The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I am a bit paranoid about getting sucked into traps when it comes to BOs of TRs.

I was looking at two examples, a successful bear BO vs a failed bull BO, and I wonder if anyone can tell me what distinguishes them.

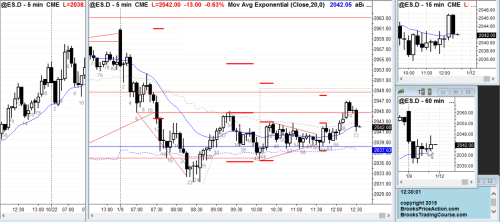

The first chart is of a successful bear BO is from course video 8B:

The second chart is of a failed bull BO from the BTR recording of January 9, 2015:

In both cases, the initial follow-through is poor. The the failed case, there was simply no follow-through.

In the first case, bar B is the follow-through bar and it's a bull bar, although follow-through did come on the next bars (bars C and D).

In the second case, 69 is the BO bar, and bar 70 was a bear bar. Al waited for bar 70 to close and said after the lack of follow-through he thought (correctly) this was going to be a trap.

So my questions:

- Both had poor follow-through. Would the next bar (ie bar C in the first case and bar 71 in the second case) be the key?

- If in the second case, bar 71 were to be a bull bar, would you (or Al) have concluded that the BO was successful?

- Is there any other consideration?

Hi PB,

The first bear trend even though succeeded in going lower isn't that strong actually; as in, I expect it to evolve into a lower TR in some kind of TTRD due to all the poor FTs. But agree that bar (C) was important in improving the odds for bears by testing the breakout gap and rejecting strongly.

In the second example, if the breakout pullback test bar 71 was a strong bull then yes it would've improved the odds for the bulls to get a little more up. But probably not much more up due to lack of good FT during a BO.

I think it's also important to reaffirm for oneself that this is all probabilities and two samples may not be enough. Even with bad FT a BO may still succeed many times. Even with good FT a BO may suddenly fail (often within 5 bars as Al teaches) due to exhaustion or some S/R levels nearby. Collecting many samples (at least 30) of BOs like these is a good exercise to help with developing intuition for probabilities.

There's also an issue of what actually constitutes a successful breakout vs just a breakout that eventually fails (even though closes beyond swing point). There was a good discussion about it here: https://www.brookstradingcourse.com/support-forum/postid/5677/

Hope that helps!

CH

____________________________

Join BPA Telegram Group for more discussions about breakouts.

Thanks, Carpet.

I think my main struggle is that even after taking into account all factors, there is still a huge amount of pure chance that determines whether a BO will succeed or fail. I remember when I first studied the relevant BTC videos on second entry traps and failed BOs, my heart literally sank, and I gave up on BTC for a few months, because it appeared to me that it's just random.

Dear P.B,

After bar C is closed, you confirmed that the GAP has not been closed, the trading range is being breakout. I will sell the close of bar C or place a stop order sell one point below bar C.

Regards,

Ma Hei Chun

Thank you both for your replies. Ma Hein Chun, your reply was an eye-opener. Even if I do take the trap trade by mistake, the moment the gap closes (even with a body gap / negative gap), that's my cue to get the hell out of that position.

I will sell below "C", if "D" close the gap, that's mean it is not a breakout and breakout fail.

I will stop loss accordingly.

You can get out of the trade and think that a failed breakout is a potential reversal.

Else

A fail of the failed breakout is a the BO pullback and you have another chance to get in.