The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi. This is the biggest problem I have been encountering these days, so I'd like any advice you have. After practicing daily setups, I have become much better at spotting nice swing trades, which Al indicates using blue boxes. However, I still often get trapped out of pretty good trades after seeing an opposite setup. That not only ruins the trade, but also brings me some losses, because I sometimes reverse the position.

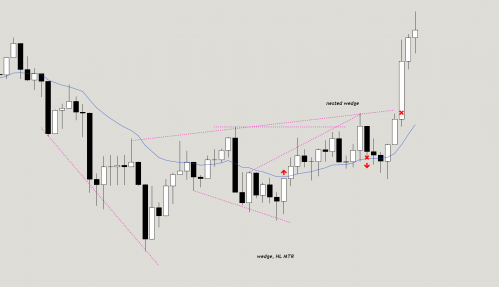

For example, you see a parabolic wedge and a possible HL MTR setup in the chart above. If you bought there, after seeing the nested wedge, would you get out?

My " hypothesis" is the second swing setup will always be less reliable if it is right after the first setup, but I'm not sure at all.

Suppose you are flat after seeing the MTR setup. Would you sell at the nested wedge? Or would you look to buy since there's MTR just an hour ago?

For example, you see a parabolic wedge and a possible HL MTR setup in the chart above. If you bought there, after seeing the nested wedge, would you get out?

No, i would hold my long looking for a test of top of bear channel or the open. Also we have the three bull bars spike at bottom of bull trend so a second leg is likely, btw the channel is tight, no consecutive big bear bars closing on the lows, the bear are failing above MA.

My " hypothesis" is the second swing setup will always be less reliable if it is right after the first setup, but I'm not sure at all.

I think it is the opposite since you will have more price action information in the second configuration, if it is right after the first setup, i assume it is a second entry which is always have higher probablity.

Suppose you are flat after seeing the MTR setup. Would you sell at the nested wedge? Or would you look to buy since there's MTR just an hour ago?

Sell that nested wedge is reasonable for swing, especially if you going use wide stop and scale in, however, assuming this a TR day, i think is better look to buy for a swing hoping for a test of the open on final third. Or you could simpy wait a BTC finish setup and scalp out on 4th or 5th bar.

Hi YOSHIHIKO YANAGI,

Your questions are some of the most difficult to answer in trading. I think it is important to break down your questions into two groups:

1. Is the nested wedge a good swing sell setup?

2. If it is, what is the best way to manage it (Take profits, Hold, or Reverse)?

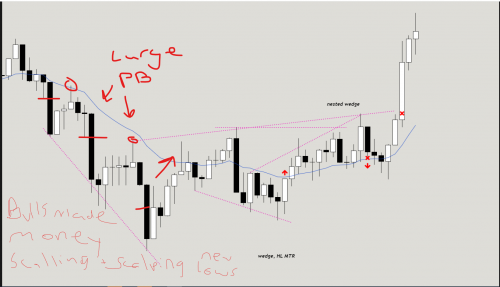

Marx Silva makes a lot of good observations on why bulls may have the advantage over bears at that spot. I would also add that the original bear trend to the left of the screen was not a very strong one. There were 5 and 6 bar PBs, not many consecutive strong bear bars, and bulls made money with each push if they bought a BO of a new low and scaled in lower.

If the original trend was stronger, it would have made a test of low of the chart much more likely. With the MTR creating a tight channel, I think a 2nd entry short and a break of the channel would have made the short much more likely to succeed.

Now, lets say you decide that the nested wedge is a reasonable short, should you take profits? hold? reverse? The truth is, all options are legitimate here. You're beyond your actual risk, so there is nothing wrong with taking profits. Holding is legitimate as Marx Silva explained. I think reversing is also an ok strategy. However, if you reverse you have to get out, and probably be willing to reverse again after that strong outside up bull bar.

Reversing is easier said than done, but it also depends on your temperament. I actually like reversing, because it makes me read each and every bar. But if you do reverse swing positions, you have to trade really small and not care about winning. I think everyone figures out what they prefer for themselves.

Good Hunting!

Thank you, Marx Silva and Paul Brusuelas!

Maybe I focused too much on the pattern itself. I should've cared more about the context.

Like Paul said, the first bear trend is not strong at all. But I only looked at the big sized bars, and I hoped to get trend resumption, which might have been a low probability bet. I might have already seen the low of the day.

Of course, trading has no absolute answers, you can buy or sell and make money on most of the bars, but I think I got some good perspective from you both. ( I am not skilled enough to scale in, so I need my own style of getting in and out all at once)

@marx

Let me show you the chart of UK100 from last week, this is what I meant by "the second swing setup will always be less reliable if it is right after the first setup."

The nested wedge took place about 3 hours away(about 30 bars) from the BO of the triangle, and that might increase the probability of the setup. Maybe bulls who bought down there are satisfied enough to take profits. That resulted in a great reversal setup. Just wanted to make my thought clearer.