The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

This is my understanding of BOM:

- 50 percent chance of successful bull BO

- 50 percent chance of succesful bear BO

- 50 percent chance 1st BO up or down will fail

And BOM occurs in trading ranges where there is reason to believe the market is close to neutral in directional probability. For example, a protracted trading range lasting at least 20 bars occurring after a trend.

Then there is something I don't understand - please correct me on this. The 80 percent rule says that 80 percent of BO attempts from trading ranges fail. How does this work together with BOM where there is 50 percent chance 1st BO up or down will fail?

Thank you in advance, Andreas

Hello, BOM (Breakout mode) accurs when you have a TTR (tight trading range for several bars) an iii pattern. Prices are congesting and a breakout will occur. It will either occur up or down and there is 50% chance that it will fail, trap traders in wrong direction and go the other way.

When a trading range is broad than 80% of breakout attempts will fail.

Just like when a trend is strong 80% of reversal atempts will fail.

I see. If any trading range is BOM, then I am still not sure how to differ between 50 percent chance and 80 percent chance of the breakout failing.

Perhaps it is because 50 percent of the breakouts that break strongly beyond the extremes of the trading range have 50 percent chance of failing, and as you say, 80 percent is a generalization of the weaker breakouts attempts within the trading range itself that fail 80 percent of the time to break through the extremes?

For protracted TRs (flat) longer than 20 bars or so Al is saying that half the time a successful breakout will be to the upside and half the time to the downside. And (separately) half the time the first breakout attempt will fail.

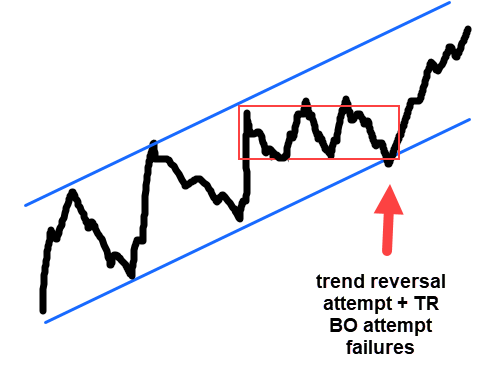

The other rule is for trends like Al points out in the screenshot above: 80% of reversal attempts in strong trends (sloping) will fail, become just a flag, and the trend will resume.

But also often can get them both combined. For example, a small TTR inside a trend:

Hope that helped!

CH

Thank you for the detailed reply. 😀

I am probably missing something simple, but I still don't understand this concept. This is what I written in my notes about breakout mode so far:

When the market is in a trading range, any reversal up from the bottom third or below the range is a failed breakout attempt, and any reversal down from the top third or above the range is a failed breakout attempt. 80 percent of these breakout attempts fail.

In a trading range, the market is also in breakout mode, and any trading range is breakout mode, since the term "trading range" implies that the market is neutral in terms of directional probability, and not in a pullback favoring a current trend.

Because the market is not favoring a breakout to the upside or downside, there is 50 percent chance of the successful breakout being to the upside or downside, and there is a 50 percent chance of the first breakout attempt failing ... (why not 80 percent chance of the first breakout attempt failing when 80 percent of breakout attempt fail? And what is meant by "the first breakout attempt" since there are many failed breakout attempts within trading ranges?)

I don't understand what you mean by seperately here:

For protracted TRs (flat) longer than 20 bars or so Al is saying that half the time a successful breakout will be to the upside and half the time to the downside. And (separately) half the time the first breakout attempt will fail.

Maybe the confusion is between what is a breakout attempt, an actual breakout, and a successful breakout?

A bull breakout attempt is any push up in the range and if it reverses then the breakout attempt is considered to have failed. The push could reverse from anywhere in the upper 3rd without making a new higher high or even make a new high above a TR and still reverse (think of all the tails that poke above a TR but close as bears). These are the 80% chances to fail.

A successful breakout from a trading range is one that restarts the market cycle. Breakout -> Channel -> Range -> Breakout. So there may be a breakout, but unless it triggers the full market reset it's still considered a failure. And a breakout is different from just an attempt to breakout. A breakout is when it actually happened, not just attempted to happen.

