The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello traders.

Over the past couple of months my long trades are overall profitable, but my short trades are bad and kill all the profit from my long trades. The total number of trades are 150 and 50 of them are short trades, but they have still killed all the profit and I have a small net loss.

Has anyone else experienced this? Maybe I am unable to read downwards charts?

Thank you.

Regards,

Andreas Gade

Hello Andreas,

You haven't mentioned which markets you're trading. But with stocks it sometimes happens that traders develop a long bias after trading bull trending markets for a very long time.

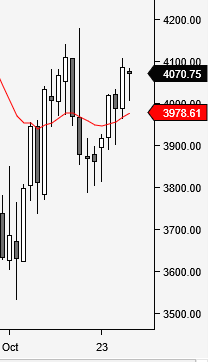

Since Oct 2022, S&P weekly chart has had a more bullish bias. It's possible that if you're selling but holding on to losers for too long and taking massive hits then they'll outweigh your winners eventually (especially if the winners are small then even if there's more of them it may not help).

Whether one has more winners or losers also depends on whether you're more of a swinger or a scalper. Swingers will have more small losses and a few huge wins. Scalpers the opposite. But still, swing losses shouldn't outweigh profits so much since a good trader is able to minimize losses from swings that aren't working out to a minimum. An unbiased trader will have about same ratio of long wins/losses vs short wins/losses.

Feel free to post charts here with your trades. Getting feedback really helps with learning this. Or join the chat for more live help.

Hope that helped!

CH

-----

BPA Telegram Chat

I kept going short expecting it to have double to, but the market kept swinging up.

I bet if I starts going long, everything will reverses.

Hello MrCarpet. I have switched to live trading the SP500 CFD and getting experience in the Brooks trading room. Previously I traded the DAX for about a year and began to study Brooks a couple of months ago and about to read the last book now. I'll take the course afterwards. I am swing trading and looking for those 2R setups with at least 50 percent probability.

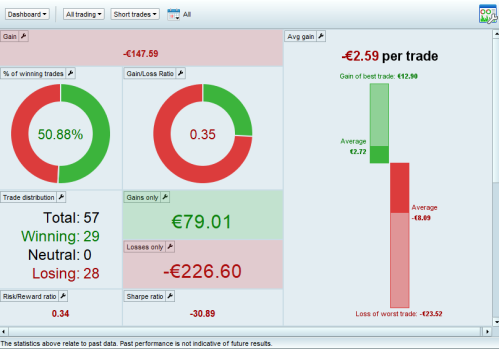

After you pointed out that I need to have small losses, I analyzed my trades and my average short loss is about 40 percent bigger than my average long loss.

Overall on both long and short trades, my average loser is 102 percent bigger than my average winner.

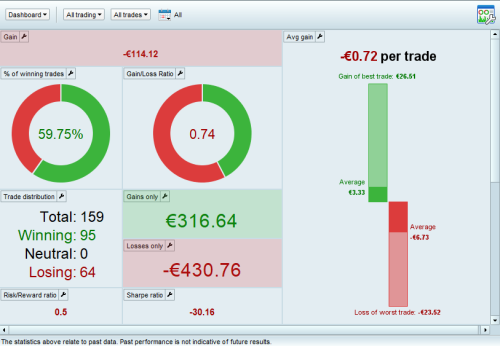

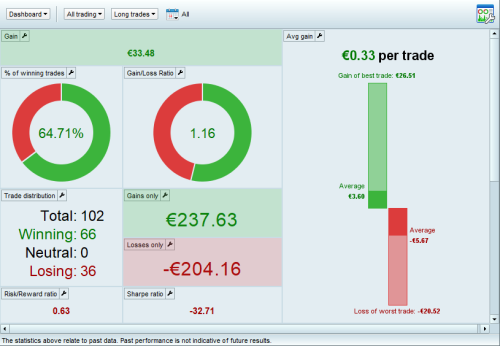

I was aware of this problem, but not that it was so big.. This is from 159 trades and from the very beginning of when I started studying Brooks a couple of months ago. I will begin to work on this problem and have already done something by beginning to aim for 2R swings as of a couple of weeks ago. Is there anything else I can implement?

Thank you for pointing it out.

These are my statistics:

All trades (above picture)

Long trades (above picture)

Short trades (above picture)

Hi Andreas,

It's good to have such stats so you can see a top level view of where the major problem areas are. Also having a journal is critical. After every trade log the usual details (instrument/time/entry/exit/PL etc) and if it's a loss then add a comment about what you were thinking while the trade is still fresh in your mind. Even if it's a win but you don't feel good about how you managed it comment on that also. Maybe you could have doubled the profit with better handling. At the end of the day take a screenshot with all the trades shown on the chart and store it next to this log as well.

Then once a week or once a month you can review your trade comments with the screenshots on the side. You may be surprised at what you discover. For example, after seeing a chart with fresh eyes you might ask yourself why didn't you see a bigger context in play when you took that losing trade. Or you might ask why does your comment say there wasn't any problem with a losing trade but you can clearly see that you held it for too long when there was a clear exit earlier to minimize loss. You may even find that your winning trades could've went for 3R or 4R instead of 2R if you just held longer.

After enough such logging you'll start to find patterns in your comments, either psychological or technical that you need to work on and you can begin eliminating the ones causing you the biggest drawdowns.

Here's a journal template you can try if you don't have one yet: https://bit.ly/tradejournaltemplate

Hi Andreas, have you studied Al's training materials on "Managing the Trade". It includes exiting at appropriate early exits. I think he also has a youtube video on it.

It is common to have an overall bullish bias when look at the market. Just look at all of the TV pundits and they are constantly talking about what stocks to buy, not what stocks to sell. When I am struggling, I will often look at an inverse chart to double-check my bias. Also, look at a lot of bear trend structures and practice thinking, about how would I sell and make money? It great that you realize your bias, therefor you can fix it.

Alright, I have a few things to work with now. I have a created a OneNote and put all my notes and prior work in there and integrated the excel journal (to log trades and comments) and powerpoint journal (to analyze every chart at the end of the day) into it so that everything is easily accessible. I will review my trades at the end of the every week. I have also opened an inverse chart in my software and are working on flowcharts to get an overview of how to process all the information I get everyday from the market.

Thank you all for your help and the excel template, MrCarpet.