The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

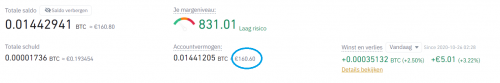

Hi I already posted a trade in some other thread. But from now on , I will be tryig to post All of the data, like equity balance. Risk taken per trade, etc.

I repeat, that I'm trying to apply Al Brooks' principles to cryptocurrencies. It's my ambition to learn how to trade Forex. But as I had some money left on some cryptoexchanges, I grouped it, and are now experimenting on it. My main goal is to put the theory I learned into practice. If have not yet even covered 50% of the fist part "Fundamentals".

So I honestly do not expect to be profitable at this point. I often don't really now what I am doing quite frankly. I.g. I recognize some pattern (at leats I think so), I take a trade, in accordance to what I think I see. But do not really know when to exit.

Or when a trade goes wrong, I stay in, because I could scale in, and another time, and another time,... until I'm in position with a risk that could potentially blow up the account.

I'm mostly trading the cryptocurrency "Binance Coin". It has good volatility, which is necessary to eliminate the influence of the commissions I pay per trade. I pay 0.075% of the purchased amount as a commission. So let's sayt I buy 1 Bitcoin (roughly 10 000$). That will coast me 0.00075 BTC, or 7.5$. To exit the trade, the same amount. So 15$ total per roundturn. That means price has to move at least 15 $ to eliminate the transaction cost. For a trading system to be profitable, average price movements for scalps should be at least 10 times the cost/commsiion, like for instance in Forex, has a cost of about 1 pip per trade. Standard scalps are 10 pips.

That's why Binance coin is a good choice. High volatility, so less influance commission.

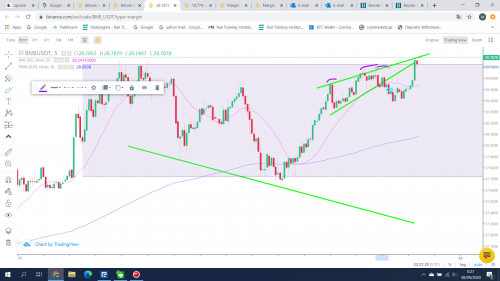

I recognized a Wedge Top, at top of a larger TR. I sold (short) in the blue circle. Expecting at least 2 legs down.

But never really got 2 legs. Still in position, and price going heavily against me now, with an attempt of a bull BO.

I sold 7 BNB, which is about 200 $. My stop loss was planned just above the big TR. I stepped in at about 28.50 and have stop los at around 2.85. So for BNB, ther would be a loss of 0.35$. For 7BNB, the loss would be about 2.45$.

My current equity is 185$.

I must have had a cryptocurrency in my wallet, that I wasn't aware of. Some position I did not close correctly. And that currency must have significantly devalued. When I checked my balance yesterday, I was at 150$.

So start over from 150$...

Yesterday, even though we were close to a potential DT, I recognized good buying pressure in the Leg up. Not particularly big bars, but almost no bear bars. And bull bars that made gaps, and micro gaps.

So went Long on a H1, at about 28.50.

But afterwards, there was really not much convition amongst the Bulls, and I realized that I took the H1 after 2 strong Bear bars. So decided to get out with a small profit, at about 28.90.

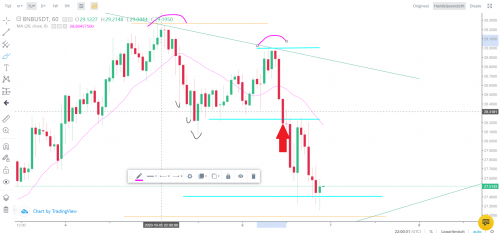

Today, I saw a potential LH MTR (see 2 pink arches). There was a Bear BO, and I sold the close of 3rd consecutive Bear bar (red arrow) at 28.25. No big position, because at that point, it was still possible we were in a TR.

Target was MM, based on distance of DT to neckline. I started with the lowest of the 2 Tops, and drew the blue horizontal lines. It seems that this MM-level is showing resistance, so exited now because of DB, of which second bottom is a small wedge. Exit at about 27.59.

Total equity is now 153,00$

Any feedback would be appreciated. I made profit twice the last 2 trades, but that doesn't necessarily mean they where good trades.