So there's the "first breakout" that fails 50% of the time (not just an attempt but an actual breakout). For example, bulls close above a TR and maybe there's a follow through bar and maybe even wants to begin a channel as per the market cycle. So clearly a breakout happened (not just an attempt). But it's still only 50% chance that the market cycle will continue from there. 50% chance it will continue to be a TR.

It's very hard to defeat market inertia.

Then there's the case of a protracted TR (>20 bars). This just means it's a coin flip in which direction the ultimate breakout will succeed for market cycle continuation.

That is a great explanation Mr. Carpet, it is exactly what I was missing. I really appreciate it!

I have updated my notes of BOM trying to collect all the information. I hope it is correct:

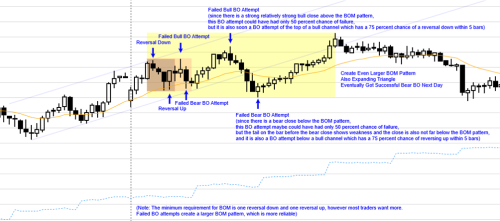

80 Percent Of Breakout Attempts Of Trading Ranges Fail

When the market is in a trading range, any reversal up from the bottom third or below the range is a failed breakout attempt, and any reversal down from the top third or above the range is a failed breakout attempt. When the market breaks out beyond the trading range but immediately reverses without creating a close beyond the trading range, and without creating a follow-through bar, these breakout attempts are included in the 80 percent of breakout attempts that fail. If a close beyond the trading range or a follow-through bar is not present, then the breakout will fail 80 percent of the time.

Breakout Mode

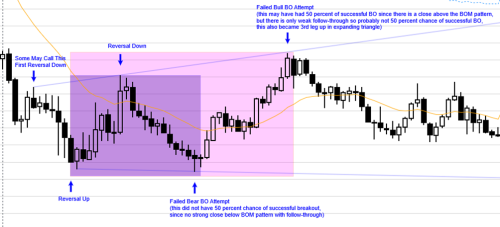

In a trading range, the market is in breakout mode, and any trading range is breakout mode, since the term "trading range" implies that the market is neutral in terms of directional probability, and not in a pullback favoring a current trend. Because the market is not favoring a breakout to the upside or downside, there is a 50 percent chance of the first breakout being to the upside or downside, and there is a 50 percent chance of the first breakout failing. This is different from a breakout attempt since this has a close beyond the trading range and perhaps a follow-through bar. This is an actual breakout from the trading range, which fails only 50 percent of the time, and it is not just a breakout attempt which fail 80 percent of the time. This means for this first breakout to not have an 80 percent chance of failing, it needs to have a close beyond the trading range and perhaps a follow-through bar.

List Of Breakout Terms From Trading Ranges

- A successful breakout is a breakout from a trading range that restarts the market cycle (breakout -> channel -> trading range). If there is a breakout, but it still has not restarted the market cycle, it is still considered a failed breakout. Once there is good follow-through in the shape of a couple of bars closing near their extremes beyond the trading range, many will expect it to be a successful breakout.

- A breakout or "first breakout" is an actual breakout and not just a breakout attempt. This means the breakout will have a close beyond the trading range and perhaps is followed by a follow-through bar. This is a clear breakout, but it still only has 50 percent chance of the market cycle continuing from here (channeling) and a 50 percent chance of staying in a trading range.

- A breakout attempt is any push up or down in the trading range. If the push up reverses down within the upper third or above the trading range, it is a failed breakout attempt, and if the push down reverses up within the bottom third or below the trading range, it is a failed breakout attempt. These breakout attempts fail 80 percent of the time, and they are different from a breakout or first breakout since they do not include a close beyond the trading range or a follow-through bar.

Examples Of BOM

So there's the "first breakout" that fails 50% of the time (not just an attempt but an actual breakout). For example, bulls close above a TR and maybe there's a follow through bar and maybe even wants to begin a channel as per the market cycle. So clearly a breakout happened (not just an attempt). But it's still only 50% chance that the market cycle will continue from there. 50% chance it will continue to be a TR.

I was always clear that a breakout with a follow through bar has a 60% chance of success, but must have overlooked that just a breakout without follow through has a 50% chance of success. That's an important piece of information. You can take the breakout without follow through and go for at least 1.5R and get a positive traders equation.