The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi Al

I truly salute and admire the commendable work you have done on Price Action. Is it possible for you to kindly make a video on "Context" as bonus video

to touch upon

1. Good and bad context

2. Look back window for context... recent prior bars or prior bars

3. examples of context favoring the bulls or bears

4. What to do in case context is good for bulls but it changes- how to handle those things

5. Any price action patterns which create good context

Or any other topic which you may think is important...

Just a humble request as this is the most important thing, I realize

I have good news and bad news for you.

The good news are that you have already available all the needed videos to know about context, good and bad patterns for both sides, how to manage the trades, etc. Isn't that great?

The bad news are... that this is precisely the goal of the entire course so, sorry, you need to watch the 100+ videos to answer your questions. You asked for a video and you got 100+, this is truly great, isn't it?

Ok, now more seriously, I recommend patience (this is a several years task), watching each video at least twice (if you rally want to make it, you will have to watch them many more times) while taking notes (I recommend a screenshot per slide so you can take notes on the chart). Don't rush to the forum, watch the entire PA fundamentals part once, you will see that many of the questions that will arise in any given video will be answered in next videos (or within the same video in next slides!).

Again, be patient, take notes, go thru the whole PA fundamentals part first, and you will see that concepts will start to be clear. And once you finish the PA fundamentals part, using your new knowledge, start doing end-of-day analysis of the EMINI and compare it with Al's in his daily setups section and bar-by-bar analysis (only available for the days Al is doing the webinar. It is in the other website: brookspriceaction.com).

This is the way to improve and, if you have questions, we are happy to help here!

Thank you so much for such a detailed answer.... I appreciate that... I got what you are trying to say....

I see you are a senior member. And must have completed the course

Is it possible to guide me on following

I have a habit of learning theme wise. What is theme wise learning- I dont usually go chapter by chapter

1st I scan through the content 4-5 times and getting the basic idea of author( here Al) & understand the style

Then I make the theme of topic covered

Likewise, I have done in BTC

I have divided into couple of parts and these part cover videos from both section ( fundamental and trading PA both)

But combining logically videos from each part

Broad parts

Basic videos - basics and charting analysis

Chart patterns -

Trends - videos from both part on trend

Reversals

Breakout

Channels

TR

How to trade - covering swing/scalp/managing losses etc

I was able to do that as I have approx 10 yrs of exp in market so understand he technical stuff quickly... here to take it to next level

so each part take respective videos from both part and cover the topic completely

Will it be a good approach here or should I go chapter by chapter sequentially

Kindly guide with your experience

In future also, I would bother you being a senior...ha ha... following you

Thanks

And must have completed the course

You can bet on it but, honestly, I don't know how many times I did. Each pass you do you get new bits of info that you overlooked in prior passes (the course is the same, but your understanding is not)!

I have a habit of learning theme wise. What is theme wise learning- I dont usually go chapter by chapter

1st I scan through the content 4-5 times and getting the basic idea of author( here Al) & understand the style

Then I make the theme of topic covered

Likewise, I have done in BTC

I have divided into couple of parts and these part cover videos from both section ( fundamental and trading PA both)

But combining logically videos from each part

I like that as well, but not on the first pass in this case.

Will it be a good approach here or should I go chapter by chapter sequentially

Most themes are dealt in both parts, as you said, but for you to make sense of each topic dealt in the second part, you need to know all the theory in the first part, not only the related to that particular topic. If not, you can't really read correctly the chart (= its context) and truly understand what Al is explaining.

Good luck!

Thank you so much...I really appreciate that... I understood the point

I follow your advice...for first pass..I go chapter by chapter...complete in sequence

May be in second pass I can go theme wise...

It gives ample clarity

Can you help me on this one

I am taking screenshots of video slides to make notes on it. Since I am a working professional so not getting time to do it... I need to make trading as my full time career

If you have screenshots of videos- can you kindly share it with me. You can remove your notes, I dont mind that

Kindly let me know... I shall always be grateful for this help

Can you help me on this one

I am taking screenshots of video slides to make notes on it. Since I am a working professional so not getting time to do it... I need to make trading as my full time career

I was in your shoes and also wanted to download the slides but the anti-piracy policy is clear and I had to go thru all the slides and print them out.

What I did was watching each video first taking the screenshots, and not taking notes but jotting down the timestamps of relevant explanations. Then, I printed them out and then watched again, now taking plenty of notes and paying special attention at the previously taken timestamps.

