The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello everyone, I recently finished the course for the second time and tried trading on a forex demo account. I traded 3 major trend reversal setups and they all failed, I was hoping to get some feedback on why it could be that they all filled. All of them are 5 minute charts.

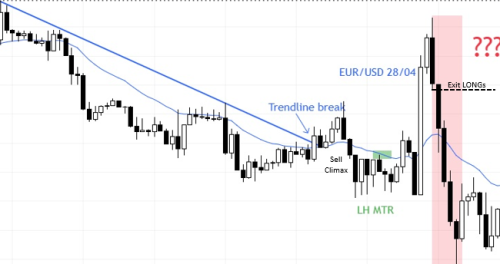

especially this on on the EURUSD suprised me, it got a very strong bull breakout with follow through but suddenly collapsed.

I would greatly appreciate some advice! And thanks in advance.

Hey Max,

Happy to provide my insight on some of your trades.

I think it's important to keep two things in mind when trading MTRs.

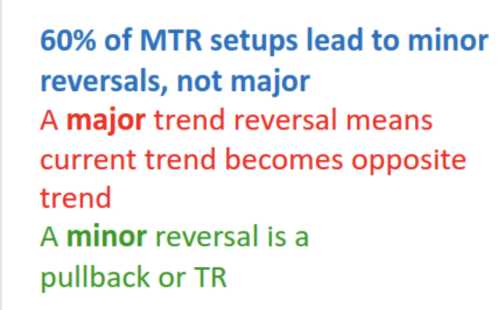

1. Most MTR attempts result in a trading range or a flag. So, it's important to try to position yourself as soon as significant opposing pressure becomes apparent. It's also better to look for signals/entries near the trend's former highs or lows if possible. This will reduce the probability of you getting in too low or too high in a potential trading range or a flag in the case the trend continues against you. Trend traders can hold for a while but will want to take profits near highs/lows or former highs/lows when there are signs of a reversal so they can keep their profits, which can usually create a profitable pull back for counter trend traders or even trigger a reversal.

2. It's usually better to trade in the direction of the trend. Even if the market pulls back significantly, chances are it forms a trading range. So, it's better to be buying low in a TR if the recent trend up was bullish and vice versa for bears. Trends can find surprising ways to simply continue.

I do not trade Forex so I do not know of all the nuances, reports, and times that the market will experience more volatility and volume.

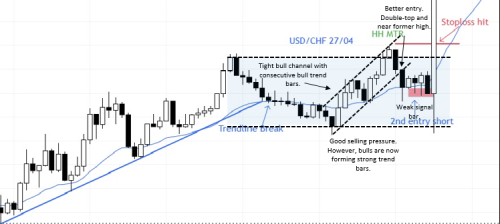

For your first MTR attempt, it's more probable a trading range has formed by the time you entered. There's a lot of overlap, dojis, and 1-bar reversals. Whenever you see 1-bar reversals, that can be signs of a trading range (dojis on a higher time frame). Your entry was based on a small signal bar and you were selling near the bottom third of the trading range. In addition to that, you are selling right after the bulls were able to form a strong trend bar with follow-through. Bulls are strong, and bears are getting out above bull reversal bars.

For the second MTR attempt, the signal bar your entered below is weak (small & prominent tail). Price is also being supported by the moving average. You're selling in the middle of a potential trading range. Again, most MTR attempts result in a trading range or a flag. It's better to try to sell earlier near former highs below the strong bear bars. Even if you get stopped out, your loss is mitigated relative to selling too low. If you are truly bearish in this scenario, you would be looking to sell the minute the bears form a strong bar after the bears have demonstrated significant strength. While the bears did exhibit significant selling pressure, they did not manage to make a convincing new low, which allowed the bulls to feel more confident it was a trading range and not a reversal.

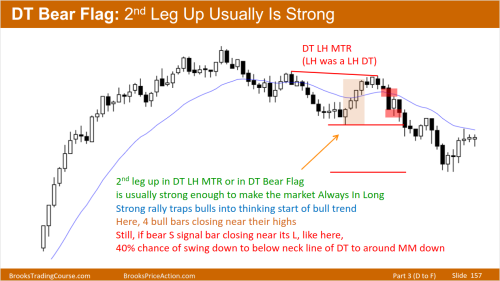

The third attempt is a reasonable attempt. The bears recently had a sell climax and the bulls are now forming strong reversal bars. However, you need to be mindful of the good-looking buy signals not triggering or having bad follow-through. Bears are successfully defending the market at this time. Then the big bull bar appeared with follow-through. This is a good look for the bulls and a reasonable trend reversal attempt (but with big risk). However, a strong sell signal bar formed in what could still be considered a bear trend (not above all the bars to the left), so this strong bull leg could be a bull trap. Bulls that entered around your price will be happy with the surprise profit they have and exit below that bar as the bears can still take control of the market.

Hey Trevor, Thanks a lot for the feedback!

Really appreciate that you took the time to give such extensive feedback, I think the Tips will be very useful!

Hi Max & Trevor,

I think Max's first trade was actually good.

It was a small W to DT LH MTR with a TL break within. Price seems to be making LLs and LHs a.k.a signs of (early) bear trend.

The second entry short is an attempt by the bear to move price bellow MA. When we see that attempt is failing at "yellow dot", we can exit.

In addition to that, you are selling right after the bulls were able to form a strong trend bar with follow-through.

I'm also not really sure about this point consider the following slide from the Encyclopedia with consecutive bull bars closing on their highs closing above MA with follow through:

I believe the price action to the left (dojis, overlap) is more indicative of a bear leg in a trading range rather than a bear trend. I agree with you that there are some decent reasons to take that entry, but the overall problem is most MTR attempts result in a trading range. Because of that, you really need to be weary of selling too low in what could be a potential trading range, which I believe was the case once Max took the entry.

I also somewhat agree with you about my follow-through statement. It's certainly not the best follow-through. But after a strong bull trend bar, the absence of a bear bar can still be considered follow-through.

In this particular case, I think the most important thing to note here is that the bears were able to form a strong trend bar (BO), but the bulls immediately reversed it and closed firmly above the bear bar and then proceeded to trade higher and also close higher for at least one more bar. If this was a bear trend, that strong bear bar should have resulted in another lower low or had some type of follow-through. I would imagine some bears sold-the-close of that big bar. Disappointed, if they did not exit early, they were probably looking to exit on any move lower near their entry point.