The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I did Als course in the spring of 2020, after I'd been trading for about 1½ years. I spent the first year following different "experts", picking up bits and pieces. Got into Elliott Wave Theory, traded different stocks (mostly on NYSE). After a while I dipped my feet into CFD trading in the DAX index and found this really interesting, with lots of potential. From there I started building strategies and coding an automated trader in Excel, which traded for me back in january- march 2020 (didn't do great, but I learnt a lot).

After all that I came across one of Als books and had a hard time understading High 1/2, Low 1/2, from reading about it. Went on the web, found this site, signed up and engulfed myself in the course material.

Went on a crazy daytradings spree, lost 25% of my trading capital, got a day job and took a break over the summer, and now came back.

I've been trading this past week, with a patience I didn't have in spring. I believe it's because I now have my primary income from a dayjob, and (since I'm in Europe) then trade during the evenings. US market is open from 3.30 pm - 10 pm for me. I've reduced the amount of trades I take to between 1-3 a day, and quit if I loose 1% of my capital in a given day. My initial risk is between ½ - 1 % on any position and I have been doing this on Tradingviews papertrading, to see if my eyes and mindset have adjusted from the selfimploding routine I ran in the beginning of the year.

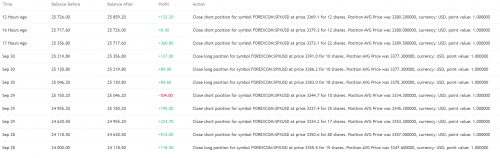

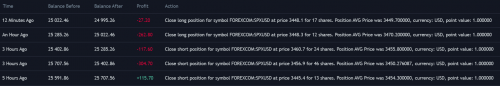

Here is the account history for the past 4 days:

>>I've reduced the amount of trades I take to between 1-3 a day, and quit if I loose 1% of my capital in a given day. My initial risk is between ½ - 1 % on any position <<

Excellent Mikael. Keep your cool and take your time.

Week 1 has come to a conclusion. Friday was very volatile and I had my kids with me my focus was not there. I missed a 2nd leg down in a perfectly executed short swing, still came out of the day with profits.

Here are the trades executed, unfortunately TradingView doesn't provide a better overview than this, as the Journal they provide shows EVERYTHING, like when a stop is moved or a trade is cancelled, which makes it for a confusing read.

WEEK 1

Result

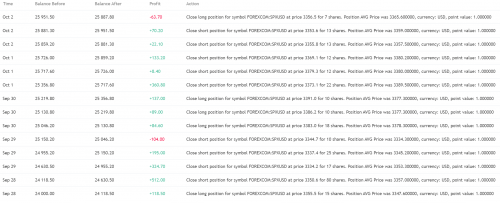

Week 2 I went back to old habbits of trying to time tops and bottoms, not sticking to the plan and doing some overtrading. My patience was low and I did not check my mindset before sitting down infront of the terminal.

The result reflects my emotional state. It was a loosing week, where I just wouldn't accept that the market was AIL *grrrr*

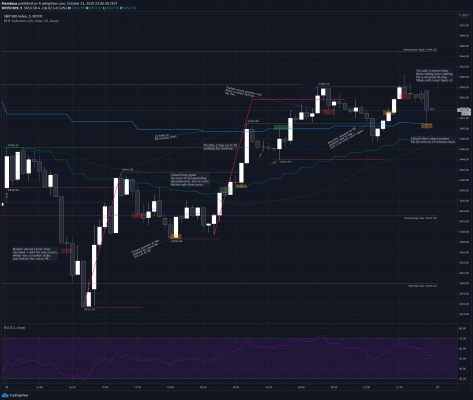

WEEK 2

Result

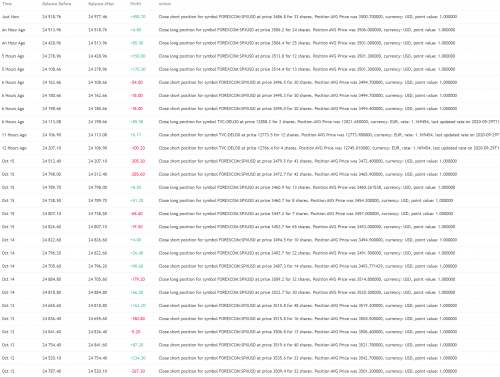

Week 3

My loosing from last week kept going. I've been going back to my old style of just being pigheaded not wanting to change my "Always-In" call from the open and trading a whole lot against the trend because of it.

