The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

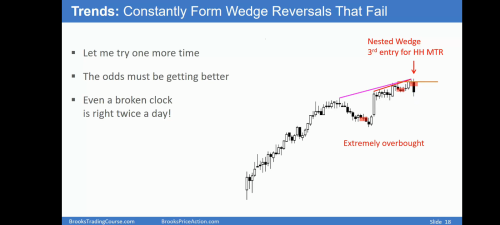

Strong BO of... Prior Day High, Nested wedge, DT x2, MA.

Protective stop above BO leg.

Probability% & Profit Target?

Strong BO Prior Day High, Nested wedge, DT x2, MA.

Good context for reversal but almost all bull bars were closing on high this so far so 29L swing probability was low.

Protective stop above BO leg.

Yes.

Probability% & Profit Target?

Once 32 Closed on low high probability a second leg down would occur, and then TR. PA profit targets were prior lows: 22L, 12L, 1L and DT 19 29 MM down.

What %

High probability means 60% (Low means 40%).

and why?

Because MKT went AIS after a decent topping pattern.

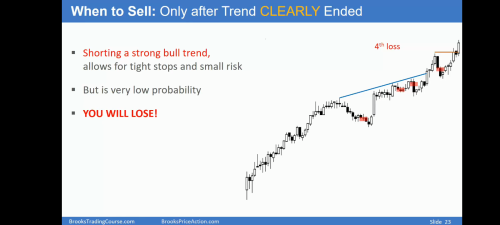

What makes the August 1 setup high probability compared to the similar setup in 14b slide18 "Beginner mistakes"

Not similar, in the beginner's mistake chart there is no prior selling pressure at all and without that, any reversal attempt will probably become a PB. In 1st August you have a well formed wedge with good SB COL and several strong bear bears in different legs, so more selling pressure and therefore higher probability, tho still low.

... 1st August =around 60% ?

No, reversal patterns are LP, the best of the best can have a 50% maximum, but normally they are 40%, like here with all those bull bars closing on the high.

Or maybe 60%= 1x risk (prior low+ DT MM)

Yes.

40%= 2x risk

As said before, 40% is for the swing down at the SB's low.

Sorry, confused.

Reversals are 40%-50% maximum.

So in this specific example, protective stop@bar 29 high & selling bar 32 low...

What is probability for 1x reward?

What is probability for 2x reward?

Reversals are 40%-50% maximum.

Yes, for the swing down.

So in this specific example, protective stop@bar 29 high & selling bar 32 low...

What is probability for 1x reward?

What is probability for 2x reward?

Bar 29 is only a swing, not a scalp, so 40% for a swing down lasting two legs and 10 bars likely going below at least one prior low, 23L. Usually, the correction last, at least, half of the bars of the pattern is correcting, here the wedge, so the correction should be more than 10 bars in this case. At 29L swing you can't go only for 2x initial risk because this target is very small, attending at the context, so you instead enter expecting the two legs and some more than 10 bars correction down but, once you are in the trade and see the 5 consecutive bear bars going straight away to the first prior low, 23L, you increase your target hoping that maybe the MKT reaches 12L or even 1L. Any swing taken on the way down since 29L has the same last exit: 66H good swing buy at the bottom of a TR. Yet, you could exit early at prior low, 12L, or at DT 19 29 MM, around the same price.

Bar 32 is a scalp, so 60% a second leg down reaching 1x Initial risk. But you can take also for a swing with same profit target than 29L.

Excellent.

To summarize: the PA profit target for a swing trade is TBTL/half bars of pattern. 40% chance of next S&R level.

(In this example: sell 29L= 40% chance of reaching 23L)

Bar 32 is a scalp, so 60% a second leg down reaching 1x Initial risk.

...1x risk is the money target. Regarding PA target, Is it accurate to say "60% chance of second Leg reaching next S&R level" ? (In this example: sell 32L= 60% chance reaching 12L)

And If selling 32L, what is the% of reaching 1L?

Is it better to use S&R than TBTL? Sometimes TBTL, the second Leg is just one bar and maybe not high or low, just in the middle. So that can be difficult to estimate.

(In this example: sell 29L= 40% chance of reaching 23L)

Not really: I recommend to better watch the related section about "How to trade prerequisites", otherwise you will keep walking in circles.

Bar 29 is only a swing, not a scalp, so 40% for a swing down lasting two legs and 10 bars likely going below at least one prior low, 23L.

(In this example: sell 29L= 40% chance of reaching 23L)

Sounds the same to me.