The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

First I am going to write some information about what I believe is true, and then I will present my questions to this information at the end.

Definition: Directional Probability

- Probability of the market going x units up before x units down

- Probability of the market going x units down before up x units up

- Probability of success is the probability of reaching the profit target before the protective stop is hit

- Probability of failure is the probability of the protective stop being hit before the profit target is reached

Value Trading and Momentum Trading

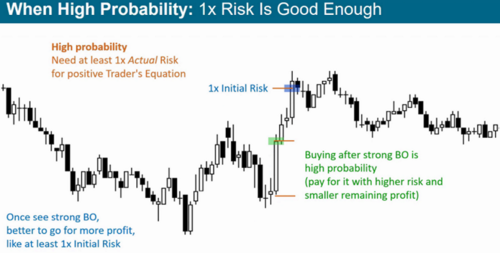

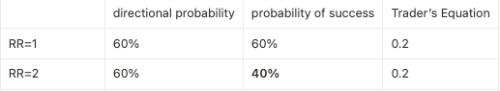

- Value trading setups has high directional probability since you are buying at the low of a trading range, sloped trading range, or weak bear trend, and selling at the top of a trading range, sloped trading range, or weak bull trend. For example, if a trader bought and he intially has 60 percent probability of reaching a reward of one times the risk, then he also initially has 40 percent probability of reaching two times the risk. Please see examples in picture 1 and 2.

- Momentum trading setups has high directional probability since you are buying during a strong bull breakout or strong bull trend, and selling during a strong bear breakout or strong bear trend. Please see example in picture 3.

Questions

- When Al refers to "probability" as low or high, does he refer to directional probability, probability of success, the probability of it becoming a trend in your direction, or something fourth? Please see top left corner in picture 4.

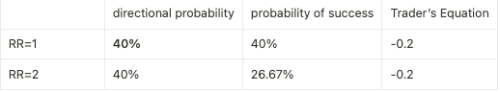

Subquestions:- If he refers to directional probability, why is it mathematically sound to take the trade? You can't simply say you want two times the risk when the initial directional probability in your direction is low, since there is only 40% probability of you even getting one times the risk. There is then less than 40% initial probability of two times the risk.

- If he refers to probability of success, then something still doesn't add up, he often says: "low probability SO the trader needs two times the risk". To me that sounds like he is looking at the chart and assessing directional probability, and then deciding how big a reward is needed. But that does not make it reasonable to take the initial low directional probability trade either?

- If he refers to it as the probability of it becoming a trend in your direction, he must also imply it has high initial directional probability in your favour since mathematically it would not make sense otherwise. This is because you initially need 60% directional probability in your favor in order to achieve the initial 40% probability of a reward that is two times the risk?

I am simply trying to understand the exact definition of the phrases he uses. I believe Al's work is truly exceptional and wonderful - it is not an attack. I fully understand that I am wrong about something here, and it may even be obvious..

Thank you,

Andreas

Hi Andreus

Yes, the probability has to be assessed, and then, when the other 2 Traders Equation factors (risk and reward) have been factored in the traders equation must be sufficiently positive to attract you.

I wouldn't get caught up by exactly what Al means when he says specific words like "want" - he is speaking conversationally.

Cheers

Graeme

If he refers to directional probability, why is it mathematically sound to take the trade? You can't simply say you want two times the risk when the initial directional probability in your direction is low, since there is only 40% probability of you even getting one times the risk. There is then less than 40% initial probability of two times the risk.

Al indeed refers to directional probability. It is mathematically sound to take those since they have great risk:reward ratio, remember the part about the perfect trade in the course? There is rarely a probability lower than 40% ( very strong breakouts ) and that is why Al recommends swing trading, its the most forgiving while learning. Its worth mentioning that taking full profit at two times the risk is the minimum to make money on those trades.

Thank you both for the replies.

@Yohtza

So you are saying that when there is initial low directional probability (40% directional probability) in your favor, there is then also 40% probability of success, when success means reaching 2 times the risk? The probability of success has to be lower than 40% here since the probability of even moving 1 times the risk in your favor is 40%. I don't think you can say "a probability" is never lower than 40%, since you need to put a definition on it, for example, there is not 40 percent probability of success if going for 3 times the risk. I don't see the logic.

