The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

first of all, I'd like to introduce myself since this is my first post. I'm a part-time forex trader from Germany on my way to achieve consistent profitability. Currently, I would consider myself in the breakeven phase. I go back and forth between demo and live accounts, but only trade live when I have time to really focus on trading and only trade small positions. When I have other things to do, I try to keep up with the markets by analyzing price action after the day is over.

After finishing the course for the first time, I am currently trying to improve my understanding of BPA by analyzing charts in the EUR/USD, my market of choice, using Al's methodology. I am also somewhat familiar with Bob Volman's trading style, who also teaches PA.

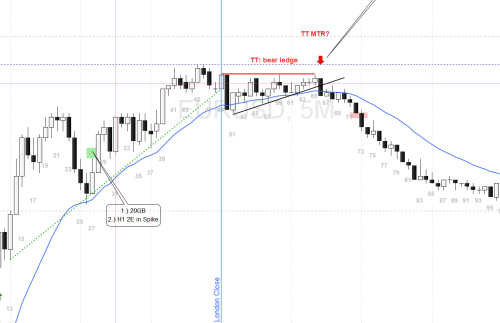

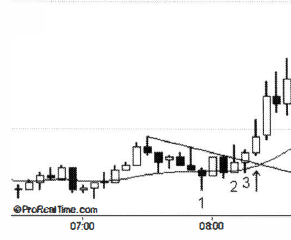

Today, there was a decent late short setup in the Euro (some hindsight bias at work, obviously, since I didn't spot it live):

The trade went to a 20 Pip profit without ever coming close to a tight stop above the bull swing or above the signal bar.

In Bob Volman's terminology, I suppose this would be considered a "pattern break" setup with good buildup, the price being wedged in between the support of the MA (and a small trendline) below and some resistance above, forming several tops ("false highs") on the same level. Also, there has been significant bearish pressure leading up to the move, as evidenced by the large bear trend bar (Nr. 50). The short position would have been entered at the market on the close of the bear trend bar that breaks the black trendline (Nr. 66) and closes below the MA for a fixed profit target of 20 Pips and a Stop Loss of 10 Pips.

My question is: Would this also be considered a viable setup from a BPA perspective? My hypothesis ist that it might be a Triple Top MTR since there was a break of a previous trendline (dotted green) and then a weak attempt at continuation.

I am somewhat doubtful it would be considered a strong setup because the first attempt at a bear reversal (bar 50) didn't go very far. Also, the "buildup" seems to be a type of triangle or maybe a wedge. I'm unsure whether it could be considered a wedge.

What is your opinion on this trade? I would be grateful for some insights from more experienced BPA traders!

Cheers,

Julian

Hi Julian and welcome!

I recently read Volman's book: Understanding Price Action and did a comparison vs BPA since many have mentioned similarities. Here are my findings below. Hopefully someone can provide more feedback and keep this thread going:

- Understanding Price Action: Practical Analysis of the 5 min timeframe

- Finding similarities between Bob Volman and Al Brooks BPA

- BPA concepts in bold headings with corresponding references to pages in the book below

- Main trade type: BO out of TTR in direction of prior trend

- Followed by BO PB trades for continuation

- Pros of material:

- strong focus on evaluating pressure buildup prior to breakouts

- gives ability to differentiate quality of setups

- strong focus on TTR FBOs/traps when looking for signals in the opposite direction

- encouragement to draw boxes to identify ranges

- warnings to not immediately trade at levels such as BRN without first seeing rejections

- stressing a need of good follow through after a BO to prove strength

- strong focus on 50% PBs

- many chart examples in the book with full analysis of trade ideas

- warnings to not trade into an MA

- explores passive management with OCO brackets vs early exits

- strong focus on evaluating pressure buildup prior to breakouts

- Differences to BPA:

- W and M Patterns (although acknowledging they include useful DBs/DTs)

- Being ok with undershoots instead of accepting TL break and retest from below so as to make visible a "squeeze" between EMA and some TL

-

- All analysis geared towards justifying tight stops only; no mention of price action concepts for handling trades with wide stops

- Curiosities:

- the word "trendline" appears only 3 times

- uses "pattern line" or "pattern boundary" instead

- reserves "trendline" only for steep and strong cases

- similar terminologies

- "We can refer to the bar that sets up the trade as our signal bar, and to the breakout bar in which position is taken as our entry bar." - p 74

