The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

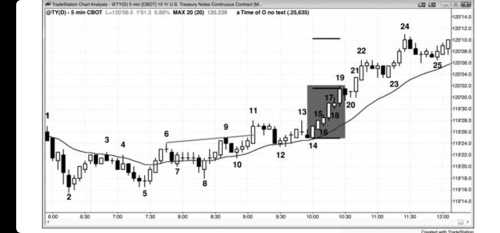

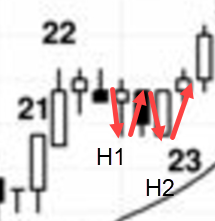

Reading Book 2 and regarding Fig 1.1, Bar 23, AL says it's a H2 because "all double bottoms are high 2 patterns." I don't get that. It looks like a H1 to me. What am I missing?

Hi David,

This is an advanced counting technique. Whereas in the classic (and safest for beginners) counting style traders wait for a bar to tick above the previous bar, in this style we monitor "pushes" down.

If you follow the movement of the bars you'll see that bar 20's tail created a "push down and then back up", the next bear bar was another "push down" and then again the market reversed back up. All together this adds up to bulls effectively reversing back up for the 2nd time, thus creating an H2.

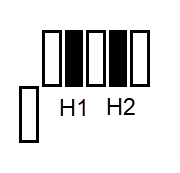

Or a very barebones way to see this concept by counting "pushes".

Hope this helps,

CH

_________________

BPA Telegram Group

Thanks Mr. Carpet. Followup question: why isn't this a H3 then since the bar after 22 also pushed down then reversed up?

Yes, it can be seen as a micro wedge even:

There are multiple ways of looking at it. I think it's a discretionary call whether to reset the count or not. But regardless of whether you see a MW, H2 or H3, I think the main idea is to recognize that a PB is weak relative to prior bull move so we're waiting for an opportunity to enter on bull trend resumption.

Thanks! Helpful.