The probability of success must be lower than 40% if going for 2 times the risk, IF there is not initial high directional probability (60% directional probability) in your favor. So a trade with 40% probability of success for reaching 2 times the risk, must automatically have high initial directional probability?

I don't think you can say "a probability" is never lower than 40%, since you need to put a definition on it

Did not say never. The definition for directional probability is in your first post. Every new bar that gets added to the chart influences it.

@Yohtza

What Andreas is asking is:

When RR=1 has only 40% directional probability, how can RR=2 have at least 40% probability of success (reaching its target before stop) at that particular moment, like an entry.

Because Al said that?

How does it mathematically make sense?

Just imagine two institutions trading against each other. If one has high probability, other one has big reward(twice the risk or more). If that was not the case then the trade between them would not happen.

Al goes in depth on the topic of directional probability in a whole chapter of his Trading Ranges book. Highly recommend reading all his books, there is massive value in them.

I'm pretty sure Andreas is not talking about bulls vs bears here, but more like scalp vs swing in the same direction.

So here is my answer.

TL;DL

I think your understanding of the those concepts are correct. Those are just counterintuitive.

Just one thing, I believe Al’s "low probability SO the trader needs two times the risk" is not about “How to set your target”, but more like “How to evaluate how reasonable your target is”.

- You find a reasonable target and stop based on the PA in the chart first.

- Then you calc your RR and evaluate the probability of success (reaching its target before stop, in this context).

- If it is low probability, you need two times the risk. Therefore;

- If your target is at more than two times

- Take it

- Else / Your reward is too small / 2xRisk target seems absurd / Am I just being hopeful?

- Wait (or even check the edge of the opposite side)

- If your target is at more than two times

This depends on the context.

Context:

- The number of X for the directional move is reasonable choice compared to the chart in front of you.

- Assuming after 1000 trades, both trading styles (RR=1 and RR=2) end up with about the same profits = TE.

- The probability ignoring the all the other real world conditions = applies to everywhere when you ignore the other conditions…

By definition, a price is support or resistance only if it has a directional probability imbalance. For example, if a market falls to a level of support, traders believe that there is about a 60 percent chance or better that there will be at least a bounce big enough for a scalp, which is every trader's minimal trade. —— Trading Price Action Trading Ranges, Part II. Magnets: Support and Resistance

I don’t put whatever the number like 100000000000 or 0.00000000001 points in it. At least its minimum scalp size, what makes sense to the chart that I'm looking at.

Every trade needs a mathematical basis. Assume that you have to risk two points in the Emini and you are considering a short setup. Is it 60 percent certain that you can make two points before losing two points? Is there a 70 percent chance of making one point, or a 40 percent chance of making four points? If the answer to any of these is yes, then there is at least a minimum mathematical reason to take the trade. —— Trading Price Action Trading Ranges, Part V / Chapter 25 / THE TRADER’S EQUATION

If all the different RR trades have some edge (more than a profitable scalp), those have more than enough directional probability like ≥60% (X is 2 points here), with of course different probability of success.

When he refers to directional probability:

If the “probability” is 40%, Both options are not worth taking.

As you said probability of reaching its target before stop of RR=2 is worse.

However, RR=2 has the same directional probability IF it has the same risk as RR=1.

I have no idea the how it “mathematically” makes sense to take them, unless your goal is to be a consistently generous donor.

When he refers to reaching its target before stop:

If the “probability” is 40%, it has enough edge to aim RR=2. RR=1 has 60%.

Both worth taking, to make money in long run.

When he refers to it as the probability of it becoming a trend in your direction:

There is no way to know the directional probability or the probability of success in this case, since we have no idea what statistical model Al has, which I believe mostly comes from his experience.

And yes, 40% for RR=2 setup needs more than 60% directional probability. (X is the amount of the risk). It might sounds counterintuitive, but if we follow the definitions, it is logical.

This might sounds much natural:

When you are considering a long setup, you don’t want to buy where you see a profitable short scalp setup. You want to buy only when it seems no longer to go lower, like when it’s at a support (value trade) or measured move up is likely (momentum trade).