- the word "trendline" appears only 3 times

- Finding similarities between Bob Volman and Al Brooks BPA

- Basic BPA Concept: Best moves result from both bulls and bears trading in the same direction

- e.g. bulls entering buy positions + bears giving up and buying back shorts at same place

- "for prices to follow through in substantial fashion, we need assistance

from both sides of the market." - p 6

- "When both bull and bear temporarily join forces on the same side

of the market-not with similar enthusiasm, we can imagine-we have

what we can refer to as a double-pressure situation." - p 6

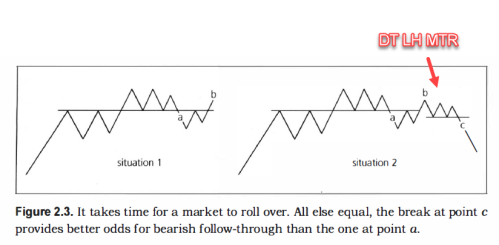

- Market Cycle: The first time one side tries to do something, it usually fails

- "the stronger the earlier dominance, the less likely the market

will turn on any first reversal attempt." - p 10

- (MTR) Major Trend Reversals

-

- "the stronger the earlier dominance, the less likely the market

- Disappointment due to bad FT leading to converting a swing to scalp and exiting early

- "Also, when confronted with a faltering break, parties positioned in

line with it, from whatever earlier level, may decide to exchange their

holdings for the safety of the sidelines, thereby further increasing the

pressure against the break-and with it, the odds for its failure."

- "Also, when confronted with a faltering break, parties positioned in

- Bull/Bear dynamics of a Breakout Pullback sell trade

- "bulls in position could grab the opportunity to quickly sell out, while empty-handed bears could make excellent use of the pullback to hop on the bandwagon in second

instance. That implies double pressure on the sell side again." - p 16

- "bulls in position could grab the opportunity to quickly sell out, while empty-handed bears could make excellent use of the pullback to hop on the bandwagon in second

- Traps from failed BOs

- "imagine a situation in which we are anticipating the market to turn bullishly around in an

area of support, and so the idea is to participate in a break on the buy

side; if the price action is currently forming a little cluster of bars going

sideways in a tight span (buildup), wouldn't it be nice to see the bears

first put in a break at the bottom of this cluster, only to get reprimanded

by the bulls." - p 17

- "imagine a situation in which we are anticipating the market to turn bullishly around in an

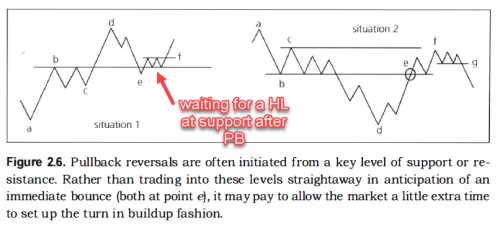

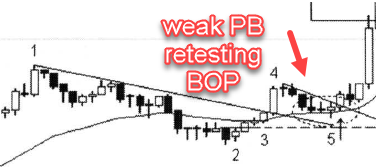

- BOP (Breakout Point) Test In Trend

- "wait for the pullback to first reach an area of support or resistance within the trending swing" - p 21

- "This technique can be referred to as waiting for a technical test" ... "corrections back to these levels are highly anticipated and can make for great bounce candidates" - p 22

- Trading a PB at BOP by waiting for a HL first -p 23

-

- Basic BPA Concept: Placing stoplosses below prior major higher lows

- "On the bounce trade at e, a technical stop may have been placed

below the first low on the left, below point c." - p 24

- "On the bounce trade at e, a technical stop may have been placed

- Concept of congestion areas acting as magnets due to vacuum effect

- "Equally intriguing, however, is this level's ability, and

tendency, to initiate the correction in the first place (magnet effect) ." - p 25

- "and they too may postpone their purchases until the level of B is hit." - p 26

- "Equally intriguing, however, is this level's ability, and

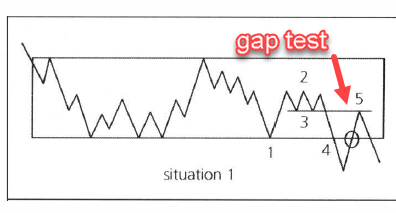

- Micro Gaps holding as signs of strength for BO continuation

- "whether or not we should participate in the subsequent breakout is

the presence or absence of a ceiling test." - p 27

- "rather than turning around in the most obvious level of former support (resistance of the bottom barrier) , a bullish pullback is known to gun for the last level of former

support, even when less prominent within the bigger picture" - p 27

-

- In BPA - this is an example of TR BOs often having a deep PB towards the middle of TR before resuming

