The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi everybody,

Several years ago, I used to be a member of the trading room and followed Al's daily webinars. Back then Al didn't talk too much about trade management. Last month, I joined the trading room again and I saw that Al talks a lot more about trade management and specifically how to exit trades 1-2 pts below any bar and/or 1 tick below a bear bar closing below its midpoint (in case you are long).

This way of managing a trade is something new to me and I am a bit confused by the new approach.

If a trader takes a swing trade then the goal is 10 bars and 2 legs, which means the trader has to hold during a pullback. But managing the trade using a tight stop means that the trader doesn't allow a large pullback. So how does a swing trade reconciles with using tight stops?

I have also completed the Trading Course and nowhere in the course managing trades using tight stops is covered.

Can anyone share their experience managing trades using tight stops? How successful such a trader has been re-entering trades and how successful people have been on trading range days using this approach to stop management? Anyone knows when Al started talking about using tight stops?

It will be great to hear if someone can share their experience or knowledge on this topic.

Thank you so much!

Hello David, great question. I have followed Al for years and have had heard this only in recent videos as well.

Of course this confused me more. Made me think I missed that all along but I can't find where he mentions before in this particular way.

He used to say below 2 big bears or three small if long for instance.

And is it before or after profit or both? I always TRY to swing but get stopped out on small or large stops so still hard to make up the profits on big swings?

Confusing.

Hi David,

I think senior members, who have been part of his trading room can answer better. I have been following his EOD report of BPA for a few weeks and to my understanding, it is probably your scalp stop as you don't allow any pullback while scalping.

As far as I recall, you can find Al talking a little more about scalping in videos 31A through 31D. He might have discussed these somewhere else as well but I watched these videos in the recent past and I remember him talking about scalping vs. swing trading here.

You can also refer to the MTR section where you can see Al exiting a swing before the stop is triggered as the setup does not remain viable any longer. Hopefully, these videos might provide some insight to you. Hopefully, someone experienced would answer this question as I am eager to learn the answer to it as well now.

Last month, I joined the trading room again and I saw that Al talks a lot more about trade management and specifically how to exit trades 1-2 pts below any bar and/or 1 tick below a bear bar closing below its midpoint (in case you are long).

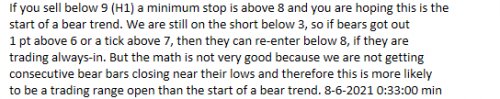

This management is especifically thought for buy-the-close (BTC) and sell-the-close (STC) trends in which countertrend surprise bars can come at any time with a huge risk, so better to exit early. If you have a specific chart in which it occurred, post it and we can comment it; anyway, below you can find an example:

There are a few more slides in the encyclopedia (part 13). I also think it is explained in the course (in any of the videos talking about BTC and STC trends) but I can't remember especifically in which ones.

He used to say below 2 big bears or three small if long for instance.

This is for a different context: 2 big bars or three small ones switch the always in direction so swing traders might exit. In the case above, the always-in direction also switches but so abruptly that it is better to exit early.

Hi ludopuig,

Thanks for the detailed answer.

The acronym for this type of stop management is BLE4, which stands for

"Bulls can Exit about 4 ticks or half an average bar range below any bar, or 1 tick below bear bar closing below its midpoint if concerned about risk. Can always buy again above next bull bar closing near its high."

https://www.brookspriceaction.com/acronyms.php

I will use the acronym from now on.

I was also using BLE4 to manage my trades when trading BTC or STC trends especially in the final hour of the day.

And as you mentioned, there are a couple of videos in the Trading Course that talk about BLE4 but only in the context of trading

the final hour, where abrupt reversals are common.

Now, Al uses BLE4 to manage all trades including swing trades throughout the day. He refers to this as stop management for "Always-In Traders" or simply as "managing your trades using tight stops".

The opposite of this strategy is the "Wal-Mart Strategy", where a trader takes a swing trade with a stop beyond the signal bar and comes back in an hour.

So, right now there are mostly two strategies for stop management:

- Always-In Strategy or BLE4

- Wal-Mart Strategy

I personally like the BLE4 approach to stop management and would like to learn more about it from other traders.

It will also be great if Al posts a new video or an article discussing the BLE4 approach to stop management more in depth, since it is something new.

