The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Do not hesitate to comment.

I just finished the course and this was my first day trading BPA.

Currently trading in Sierra Chart's live simulator. Finishing the day up +40 ticks on NQ.

The day was chaotic. There was a lot of ups and down.

For the first time I removed volume from my chart, and all custom indicators I had, in particular about market depth. Focusing on price action only lifted a HUGE burden.

However, I realized there is something else I need to remove: the 10 seconds chart. I kept looking at both the 1mn and 10 seconds chart and it was exhausting: conflicting information, temptation to constantly switch from one to the other.... I took the decision NOT to look at the 10 seconds chart expect in one occasion: on BO spike, to find micro pullback on the 10 second chart to enter on the spike.

I removed order entry from the 10 seconds chart so temptation to trade from it is killed.

Yes, I know it is heavily preconized to trade the 5mn chart.... but Al started on the 1mn chart and as Al said it can speed up the learning process since there is a lot more to analyze.

Also I scalp: taking profit at 1x latest 10 bars range average, or 0.5 x latest 10 bars range average. For now I simply CAN'T resist the temptation of scalping. I must lose my virginity on this before swinging.

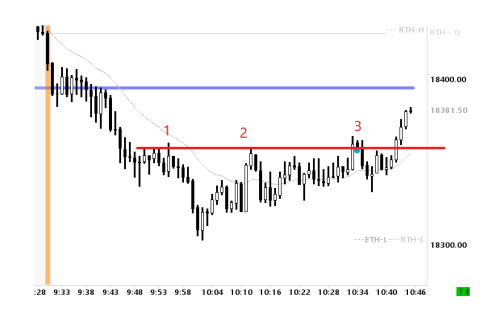

Here is a sample of my best trade:

- Context: TR

- Signal: breakout failure (short on the blue dot)

- Profit: 1x 10Bars average range

Focus for tomorrow: trade only the 1mn chart. Temptation is huge to switch to 500 tick chart. Will have to resist this.

I think you are making three mistakes. 1&2: trading the NQ on a 1 minute chart. If you trade that way you are denying yourself the chance to compare your read of the market at the end of the day with Al's charts. You are also forcing yourself to make decisions too fast for a beginner. 3: Scalping requires a win percentage that is completely unrealistic for a beginner. The Trader's Equation for small profits like that requires a win percentage close to 100% because you will be taking losses that are multiples of your wins.

In addition to what Andrew says, ES actually needs lower margin than NQ, so that's another reason to trade ES, but the biggest reason is comparing your analysis with Al's.

Also, don't spend too long on sim trading. Move on to micros quickly because having money on the line is a whole different kettle of fish.

If you trade that way you are denying yourself the chance to compare your read of the market at the end of the day

This is a very good point. Didn't thought about it in such a way but after the first day I realize how this can be extremely helpful, and how naked I feel at the end of the day without having an authorithy to compare to.

I'll definitely change to MES/5mn.

But not right away, I need to purge myself from the desire to trade MNQ/1mn.

Thank you Mike.

On the moment I took the trade, I saw it as a double top (your 2 and 3) and failed TR breakout.