Still, there is a situation you can enter a profitable long at the exact profitable short scalp setup, IF you use wider stop. However, this is possible because using different stop, means it has different probability. Directional probability for the wider stop is different (here, higher) from what the short setup has. In that sense, you still can't say that you can have an edge where the directional probability is low, even that is a "low probability of reaching its target before stop to aim 2x risk" trade.

🚨 Caution

“X must to be reasonable.”

This sentence is super useful, therefore it can mean almost everything and swallow any nonsense.

You can just came up any situation that seems the Trader’s Equation logic is broken, but BPA has this magic word X. "That is because the stop and target are not REASONABLE choices.” You have to learn how to put correct stop and target to use this concept. And this is true in its logic.

You mentioned that aiming for a RR=2 seems absurd when the directional probability appears low. Yes, it’s wrong, but this is not actually what Al is doing/saying. This is about using the TE as a ruler, measure to evaluate the edge. You find reasonable stop and TARGET first, then see the RR is high enough or not.

First of all, you should not take the trade if the directional probability is low, like 40%. Just wait

Do I understand your confusion correctly, Andreas?

For me, it's like "You can't just use whatever the number labeled as 'probability’! Are those the same because you can't explain the differences?”

P.S.

I feel your confusion. It's hard to keep up with what Al is referring to in videos.

What makes sense to me:

TE = X・Px - X・(1-Px)

Px: Probability of reaching X before -X (which we don’t decide what to put, yet pretending that formula is ready to derive the expected value)

TE = InitialReward・Pt - InitialRisk・(1-Pt)

Pt: Probability of reaching its initial target before initial stop.

What the heck? to me: (I believe this is the part of your confusion too.)

TE = InitialReward・Px - InitialRisk・(1-Px)

…What about Pt?

I get confused when I see people talking about directional probability without explicitly stating which X they have chosen.

And this all above is just for the moment of entry, and we haven’t even touched about actual risk and probability around it 🤣

Thank you for the detailed reply.

I think this is turning into the most useful thread. Thanks to everyone for asking and answering.

From the books, I gather Al suggests using the traders equation to asses a probable trade. Or to asses the probability of the trade. If the probability is not above %50, look for 2 times the risk means, asses the trade and see if you can get that 2xrisk as a profit. If not don’t take the trade.

Here is an excerpt;

Trading Price Action TRADING RANGES, PART V Orders and Trade Management

CHAPTER 25 Mathematics of Trading. Should I Take This Trade? Will I Make Money If I Take This Trade?

Page 444

“ Once you see a possible setup, the first thing you have to do is determine how far away your protective stop has to be. Once you know your risk, you can decide on the number of shares or contracts that you can trade, keeping your total risk to within your normal limits. For example, if you normally risk $500 when you buy a stock, and you think that you would need to have your protective stop on the trade in question at about $1.00 below your entry price, then you can trade 500 shares. You then decide on what the probability of the trade is. If you cannot tell, then you assume that it is 50 percent. If it is 50 percent, then your potential reward should to be at least twice the size of your risk to make the trade worth taking. If you cannot reasonably expect to make $2.00 on that long, don’t take the trade. If the chance of success is 60 percent, then your reward has to be at least equal to your risk, and if that $1.00 profit target is unreasonable, don’t take the trade. If you do take the trade, make sure to use at least a $1.00 profit target, since that is the minimum that you need to have a positive trader’s equation when the risk is $1.00 and the probability is 60 percent.

Every trade needs a mathematical basis. Assume that you have to risk two points in the Emini and you are considering a short setup. Is it 60 percent certain that you can make two points before losing two points? Is there a 70 percent chance of making one point, or a 40 percent chance of making four points? If the answer to any of these is yes, then there is at least a minimum mathematical reason to take the trade. If the answer to all of them is no, then consider the same three possibilities for a long. If the answer is yes for any of the three choices, then consider taking the trade. If the answer is no for both the bulls and the bears, then entering on a stop is not a good approach at the moment, and the market is unclear. This means that it is in a trading range, and experienced traders can look to short above bars and buy below bars with limit orders. “