The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I'm set up to trade cryptos because I first got interested in trading looking at those markets. Also I tried to find some FX broker that's available in my region but their software looks like Windows 3.1 so I gave up.

So I'm going through the Forex course videos because I'm guessing that's the most like trading cryptos.

Looking at some of the setups that Al discusses, eg., the 5min USDJPY charts, he gets excited about a trade and talks in terms of pips but when I looked at the %'s they seem small compared to cryptos, like 1% move.

Looking eg., at the 5min LUNAUSDT chart, in a couple of days it trended up 14.5%. That's actually not unusual. I'm finding that it's not that difficult to win 2-10% on a trade within a few hours on these charts.

Problem is that it's also easy to lose that much so my goal is to keep the wins but reduce the losses. Currently I'm basically breaking even so I figure that if I can reduce the obvious mistakes and reduce losses through better management I'll be profitable.

My question is whether I'm correct in the observation that these FX charts have small moves and whether there is any greater risk or difficulty associated with the apparent bigger moves on the crypto charts.

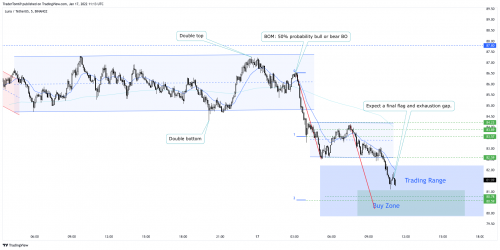

I can see all the same sorts of setups that are discussed in the videos (see attached chart), eg., the LUNAUSDT chart shows the same sort of market cycle with spike, channel and TR, etc.

Al talks about this repeatedly that price action is similar for all instruments as they are not an expression of the instrument itself but of human behaviour which is pretty much encoded in our genes. So, it hardly matters what you're trading as long as you can take rational decisions in structuring your trades.

To my understanding, cryptos are far more volatile than the E-minis or currencies probably but if you dissociate the pricing scale from the chart, it would be impossible for you to state clearly whether you're trading a crypto or something else. What remains is your preference in trading. If you think you're comfortable trading cryptos, do that. Nothing should stop you as interpretation of price action would be the exact same as long as the instrument is not closely controlled and prone to manipulations somehow. The only similarity I find among cryptos and currencies is that they are both traded 24 hours in a day.

Regarding how much % you can make on a single trade deepnds on your volume and not the volatility so much. If it is too volatile, trade small enough so that it fits your risk appetite, if it isn't very volatile you are free to trade higher quantities.

Although, there are circumstances when you should stop trading as the price fluctuations at that stage are too low for you to structure a profitable trade but that happens everywhere and again does not depend on what instrument you're trading.

Thanks Abir. That's pretty much what I thought. However, a couple of clarifications would be welcome.

Regarding how much % you can make on a single trade deepnds on your volume

I don't really understand this. Do you mean the "size", eg. whether I'm buying $1000 or $2000? Why would that matter other than the fees? Otherwise, what do you mean by "volume".

Also, a followup question if I may: if the currency and forex markets are 24/7, is there a single start and end of the day?

Sometimes Al talks about the start and the end. I'm located in the Hong Kong time zone. Should I be looking at European and US time zones for start and end of the day? Is there some sort of a rule of thumb here?

Yes, I mean position size when I say volume. Your position size actually determines how much of actual money you're risking per trade and accordingly how much you stand to make. You shouldn't be risking more than 3% of your capital on a single trade anyway(3% is when your accuracy is pretty high, say about 80% meaning you're scalping). Do let me know if you still need a little more clarification on this. I'd be happy to elaborate.

To my understanding, there probably is a very small window of time when no trading takes place at all. Other than that, I've known Al talking about start and end of a regional session (say Asian session or European session or American session). During any of these sessions, the quantity traded is fairly large and institutions are very active during these times. Between these sessions, although the markets remain 'open' activity and volatility dries up and it'd be fair to say institutions are inactive during these times and you shouldn't be trading a market where institutions are largely absent. It'd be almost impossible to structure a reasonable trade and extract money from the markets during these times.