I will go ahead and post some charts with Al's commentary from the webinar, as to makes things clear.

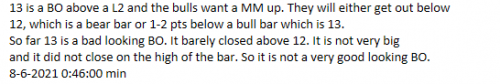

"If you are an always-in bull and got out below 20 and it starts to go up again and you are trading always-in, you need to get long again. And there are two ways to do it. One is you buy above a bull bar closing above its midpoint, preferably closing near its high or you buy at the prior high, which is the 20 high" - 7-28-21 around min 51:00

"Bulls who bought above 10 can get out a point or so below 12 or they can keep a stop below 10."

Thanks Abir,

I will check out the videos you told me about. Thanks for your answer

Everything David Kalinov said.

Also, his AIBRE and AIBLE and AIBLE4 and AIBRE4 accronyms also describe similar early exits. He mentioned some of those accronyms in some of his markedup daily blog charts, and also his daily bar-by-bar charts' commentary in his other website, during the past couple of years.

Huge respect for you Ludopuig. Your knowledge is exceptional and your answers are usually always spot on.

I am confused though. Today I traded a day that looked pretty much like that. BTC. So buy the close are not swings?

If your buying in a strong trend why are you getting out after one bear bar?

And why not the bear bar before or the one before that or even the one before that?

Although I generally trade like that anyway...

This is my day. Made a few mistakes. Would have made WAY profit more just holding. But that's hindsight and I don't play that game. Just learn what I can and move on.

This defensive strategy is the only one I can make profitable even though execution is hard.

P.S. "In the case above, the always-in direction also switches but so abruptly that it is better to exit early." ??? How could you know that? The big bar didn't happen yet?

If your buying in a strong trend why are you getting out after one bear bar?

And why not the bear bar before or the one before that or even the one before that?

I think Al covered something on similar lines in a recent blog post. BTC or STC late in a bull or bear trend respectively are in many cases just momentum trades as there are traders who are still entering the trend due to FOMO. Once the market get saturated, the opposite trend often unravels quickly and if you've entered in the trend particularly late, it can wipe out a decent amount of your capital. So, if the trend does continue after the attempted trend reversal, having said that the surprise bars down or up did not shift the Always-in direction, you get an opportunity to re-enter.

This is my day. Made a few mistakes.

I am a beginner and know almost nothing, but even I can say that your trading style is nowhere close to what Al teaches. To think that you then come to these forums to say things about Al which I would not even dream of, is in the least bit, interesting.

But that's hindsight and I don't play that game.

Would you be willing to accept anything, ludopuig or someone else says? They are all in hindsight and you would just end up calling them out for no reason.

P.S. "In the case above, the always-in direction also switches but so abruptly that it is better to exit early." ??? How could you know that? The big bar didn't happen yet?

Before the second(and I might say, pretty violent) leg down, the markets created an ii pattern below which you sold, can be interpreted as a final flag. To top it off, the selloff after the ii was pretty big and it raised the possibility that it was an exhaustion gap and not a measuring gap. The markets eventually went on to create a DB(probably micro) and a second entry buy which closed the gap, and then SBU(bars, there were quite a few) finally turning the always in direction to long.

Sorry, if I have been too loud. I know I am a beginner and you have studied the course for 5 years. So, you know things better. Considering how stupid I am, that I got bewitched by Al's halo effect, I hope you can disregard the places where I loudly tried to shut you down and reject any criticism of Al.

No Abir I will stop posting questions as it doesn't get me anything but misunderstanding.

And NO dont trade like Al. I CANNOT make it work. I need to trade defensively. Too many contradictions in Als work.

That WAS why I ask questions.

Al and followers ALWAYS ALWAYS ALWAYS have a backward, I would have done this here, after the fact confidence that bothers me as I don't see anyones trades to me you are all full of it.

If you could all trade like that you wouldn't be studying Al for all the answers.

Did you trade yesterdays big BTC trend and get out at the top like Al most certainly did riding the whole wave? How did you trade it? Did you trade it?

You are right Al's teachings are the best I've ever found but I CLEARLY DONT BELONG here as I don't believe you can predict markets but the minute I say that I'm a bad guy?