- "whether or not we should participate in the subsequent breakout is

- BRN (Big Round Numbers) 00s and 50 levels

- "One does not need to observe the charts for

long to find constant evidence of how the price action tends to work

up to, and then revolve around, a notable round number of interest." - p 30

- "One does not need to observe the charts for

- Breakout + Follow through Concept

- "The very moment the high of bar 3 was taken out,

however, bulls didn't waste time buying themselves in, leaving plenty

of bears little choice but to quickly buy out. A classic double-pressure

situation." - p 37 -

- "The very moment the high of bar 3 was taken out,

- In BPA expecting only 10% of bars in session to be part of strong breakout

- "It's best to concentrate on the nondebatable

high-odds ventures first. They do not come in abundance; maybe

once or twice a session in any one market." - p 40

- "It's best to concentrate on the nondebatable

- Likelihood of retesting TLs after breakouts

- "If your pattern line has become invalid or redundant, erase it to

keep the chart clean, but do not do so immediately when prices break

away: the extension of the line could still play a role in a pullback situation.

(Will be taken up in Chapter 5 . )" - p 42

- "If your pattern line has become invalid or redundant, erase it to

- Watching to enter on a weak PB after a flag BO

- Always thinking about the bull and bear case

- "Although we can never be sure of how a break will play out, it is essential

to always look at the situation from both sides of the field prior to

taking position." - p 49

- "Although we can never be sure of how a break will play out, it is essential

- First touch of MA after >20 bars

- "Pullback 4-5 came to test the broken round number (adverse magnet)

, a feat that coincided with the first touch of the 25ema since the

start of the bull rally" - p 50

- "Pullback 4-5 came to test the broken round number (adverse magnet)

- Using reasonable targets and stops

- "equally essential is to scan for potential obstruction on the way to target" - p 76

- "-as well as for adverse magnets that may work to the detriment of the intended stop."

- warning re danger of tight stops when near areas susceptible to vacuum effects

- Key BPA Concept: When market tries and fails to do something twice, it often tries the other way

- "But whenever we see one side repeatedly fail to make it to their

magnet and then lose the initiative, a power shift is likely at hand. Put

differently, the failure of one side to reach their round number very often

sets the stage for a successful attack on the number at the other end." - p 79

- "But whenever we see one side repeatedly fail to make it to their

- Signal bars that are too big in TRs are suspicious

- "Bar 3, for example, the bearish powerbar that had

crushed the bullish breakout, positioned itself as a terrible signal bar

for sell-side purposes. It was way too tall to set up a high-odds break

of its own, right in the lows of the market" - p 94

- "Bar 3, for example, the bearish powerbar that had

- Hint of MM leg1=leg2 concept

- "There is a widespread notion among technical traders, and not without

merit, that the extent of follow-through on a flag breakout often mimics the length of the pole from which the flag is hanging. We can refer to this as the pole-flag-swing principle (a lightning symbol" - 99

- "There is a widespread notion among technical traders, and not without

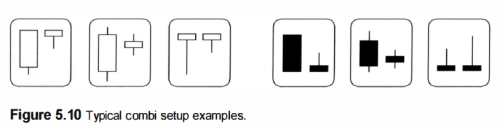

- Inside bar patterns (including ii)

- calls them "combi"

-

- three-bar combi (ii patterns)

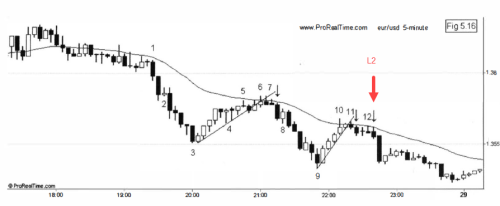

- Using L2s in a PB

- "In countless turnaround situations, it is the second break that triggers the desired double-pressure response." - p 129

-

Hope that helps,

CH

___________________

BPA Telegram Group

Also to answer your question further, I think you are right on all counts: the triangle is a wedge, it's also setting up a LH DT MTR and bar 66 would've been an OK entry. MTR setups by themselves are low probability of 40% so it's perfectly fine to also wait for cc bear bars like you did and enter a little bit later for increased probability. It looks very BPA, nice trade!

Very interesting! Thank you. I've noticed several of these similarities as well. Perhaps Volman builds on some of Al's concepts -- or both have discovered the same timeless principles of PA independently.