You can choose to trade any one or all of these sessions if it is feasible for you. There isn't a rule of thumb per se but it is pretty clear that it's better to avoid the dull periods if you're an intraday trader. Whole other story if you trade positionally. The dull periods do not hold nearly as much relevance for you.

Also, mind you that forex markets are not open 24x7, they close on Friday night(US session) and Open on Monday morning (Asian session).

Your position size actually determines how much of actual money you're risking per trade and accordingly how much you stand to make

Ok, I get you now. % risk/reward relative to my account size.

I've known Al talking about start and end of a regional session (say Asian session or European session or American session)

Yeah, I just noticed that in FX trading Video 41D that he mentions Asian trading session. So I guess I don't have worry about that too much. I'm right in the middle of it being in the HK timezone.

mind you that forex markets are not open 24x7

Right. But I'm going to stick to cryto and those are 24/7 as far as I know. So far looking at LUNAUSDT it's exhibiting textbook setups and profit targets, Measured Moves etc., so looks like a promising start for a beginner like me.

Tom

I think you raise a great point.

I have also often wondered about the fact that Forex and the major world stock indexes (such as the SnP500) have way less daily range than instruments like crypto, and therefore far less potential profit.

So, yes the potential daily average trading profit is way more. It seems to me that if you are a consistently profitable trader, theres no reason crypto wouldn't produce much bigger trading profits. Particularly on something like the 5min timeframe. (I personally wouldnt trade crypto on daily bars on regular hours because the daily moves can be too big [sometimes 4-10%], and also of the potential of huge overnight gaps)

The downside I see, is that, as we know, crypto can occasionally, suddenly move a few percent in an hour. So there's the possibility of a very big loss from the price moving so fast that it bypasses your stoploss. I can only remember this happeneing once in forex in the past 10 years (when the swiss franc had a sudden giant unexpected move).

Otherwise, I understand crypto has good liquidity, so it should produce reasonably reliable setups.

I think it would be better to only trade about 20% of your portfolio in crypto (to take advantage of the greater potential profits, and the other 80% in major forex and stock indexes, because it is possible that crypto could suddenly fall 10-30% if the American govt suddenly announced a policy whereby they decide to regulate it, or start their own digital currency.

The problem with incurring a huge sudden loss is not only financial loss, but also damage to your psyche. Obviously, you must guard against huge losses.

You're studying price action, and with how thin some crypto's are traded, price action can become unreliable since large traders can move the price with a single order. For myself, I've been looking into trading the NQ rather than the ES, and that already makes a difference in how easy it is too read the charts in the way Al teaches, and how reliable they are. The NQ isn't exactly a small instrument.

It's easier to learn price action trading instruments that have so much liquidity, no single player can influence the price. That has 2 advantages: Price action becomes easier to read and you can scale up. The ES for example might only move 10 points in an hour, but it has enough liquidity that I can buy 200 contracts and make $100.000 without slippage (hypothetical..). The same goes for Forex, the market might only move 20 pips but there is enough liquidity in the market to trade with lot sizes that make those 20 pips worth hundreds of thousands. You can't trade that big with crypto while still managing risk, it just moves too quick.

My point is that big moves might feel exciting, but they're really not that special. You can be as profitable on anything else as long as there is enough volume.

It's like comparing low float stock vs large cap stocks. Most traders who have been around for a while are very careful with low floaters, for good reasons. They take positions in the millions in large caps like TSLA, and scale down significantly with low floaters to manage risk. If you're really set on trading crypto, I would advice picking a market or instrument and mastering it's price action. Don't chase the big moves, it's not worth your risk.

PS I understand your comment on the software most Forex traders use. The futures market is much better in that regard. Check out AMP futures for the amount of platforms they support (Quantower is a modern solution, but not stable enough imo). Ninjatrader is excellent. Haven't tried TradeStation yet.