All good I can appreciate Al and the course and just continue to trade my way.

Thanks and good luck in your trading career.

I am a beginner and know almost nothing, but even I can say that your trading style is nowhere close to what Al teaches. To think that you then come to these forums to say things about Al which I would not even dream of, is in the least bit, interesting.

Really? So where exactly WOULD Al have gotten in and out? Was it my entries or exits? Both? Where did you trade it? How did I go wrong. Aka what did you see LIVE trading that I did not? IOI. There are a few on there. You just chose the last one because you could see that big bear bar. That's just MY OPINION. But it's also my point.

Would you be willing to accept anything, ludopuig or someone else says? They are all in hindsight and you would just end up calling them out for no reason.

NO I have alot of respect for Ludopuig. He is pretty much always spot on analysis wise. No idea if he can trade it but if anyone can, I don't question HE COULD do it. Does he? Can he? I dont know.

Theres a G*D D@am world of difference between analysis and money management.

But in the end YOU are correct I probably wouldn't believe until I seen a REAL trade period. Or at the very least trades taken LIVE.

P.S. "In the case above, the always-in direction also switches but so abruptly that it is better to exit early." ??? How could you know that? The big bar didn't happen yet?

Same question.

Sorry in advance to anyone, to whom this thread is causing any form of distraction.

No Abir I will stop posting questions as it doesn't get me anything but misunderstanding.

Misunderstandings arise because you're making baseless allegations against Al and a whole community of learners. I for one, have no authority whatsoever to make you stop raising questions. You're welcome, just like everyone else to raise questions. However, if you're being disrespectful, that won't help your cause. Just FYI, hedging your statements does not nullify what you said in the first place.

I need to trade defensively

Not sure what defensive looks like. You're boldly selling a clear bull trend and buying a clear bear trend.

Too many contradictions in Als work.

If there are, just point them out. I think there are a lot of people, who would be glad to learn from those. What makes Al great is that, there are no inconsistencies, at least to my eyes in his teachings. At this point, my readings match at least 60-70% of Al's swing trade markings on his daily reports on this website(not the BPA one, can't still figure that out yet).

Al and followers ALWAYS ALWAYS ALWAYS have a backward, I would have done this here, after the fact confidence that bothers me as I don't see anyones trades to me you are all full of it.

And you're making allegations again. Have you ever stopped and considered that your attitude perhaps is backwards? Try and see for yourself, if we are really a community of swindlers or there is something really positive being created here. FYI, I remember a thread where a successful student of Al(Vy A) said a few things to you, which you clearly disregarded. On that very same thread, a user named Kristof also said some things. He even posts his trades on his journal but you probably would find reasons to not believe those as well.

If you could all trade like that you wouldn't be studying Al for all the answers.

At least, I could not trade like that myself before I found Al. Now, I see many setups and they work. That's the great thing about it. Seeing it unravel before my eyes.

Did you trade yesterdays big BTC trend and get out at the top like Al most certainly did riding the whole wave? How did you trade it? Did you trade it?

I am based in India and just in the learning phase. I follow the Indian markets all day and then follow the E-mini in the evening. I trade on a sim account till I can and then go to sleep. If you want, I can show you my trades on the sim account. Although, I did not trade the up swing and left the market before that, I was trading short and did not stay after the breakout from the final flag and exited my shorts on the sim.

You are right Al's teachings are the best I've ever found but I CLEARLY DONT BELONG here as I don't believe you can predict markets but the minute I say that I'm a bad guy?

Again, empty allegations without any mettle. My long post would probably go to waste but I want you to succeed, just like I want everyone else here to. That's why, I try to help everyone in any way I can, despite being a beginner. This also helps me get better by identifying my mistakes. I would rather say the incorrect things and be rectified by the experienced members than stay quiet and pretend to be smart when I clearly would be not. Also, there are no one here who can predict the markets. Some are following the higher probability event while others are chasing the lower probabilities in exchange for higher risk-reward ratio.

All good I can appreciate Al and the course and just continue to trade my way.

If you can find a way to trade successfully by following Al or whoever else you were talking about before, then great! No worries at all.

Thanks and good luck in your trading career.

