The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

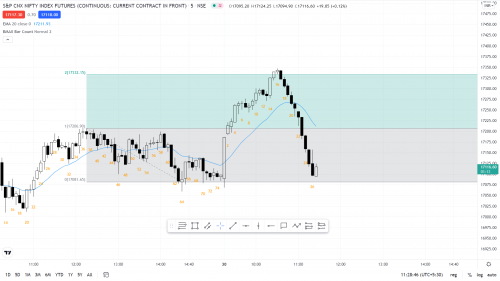

At what bar number will you decide that the Always In direction has flipped to AIS??

The BO looked strong to me as it broke through resistance by many points above the TR and I concluded that it might be a Spike and channel Bull trend day.

However, a low probability event started taking place as the market sharply reversed (maybe it reached a MM based on the height of TR).

So At what bar number will YOU veteran traders decide that the Always In direction has flipped to AIS??

Ticker: Nifty Futures(NSE)

Many traders would swith to AIS at bar 19 third consecutive bear bar closing on the low (COL), and the rest at bar 20, 4th consecutive bear bar COL and closing below the climax low 14L.

Hey ludopuig , could it be at all possible that maybe there is something wrong in what you're saying? The 3rd consecutive bear bar was still above 20 MA and had barely broken below the channel of the spike and channel bull.

What makes me wonder whether you might be off is, even institutions started building shorts only a little bit from the 4th consecutive bear and steadily increased their short positions from the 5th consecutive bear bar onward.

Hey ludopuig , could it be at all possible that maybe there is something wrong in what you're saying?

Oh yeah!

The 3rd consecutive bear bar was still above 20 MA and had barely broken below the channel of the spike and channel bull.

But none of those is a requirement for the MKT to turn to AIS. A decent setup for the bears (parabolic wedge in a spike and channel setup at a MM) and consecutive bear bars turn the MKT to AIS (first reversal probably minor, but today it became major). Depending on the size of the bear bars you need more of them to switch so this is why I say maybe the third or for sure the fourth.

What makes me wonder whether you might be off is, even institutions started building shorts only a little bit from the 4th consecutive bear and steadily increased their short positions from the 5th consecutive bear bar onward.

Every bear bar closed on the low so this meant that bears were selling from the first bear bar. After the third or fourth bar you could also expect a second leg sideways to down, maybe to the bottom of the channel or the BO point (37H) but, instead, bears broke strongly below and went all the way down to the bottom of the spike.

I think ludopuig is right. You do not need to expect an AI position to last long, but the reversal was at a logical resistance level, had a decent looking parabolic wedge, and perhaps most importantly it was after a BO of a 50+ bar Trading Range. It's fairly reasonable to expect the market to at least test the BO point (in this case it went all the way down to the bottom of the range).

Al normally refers to 3-5 consecutive bear bars as being enough to switch to AIS.

In this particular case

1The third bear bar broke through the trend line of a relatively tight channel

2. The third bear bar also tests the breakout point of the last bull spike and closing a n exhaustion gap .

3. Most bulls would exit once the third bar closes near its low .

Possible sell set up on next bar . One could enter with limit order on the third bar close

Thank you everyone for all your inputs, especially ludopuig for patiently explaining his reasoning. I have a few follow up doubts, if you could spare some time to resolve them...

1. There seems to be a consensus among the members that the last leg of the parabolic wedge was a climax - Al also says that there is a 60% chance that the climax move up will see a 2nd leg sideways to up. That is to say, at that point the MM up from the BO(the spike in the spike and channel) was still ways to go and the 3rd consecutive bear had not closed below the climactic 3rd leg. Even the MM based upon the height of the TR was still a little bit above the price actually reached. Al is usually quite specific about MM targets being reached to the dot even in his BPA commentaries.

2. What worked out in this case, it appears to me isn't all that high probability an event as the market skipped a phase entirely - that is the TR. Usually, the bottom of the 3rd leg is the first target for any sell in a wedge or parabolic wedge for that matter. In this case, the bottom of the 3rd leg up was at or around the MA too. So, I can't imagine why selling there would make good sense. It does not make good sense mathematically either. I know my possible reward might be limited and does not compare close to the risk I would take in order to enter the trade. It isn't that high probability a trade to make sense mathematically.

3. COL could be attributed to aggressive profit taking too, as can be seen usually near a MM target. Why would my first thought jump to short buildup when there is almost non-existent selling pressure before the selloff? I think it could even be classified as a small pullback bull.

and perhaps most importantly it was after a BO of a 50+ bar Trading Range. It's fairly reasonable to expect the market to at least test the BO point

Just so you know Paul, the 50+bar TR was created on a separate day. You can see the bar count restarted on the chart. Also, why must I expect such a tight bull channel to reverse on the first instance and test the BO point? That does not make any sense to me. The market was moving up at that point creating gaps all through the way. I don't quite understand why mustn't I take the first selloff to be a 20 gap bar test of the MA.

1The third bear bar broke through the trend line of a relatively tight channel

Yes Drishti, but only after the market broke above the bull channel line on the upside. It was expected that the market would reverse within 5 bars which it did(75% event) just like it was expected that the market might reverse up from the break of the bear channel within 5 bars.

What worked out in this case, it appears to me isn't all that high probability an event as the market skipped a phase entirely - that is the TR.

That is something that bugged me as well. However, Al has mentioned this kind of event occurring to be a "pain trade" i.e a low probability event.

We don't need to know exactly why it has started reversing (Could be that I am not able to read the subtle PA as other veterans) however, we do know that it is going down instead of going up. There might be bulls getting trapped in and sellers trapped out. Since AI has flipped to short we must look to sell.

Since the BO occurred beyond a TR, and now it effectively has failed it might test the low of TR. That's what matters to us as traders I think.

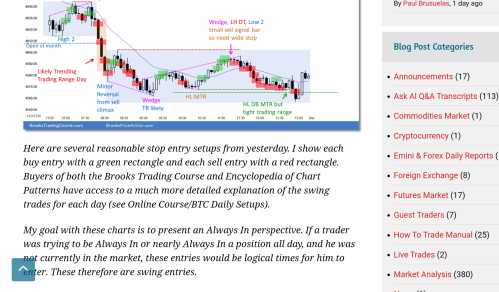

I am attaching a 15 min chart of the same ticker:

Here it might be clear why the market turned down sharply. And traders on 15 min chart would be seeing as the market rushing to test the Support turned resistance and everyone here probably would conclude the same.

Some Always In flips can happen even after just 1 or 2 bars of a change of direction - refer the attached daily AI Brooks suggested AI swing entry flips. Its then a question of each individual trader's assessment of the traders equation, and then also does it fit with his trading rules.

For me, regarding the author's original question, it flipped to AIS on bar 18 but, of course, entering on bar 18 is a low probability but lower risk setup still in the bull channel, but assisted by a wedge top.