The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Week 4, Day 5 (I traded DAX today, because I'm travelling in the afternoon)

Chart (DAX)

List

Summary

Bulltrending day, got some really nice L2 setups, which I traded. In the end I had to close my last 2 positions due to having to leave. Todays trading was relaxed and on par.

Todays result = +1,2%

Week 5, Day 1

Chart

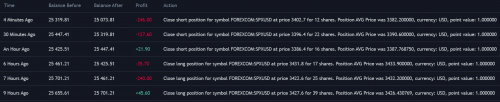

List

Summary

I brike my own rule of NOT trading the Globex market today. That put me in an odd mindset coming into the session and it shows. I was hessitant in getting in the bear run from the open, and stubborn once I got in, ignoring the V shaped bounce from the bottom. Topping it all off I managed to stay in an AIS mindset and go short on a beartrap leg, which closed at the bottom of a tight TR, forming a wedge at a DB, obliterating any hope of coming out on top. A humbling reminder that the market will kick my butt if I don't stay sharp.

Todays result = -2,2%

Week 5, Day 2

Chart

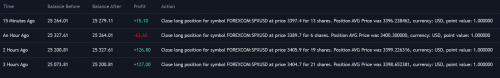

List

Summary

Today very early showed to be a TR day. For the first time ever though I managed to trade it successfully. I lowered the risk on entry to 0.25% rather than 1% that I usually go with. This allowed me to anticipate the bottom of the range coming in being confirmed, and slowly adding onto my position. This gave piece of mind as I wasn't as worried about the market hitting a little below LoD. It worked out well, as the chart and list also show.

One thing I would have done different in hindsight, is that, instead of having my stop right below LoD I would have it a few points lower. The third trade today wouldn't have been stopped out, but then again I was quick to re-enter. All-in-all today was a personal success as well as a trading success.

Todays Result = +0,8%

Week 5, Day 3

Not trading today as I'm going out to dinner.

Week 5, Day 4

Chart

List

Summary

I started the day trading DAX and killing it, which meant that I came into the US session a bit too cocky. This resulted in me over confidentially entering the market short on the second bar with way too much risk. I got stopped out, stepped back and readjusted myself, trying to look at things with fresh eyes.

Went long twice with the correct risk but chickened out in a bear trap only to realise that a near perfect IHS pattern had formed. I kept my wits about me and re-entered long on a good signal from the right shoulder and rode the bull break out almost perfectly to the top, just below yesterday’s high and EMA on 60 minute.

A couple of mistakes happened today. I need to keep patient in PBs as they often last longer than expected. I need to wait for a reversal, rather than to try to foresee them. And I need to be careful of upping my risk because I feel to confident.

Todays result = -0,02%

Week 5, Day 5

Not trading today, as I'm spending time with my kids

Week 6, Day 1

Not trading today

Week 6, Day 2

Chart

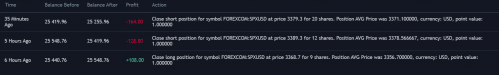

List

Summary

I had a couple of good entries. However, with no exit strategy I failed to capitalize. I am struggling with greed as market moves in my direction. FoMo kicks in both, when trying to enter the market as well as when wanting to exit. I still need to build the patience to take profits at measured moves, as I am good at entering upon the right conditions.

Todays result = -0,73%

Week 6, Day 3

Not trading today

Week 6, Day 4

Chart

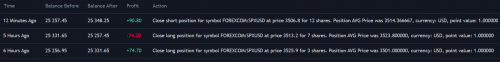

List

Summary

Jumped on the initial bull run after a strong open and got out just when I should at a MM, well done! Then I got impatient and instead of waiting for a probable TR, I went back in and lost what I had just won. Back to square one. The slow trickle down confused me and when I saw a strong bear bar I was quick to jump on it for all the wrong reasons, completely ignoring warnings… Big bar, late in trend, TR PA, Close to LoD. Market sure showed me. Fortunately I had set my stop above HoD and started the waiting game, as I saw a LH form, I added to my short position and closed everything a yet another MM 2nd leg down, making today slightly profitable.

Practicing my trade management and today it paid off.

Today’s result = 0.36%

Week 6, Day 5

Not trading today

So far for the past weeks the result is as follows:

Total P/L to date = +1.48%

Average daily P/L = +0.64%

For now that adds up to being profitable. I have decided to keep this journey going for the rest of the year and see where I end up. That is just about 3 months of daytrading. If I end up profitable over that time, I will be going back to trading real capital.

Congratulations for beeing profitable so far!!

Week 7, Day 1

Chart

List

Summary

I was nervous going into the session today. The move just before the open surprised me and was extreme, why I traded with caution today.

The opening did look like a reversal and I entered with 0.25% risk. Added on what I thought would be a wedge, however it needed a small move further up before turning back down. When I felt fairly sure the market was continuing the bear trend, I now had a full 1% risk to a stop above HoD (taken from the globex session).

Once market hit LoD in session, which corresponded with EMA on 15 minute chart, I decided to exit above bull bar, even with the tail on top, as we could still be in a TR, and to many times before have I been stubborn and held onto a position only to see profits dwindle.

Market sold off by at the end, but simply due to all of the support levels from previous LoD down to below 12th of October High and being close to the end of the session, I didn’t feel like re-entering.

Today’s result = 0.26%

I'm not going to update this thread any longer.