Well, I did try to resolve your doubts to the best of my abilities(although they are probably inadequate). Finally, like Al says - a beginner relies on luck. I would be happier to trade the numbers and percentages.

Hope you realize your mistakes and come good. That's all I can say. Good luck!

IOI. There are a few on there.

Nope, just 2 on the chart as I can see. Both were in the right context and exactly spot on.

Was it my entries or exits? Both?

You're exiting every bar probably. Not sure what you're doing but yeah, it's not something anyone can do sustainably for a long career. I have said before, many of your entries are scary. Not all though. You took some good entries there as well.

You're asking many things without providing proper context. Mostly, you're angry. Probably, on yourself. That seems to be your greatest drawback at the moment.

Theres a G*D D@am world of difference between analysis and money management.

There sure is and you probably don't realize it. Maybe you're trying to get rich quick or something else, I don't know.

NO I have alot of respect for Ludopuig. He is pretty much always spot on analysis wise. No idea if he can trade it but if anyone can, I don't question HE COULD do it. Does he? Can he? I dont know.

But in the end YOU are correct I probably wouldn't believe until I seen a REAL trade period. Or at the very least trades taken LIVE.

Not sure why you're stuck on this point. I don't understand why would it be of any difference if they can trade or not. What matters is, all the ingredients of anyone becoming a successful trader is provided on this forum. I have never come across a more complete source of knowledge than Al's. If you can internalize all of it, you would be on the path to success. Al never said that it would be easy. Al never even claimed that you would be always successful. He provides the complete information.

NO I have alot of respect for Ludopuig.

Glad to know you respect someone. Ironically enough, you don't respect the person from whom we're all learning.

Coming to the forum out of frustration and talking aggresively, even if not intended to offend, will not help you out. I have many times been frustrated and I have wrote down very aggressive notes (some of them were to Al, others directly to God), but I have never sent them. What I have done has been reading them some time after and every single time I have been very happy of not sending them on the first place (especially the ones sent to God, just in case:) because, at best, I was completely off. As I said, Al teaching is not perfect, we all would change something, but this is what the forum is for, to fill the gaps, clear misunderstandings or raise flags if something is missing in the theory. Precisely, If I am so active here is because I still remember the bad feelings I got when I was starting out... the more of those I can save you from, the better... yet, we all need to be responsible for ourselves.

David posted an interesting question, because I haven't been in the webinar for a long time I didn't noted what he is pointing out so I gave him a wrong answer on the first place referring to the end-of-day BTC/STC management. Now, I DON'T UNDERSTAND what Al is saying there so I asked Richard to let me watch those particular days David is referring to and, if it is as it seems that Al didn't covered it in the course, we can tell him and, hopefully, he somehow will fill the gap or clarify what ever is needed.

Ok seriously... last post.

First off my apologies. Seriously, I am sorry. Reading back through you guys are right. At times they are just rhetorical rants.

I will take Ludopuigs fantastic advice and keep off the keyboard as that is just me.

Abir you sound like a kind, smart, individual and are in the right place and your right I don't want to mess things up in here.

I learnt soooo much from Al.

(??? My trades? I sold in the morning. Caught some good trades. Waited to see at the bottom then started buying just after 8am PST and ONLY bought the rest of the day. Appx a 15 point day (60ish ticks) in profits before comms... with real money. I trade with Ninjatrader. The arrows on the top and bottom are the bar and the tiny triangles point right for entries and left for exits. But I know I don't really trade like Al. Everyone has to find their own niche.)

Ok... Lastly... My main frustration is if you understand what Al says shouldn't everyone get he same results? Give or take. At least in retrospect?

Like a guideline a baseline? It's the old, "it's not if I'm profitable or not but whether or not I followed the rules."

I'm not sure how to ask? How do I know how Al would have traded that day so I know how he did and most importantly where did he exit his trades?

Maybe he is always taking smaller stops than me. Wider. Maybe he's super active with his stops. Maybe he did what I did that day and maybe he held all day? (Which in RETROSPECT I wish I would have done.) What did he do and how did he manage them?

It seems we all know where to enter. To me it really isn't as important as the exit. The exits the money maker or loser. So I'm usually referring to the exit.

Other than that Abir is right, this place is not for this. If I have constructive questions, then I will ask.

Good trading all!!!