The first time you watch without taking notes is not wasted time because you get the big picture and the second time (and next ones!) you will get much more info than the first (and previous ones!).

Give it a try and check by yourself, good luck!

Thanks...appreciate that... I will do that...I was thinking the same...to watch all first and take screenshots and second time I take notes

Hi Ludopuig

I am thankful to your guidance earlier. I have completed lot of slides as first pass and taken screenshot...as I am moving ahead, clouds are getting clear

I will make my notes in the second pass

I have recently seen your post and they are really amazing with good information. Your answers are really elaborate and with clarity

Truly appreciate your help and respect your knowledge and intelligence

Don't know how I can connect you outside this forum as well. I really want to.

Happy to be helpful, Tarun, and thanks for your kind words.

Regarding your last sentence, it is better to talk thru the forum so every new trader can learn from others' questions. Had I just sent my feedback to other traders before you privately, you would never have been able to read, learn and appreciate them... Let's give others the same opportunities! Hope you understand.

I Understand your point.

Hey

Is it possible to guide me through your decision making process of buy/sell

Like what are the mental steps you follow to frame a decision on buy/sell

As I am progressing, My process is looking like

step1- decide about the market cycle - trend/ TR

Step 2- there after look for buy reasons or sell reasons (DT/DB/Reversal/Breakout/Wedge etc) according to direction

Step 3- Do math using trader equation

Step 4- take trade

I would appreciate if you can help me with your mind process, it can help me to improvise my process

Thanks in advance as always

I can't help much on this because nowadays I just like a trade and jump on it without too much rationalizing.

I only trade the EMINI opening so I look for swing setups (blue-rectangle trades) and then I watch for supports and resistances (looking for possible targets), having in mind the always-in direction and whether there are trapped traders. For trade management, I use defaults or clear PA targets and I exit whether I reach those targets, the opposite side gets a decent setup or I am stopped out.

How do I get to like a trade? I have scanned the daily setups section from its very beginning and I like a trade if I can recall a similar one in the daily setups (helped with the encyclopedia sections devoted to openings) that worked.

Thanks for reply

I get your point. But I liked your approach

My mind is kind of systematic and thinks in rational manner. But lately I realize, too much logic and rational thinking does not work in market

Premises change so you change accordingly

Currently I am not able to access Encyclopedia and daily set ups due to minimum onboard period policy.

Soon, I will be able to access the same and will surely follow your advice about those

Just a question

Can you kindly elaborate on "Trapped traders" ? What it means and where in course I can find any explanation on this

Really appreciate your efforts and respect your sincerity about educating & sharing with others

My mind is kind of systematic and thinks in rational manner. But lately I realize, too much logic and rational thinking does not work in market

Premises change so you change accordingly

Don't make me wrong, I did rationalize everything but after many years I have assimilated the PA and now I simplify.

Soon, I will be able to access the same and will surely follow your advice about those

It is well worthy while learning (and then!) to compare you reading with Al's. This gives you good feedback.

Can you kindly elaborate on "Trapped traders" ?

I don't remember in the video course but in the books there is a short but very illustrative chapter devoted to trapped traders, although this theme is present through out the whole book.

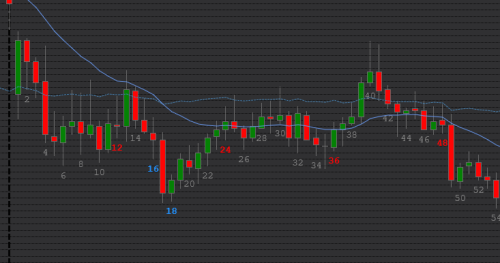

Just an example, take yesterday's chart (attached below). Bar 6 was an opening reversal buy and bar 10 was a second entry. Any of those were really strong buys but some traders took them for sure and got trapped when 14 closed on the low, so 14L is a good sell. Then, bar 18 trapped those bears when it created a wedge, so 18H was a good buy.

Got it...

Sorry, but my intention is not to make you wrong...I know you are experienced and have good understanding of things including this course...what I meant was "Simplifying " things only...

I am learning from your posts

Thanks

Sorry, but my intention is not to make you wrong

No, I have to say sorry: I wanted to say "don't get me wrong" instead of what I said, "Don't make me wrong". No problem at all! 🙂