Considering a reversal trade now, so possibly Long. We are at around 50% PB-level from the strong Bull swing (see orange lines). We have a big wedge bull flag (purple lines. But the last push down of the wedge, was showing a lot of selling pressure, so I skipped this H1 Buy. Would need something extra, like a second entry with strong Buy signal, or more consecutive Bull bars to take the Buy.

Second Leg of the PB of the big Bull Swing, is now forming a nested Wedge. Probably a lot of traders waiting for Bull BO. But my gut tells me we're going to brake down to the downside. I don't see much buying pressure. This (BO down) would surprise lots of traders, so more than one Leg down to be expected. But this is purely hypothetically. First, let's just see how reliable my gutfeeling is...

I exited my Long-position with a small loss. And a few moments later, I initiated a Short, A Wedge Top has formed at the top of a 100-bar TR (purple box. I exited with a stop after strong bear signal bar.

As the Follow-through bar (after BO-bar kept growing, I initiated a short trade, shortly after exiting (red arrow). There also seemed to be good selling pressure,

I'm watching this trade on the 15min chart, but all the elements are visible on the 1 H-chart as well. I put a OCO-order some distance above the TR (Stop Loss) and justabove the bottom of the TR, as I am going to sleep now.

Yesterday, saw a MTR-setup. Bear BO below Bull Trend Line. Resumption of the Bull Trend, and then what seemed as a failure near previous High.

Didn't really work out, as can be seen in next chart. Probability is always less than 50% with this kind of trade. But still, I think I made some mistakes.

For instance: the Bull trend was pretty tight, maybe too tight to take countertrades. Also the Bull resumption was fairly tight. Took the first entry, with a reasonable signal bar. But maybe should have waited for second entry, or some Bearish Follow-through.

I went to sleep after I entered the trade. When I woke up, the market had turned against me quite a bit. Market seemed AIL, so I exited my Short position immediately (see chart below).

This update just to inform that I'm still in the trade that I initiated oktober 12. The stop Loss is way below the Bottom of of the BO I bought.

At a certain point, the market became AIS. But I stayed in the trade. Right now, it seems that we made a higher Low, which keeps the premisse of an uptrend still valid.

I see a broad Bull channel, which might soon transition into a TR. Limit Order Bears are making money. And we had a big Up and a big Down, between 10 days ago, and now.

I also like to keep an eye on the daily chart. It seems that we are now in a Bull Flag. With, at this moment a 2 bar reversal (orange box) for a H2 Buy setup. The day hasn't yet closed, but if today Closes as a strong Bull bar, the setup seems reasonable to me.

Still I need to be aware of a possible MTR pattern forming. And a large DT in the bigger context.

Took some profit off the table. Mainly because I had too big of a position/risk was too big. I bought 5 BNB at about 30.20, and the Stop was at about 27,75. So I was risking 5*2.5 = $12.5. On an equity of about $150, this is way too much. I sold 3BNB at around 31.00.

I stayed in position, becaus any reversal was probably going to be minor. Indeed it seems that after a PB H3-setup, the trend is resuming, accelerating fast.

The chart above shows where I exited the rest of my (long) position, which I entered 10-22 (blue arrow). Did that around BE (purple arrow). I exited because the Bull BO above 11-07 High had poor Follow-through. It's now also forming a DT.

For the above mentioned reasons, I entered a new position, selling. 2nd entry Sell (red box/red arrow). Big ups, big downs, big confusion, so probably TR. The market's also near teh Top of a broad TR, where price has been moving sideways since 09/27. Sold 3BNB (approximately 90$).

For info: current equity is about 179$. The increase was not due to profits, made by PA-trading. It's because I have a small amount of Bitcoin, which I don't touch.

Look at the weekly Bitcoin-chart by the way. It's experiencing an extremely strong Bull BO. It's possible that price is being vacuumed into the all time High at 20.000$. But I think, Bitcoin will only keep on rallying in the long term. It's designed so that there will only be 21M BTC mined (created). Which means it's scarce. The idea of an asset, that's so abstract, can't be touched and exists only binary, will become more and more accepted. The money we know today, is nothing more than a peace of paper. Bitcoin will not be used as a payment method, but rather as a investment.