a few minutes before market open. However, it soon proved that the market was very volatile, with violent up-and downswings. So I soon stopped trading, as I was very uncertain about the state of the market.

- Trade: See comment on the chart. P/L: +29.7 points

- Trade: Speculated on repopulation of an old TR. P/L: +14.4 points

- Was looking for a retest of the breakout area. However, as I was really unsure about the market, I exited for a profit of +0.5 points and quit trading for the day.

Generally, I can say that I was constantly switching between TR and Trend Mode in my mind. It was probably a good decision to quit trading when I realized my discomfort, even though afterwards, there where a lot of good trading opportunities.

For your second trade, wouldn't it not have been better to let it run? To swing trade in other words. The Pullbacks were very weak until about 15:00. Maybe when we became AIS, then exit.

In this my post I was referring to trading day Monday of week 2! I pushed the button reply of that post of yours. But my message came as last in the thread...

@marvinbertonyahoo-co-uk

Thanks! No problem. Yes, you're right. At the time it really looked like it was strongly bouncing at the support level, so I exited, even though the pullbacks were very moderate. You can see that I then re-entered in the same direction but still failed to let the trade run. Learning to let profits run is now my priority (since last week thursday "happened").

Same thing is true for the last trade on monday. Letting it run a bit longer would have afforded another 70 points.

Week 3: Wed: All trades with chart

Daily P/L:+67.6 DAX points

Detailed analysis: Started my trading day again a few minutes before market open. At this time, the market was at top of a trading range. However, since the DAX tends to move violently on market open, I didn't take the short. At the open, the market quickly dropped about 250 points, so I was a bit angry for not taking the short. Although I still knew, that it could have been easily moved 250 points to the upside against my possible trade.

- Trade: It is quite usual for the DAX to make a violent move in the first half our, that is then completely reversed within the first hour. So as the bear move got exhausted, I went long for a possible move of at least ~100 points. However, we quickly lost upside momentum, so I reversed my trade for a possible revisit of the daily low at that time. P/L: +12.9 points

- Trade: Losing upside momentum, I sold to close and then sold to open. As I was just looking for a retest of the daily low, I exited way to early with a profit of +14.0 points.

- We broke below the low of the day so I shorted again. I assumed the formation of a LL MTR so I exited with a marginal profit of +0.5 points.

- Seeing an invalidated LL MTR, I sold again and closed at a support level from the 2nd October for a profit of +40.2 points.

All in all, I am not too happy with my trading today. This should have been a day, where I make at least 100 points if not more. I was too impatient and hesistant to enter.

This is what I'm talking about regarding the first trade:

As you can see, the DAX is in a TR, then, at the open, there is a violent move to either side, that is then completely reversed with equal force. This is a fairly regular occurence for the DAX and probably also other indices. So that's what I have been speculating on with my first trade. Usually, if the reversal does not happen with about equal force, it is better to exit and look for another trade.

Week 3: Thu: All trades with chart

Daily P/L: +58.0 DAX points.

Detailed analysis: Started trading at the open, where a big breakout to the downside manifested itself quickly. I was able to make two fast scalps and stop trading until the evening session, where I made another two scalps.

- Trade: Sold into the downside momentum that continued for a few minutes after my entry. Exited as we where nearing a support level from the end of September. Profit: +25.4 DAX points

- Trade: Sold the pullback from the day's low. However, price got very jumpy so I exited with a profit of +23.6 DAX points instead of waiting for a retest of the daily low.

- Trade: In the evening, I bought a possible continuation from a bull flag and was eyeing the HOD, where I exited with a profit of +5.0 DAX points.

- Trade: Shorted at the HOD for a possible retest of the bullflag breakout. Exited as momentum dried up near the top of the flag with a profit of +4.0 points.

All in all, I am happy with the trading day, considering the little time (~1.5 hours) I spent today.

Week 3: Fri: All trades with chart

Daily P/L: +26.9 DAX points

Detailed analysis: Didn't have much time to trade, so I was very hasty with my trades, often frontrunning the market. Luckily, the last trade just about hit the TP, that was placed at the top of the conventional gap on the chart.

- Trade: Short for second leg down, closed trade when reversed off support level. P/L: +6.6 DAX points

- Trade: Long with strong upside momentum off the support level. Closed way too early. P/L: +2.4 DAX points

- Trade: Reversed 2nd trade and was looking for retest of LOD. SL triggered. P/L: -28.3 DAX points

- Trade: Shorted for second leg down, TP placed at top of conventional gap, filled for a profit of +46.2 DAX points.