Thanks Michiel.

with how thin some crypto's are traded, price action can become unreliable since large traders can move the price with a single order

This is what I thought as well. But there are many cryptos and I guess I'd go for the bigger ones. When I first started looking at trading I was looking at people who trade penny stocks. They can build their account faster apparently because of the greater volatility. So I'm guessing the more volatile cryptos are like penny stocks which is good if you want to grow a small account quicker.

For myself, I've been looking into trading the NQ rather than the ES, and that already makes a difference in how easy it is too read the charts in the way Al teaches, and how reliable they are

I don't know what those are. As I indicated above with the charts from LUNAUSDT it looks like this chart is showing all the things that Al is teaching in terms of the market cycle, measured moves, double tops/bottoms, spike and channel, exhaustion gaps, reversal bars, etc. So I just wonder if there really is any difference.

My point is that big moves might feel exciting, but they're really not that special. You can be as profitable on anything else as long as there is enough volume.

Yeah, I don't really understand that. If I have a $10k account and I have to wait for a whole day for a 1% move vs. have a couple of 2-3% moves in the same period of time, wouldn't that make a difference? On the LUNAUSDT charts I can see a couple of 2% setups within a few hours trading TRs. I'm not in position to make a $100k because I'm not a millionaire so I wonder how that applies to a small account like mine.

Don't chase the big moves, it's not worth your risk

I don't really understand what what you mean here. Al is repeatedly drilling into our brains that as beginners we want to hold for swings, and for reward twice the risk. What's a "big move"? My question is whether, given that I stay within the parameters of not risking more than 3% of my account on any given trade, trading a chart that has regular 2-5% moves is any worse (difficult, risky, etc.) than a chart that has <1% moves.

If you're really set on trading crypto, I would advice picking a market or instrument and mastering it's price action

That's what I'm planning to do.

My point is that big moves might feel exciting, but they're really not that special. You can be as profitable on anything else as long as there is enough volume.

Also, I don't hear Al talking much about "volume". If I remember correctly he dismisses it early on in the course. Also, he says that you should wait patiently and then when there's a set up for a swing then you should hold to get the maximum because as a beginner that's the best way to make money. If you look at the LUNAUSDT chart below, is that a scalp or a small swing trade? Is that a "big move"? Is there a lot of volume? If you bought in early and held for a swing the profit potential is 2-3% within 3 hours. So why would cryptos, or this particular chart, be more risky?

He was talking about using volume as an indicator. He doesn't dismiss it at all, he simply says you can read it from bars alone.

And in that case I mean liquidity. You can make as much profit as long as there is enough liquidity. Liquidity allows you to scale up your trades.

Hi Tom,

Yeah, I don't really understand that. If I have a $10k account and I have to wait for a whole day for a 1% move vs. have a couple of 2-3% moves in the same period of time, wouldn't that make a difference? On the LUNAUSDT charts I can see a couple of 2% setups within a few hours trading

My question is whether, given that I stay within the parameters of not risking more than 3% of my account on any given trade, trading a chart that has regular 2-5% moves is any worse (difficult, risky, etc.) than a chart that has <1% moves.

You're correct that it isn't any more risky to trade more volatile assets, and that there's plenty of suitable cryptos to trade that have sufficient volume (I haven't heard of LUNA before but something like BTC or ETH is perfectly fine).

However, your profit potential on a more volatile asset generally isn't going to be any different from trading a less volatile asset. For example:

- Assuming you want to risk $200 per trade on a $10,000 account

- You take a trade on a crypto of your choice. The appropriate stop is 2% below your entry. You buy $10,000 worth. You take profit at a 6% gain. Your profit is $600.

- You take a trade on EUR/USD. The appropriate stop is 0.2% (about 20 pips) below your entry. You buy 1 lot ($100k) with a $2000 margin deposit. You take profit at a 0.6% gain (about 60 pips). Your profit is $600.

So the profit you achieve isn't going to vary based on the volatility of the asset, because you adjust the position sizing to risk the same amount either way. The only time your profit potential would be limited by volatility is if you don't have enough leverage to size up enough.