Friday I decided to try my hands on some DAX trading during my daytime, to do something else, and around the time US opened I had pretty much lost all my gains from the first week, leaving my account atroud 24.1k down from just under 26k.

What I've realized though is that I'm reading things right, and it's all in my head. I'm loosing because I'm stubborn and unable to stay fluid, moving with the market, rather than fighting it.

So I traded SP500 and ended the week just below 25k. That feels really good!

Need to stay cool , and just wait for those setups.

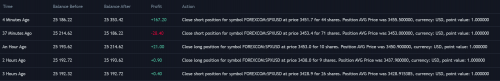

WEEK 3

Result

@mikaellindeman-dk

Yes, it is very similar for me: I know what I should be doing, but then the neanderthalian part of my brain takes over and wants to close the trade with 6 points of profits, even though I could easily make 50 points by letting it run 5 minutes longer.

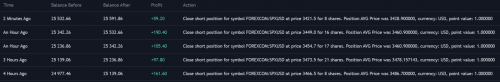

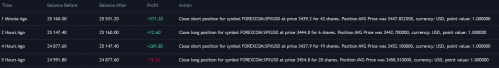

Week 4, Day 1

Chart

List of Trades

Summary

I should definitely have made more money on a day like today. However I traded, while playing with my kids, and wasn't 100% present. Enough excuses. I got out of trades to soon and missed a couple of entries. I completely put Thursdays low from last week in the wrong place which led to me existing a trade, late in the day, way, way to soon. I have now found that the more information I put on my chart as I go, the more comfortable I am waiting for a good entry.

Todays result = +2,4%

@mikaellindeman-dk Still, good work! The same thing happend to me on the last trade. Closed it way to early and missed 70 points.

Week 4, Day 2

Chart

List og Trades

Summary

FUBAR day 😀 OMG! I was chasing the market not present enough and accepting the shift in an obvious TR. I knew it would be a TR day, well, I expected it to be, but still I managed to F it up beyond all recognition. Horrible, horrible trading.

I write comments in my chart as thing develop and leaving it there to illustrate my state of mind as the market moves. I am obviously behind the market all day making terrible decisions.

Earlier I was marking up DAX and doing great, so came into the US session with an elevated ego ready to make a killing. The market has showed that humbleness is a better route.

I bow down and realize I still need to work of my psyche in order to be profitable. Disaster is the work that comes to mind as I review todays decisions, and also that there is a lot of revenge trading going on.

Todays result = -2.33%

Yesterday was a really strange day. Very choppy and volatile. I threw in the towel 1.5 hours after market open. Of course I don't know your trading level but you could try to not use scaling in an out of trades. Of course the concept makes a lot of sense, but at least for me, it makes it very easy to bend the rules.

Using terms like the market being choppy and volatile only tells me that we are in very different places when it comes to how we view the market. I'm very comfortable with how I am progressing.

As much as I can appreciate the commentary, I am posting here mostly for my own benefit. I could also just keep everything offline.

Choppy and volatile are some of the best conditions for trading. Terrible for investing...

Week 4, Day 3

Chart

List

Summary

Not much to say about today. Steady solid trading. Big TR, and managed to stay cool and agile. Especially happy with the first reversal, which I caught onto and held all the way down. Towards the end of the day I got into a short position pretty low in the range, with a good stop range. Waited it out and added another position when market reversed down from DT 20EMA on 60min, closed near bottom for a healthy profit.

Very good trading today, more days like this will be good in the long run.

Todays result = +2.3%

Week 4, Day 4

Chart

List

Summary

I have to realize that I am such a perma-bear, that I get uncomfortable being long at the moment. Jumped in early and got back out, never really caught onto the bull trend, and kept trying to find a reversal down, ended up getting a little action at the end. Not much profit, but stayed cool enough to not loose a bunch, which also is a big improvement from earlier.

If you're following this and wondering why the account balance starting out today, doesn't match up with when market closed yesterday, it's because I was trying to trade DAX today before SPX opened and it didn't go so well.

Todays result = +0,6%

I won't be trading tomorrow, as I'm travelling. But will be back on Monday.