The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello traders,

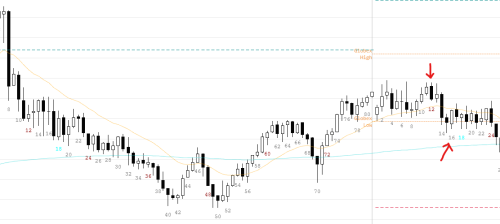

If a trader sells for a swing down below bar 12 for these reasons:

- Possible opening reversal since triple top.

- Bear bar closing on its low.

- Top of trading range - both the top of the current opening range but also the top of the bear channel from yesterday.

- Around a 50 percent pullback from yesterday's bear swing.

- Probably trapped in bears below from yesterday's bear swing that will drive the market down again.

- If the possible bear breakout goes below LOD, 70 percent chance HOD will stay the same.

Does he get out or reverse to long above bar 16, bar 23 or anywhere in that tight trading range? The buy above bar 16 is a possible opening reversal with a good bull bar closing on its high and failed breakout below a double bottom in a trading range. It is also a wedge with bar 4 and bar 8 and still a higher low in a bull trend.

I sold below bar 12 for a 20 point swing down and reversed to long above 16, which was a bad decision in hindsight. I want to take walmart trades and leave the trade on, but it is very difficult when I see setups in the opposite direction. Please correct me about anything.

There was clear TR PA for the first hour, making a Walmart-type trade unlikely without a very clear BO with good follow-through. Short of this, expect sellers above and buyers below.

B12 had follow-through on B14, but after bad follow-through on B13 (bulls scalping out). B14 did not close below the LOD at that time, and the next bar, a bear bar, closed above its midpoint as well as the low of B14, and had a prominent bottom wick. Possible wedge bottom (B12, 13, 14).

Given this and the session's clear TR PA, reasonable to exit above B16 for a scalp OR maintain your initial stop, hoping for a 2nd leg down.

I personally would not have reversed for multiple reasons, and you've probably assessed these based on your comments. The first leg down was strong enough for at least a small 2nd leg down. You could expect sellers above. Bad follow-through on B16. Until B23, not one close above the MA. No break of the bear trend line.

Hope that helps.

Thank you for the reply, Wesley.

There was clear TR PA for the first hour, making a Walmart-type trade unlikely without a very clear BO with good follow-through. Short of this, expect sellers above and buyers below.

Isn't a walmart trade on the open a setup where you can argue the market is possibly at an extreme and will possibly have a 20 point swing from here? As far as I understand, most swing targets are unlikely initially, so a walmart trade is always initially unlikely to work.

When selling below B12, it is unlikely to work out as a walmart trade initially, but it is still a good candidate, as it may possibly work since B12 did not go above the B11 range (which was the range at the time) which would have made the chance of a new low only 40 percent.

For example, when B14 broke below LOD and the B13 range, there is then a 70 percent chance that B3 is HOD, and like you say, I could maintain the initial stop. Then I hope for a 20 point swing, because there is only a 30 percent chance of a new high of the day (where my stop is), and therefore the swing is probably going to be in this direction. And there is a 90 percent chance the day will have a 20 point swing. For the 20 point swing to be in the other direction, the downside swing is probably going to have to come short of this target first but also widen the days range enough so that a bull swing could reach 20 points while staying under the high of the day. This would be difficult because the signal bar for the swing up would have to be small and form at a perfect location.

Is there a flaw in this logic?

I personally would not have reversed for multiple reasons, and you've probably assessed these based on your comments. The first leg down was strong enough for at least a small 2nd leg down. You could expect sellers above. Bad follow-through on B16. Until B23, not one close above the MA. No break of the bear trend line.

I see your good points about not reversing there, and in hindsight I see it is not the correct thing to do since the setup is bad.

If you're taking previous day's trend into context, then today's opening TR actually created a wedge bear flag(yesterday's 46,64 and today's 3) on the 15 minutes chart. Selling below 12 was the 2nd attempt to reverse into bear trend after the W. Minimum target being yesterday's 70L.

Coming to the 5 minute chart, to me the market was AIS on bar 15 but the bar 15 close was above bar 14L. Increased chance of the bear BO failing. Bar 16 was attempted failure. Reasonable to get out above 16, and even go long. Despite that, you need to keep in mind that the market still is in AIS. When you get TR PA while still in AIS, it means bulls are failing to fail the bear BO. Better to get out BE(plenty of opportunities), and wait for clarity.

Bar 24 once more was the clarity you were waiting for.

Then again, this is my style of management.

When you get TR PA while still in AIS, it means bulls are failing to fail the bear BO. Better to get out BE(plenty of opportunities), and wait for clarity.

Thank you - good point about the bulls failing to fail the bear BO. I thought about getting out breakeven and getting back in but I also saw the consecutive failed bear BO attempts, so I held long. In hindsight I don't see this setup as a good setup to go long because of the reasons given in the above reply to Wesley. Can you explain you why you say it is reasonable, is this not a very low probability trade? Of course you could go for a big reward. I am not attempting to argue against anyone of you, I just want to have a good discussion to get better at understanding these opening reversals. 😀

When Brad does his EOD video, you'll notice how he often uses the word 'reasonable' to describe an entry or exit. Al, of course, does this a lot, as well.

That usage pertains to context. In this case, my read on reasonable is that there was a wedge bottom, as Abir mentioned a TR where bears hoped / wanted to see momentum, and then a good buy signal bar. Reasonable to exit shorts, reasonable to enter long, reasonable to hold a short swing.

Regarding your earlier comment on Walmart trades -- I suppose the vernacular is open to interpretation. My understanding is it applies to a trade where you're comfortable enough with the premise to 'set it and forget it'.

In that context, the question becomes whether you were comfortable enough with that opening trade (emotionally, with the validity of the premise - or both) to set a stop and target and walk away.

I thought 'walmart trade' is applicable once the AI direction is clear during trends or once the day is clearly a TR day where the top and bottom for the day are somewhat clear , not for opening range trading

I thought 'walmart trade' is applicable once the AI direction is clear during trends or once the day is clearly a TR day where the top and bottom for the day are somewhat clear , not for opening range trading

My basic interpretation, as well.

One thing that has helped me not get out of swings too early is focusing on the always in direction. By the time you switched to long it was always in short with a new low of the day. With all the trading range price action it was reasonable to buy for a possible failed breakout and double bottom, but the bear already had the minimum follow through required for a MM based on the height of the range. Better to hold in direction of always in if you're already in a swing. Sometimes when I'm in a swing and see a potential reversal but it's not quite good enough to change the always in direction, I will take partial profits or tighten my stop above 14

I thought 'walmart trade' is applicable once the AI direction is clear during trends or once the day is clearly a TR day where the top and bottom for the day are somewhat clear , not for opening range trading

My basic interpretation, as well.

I understand your thoughts, but I don't think you can say that an opening range swing trade can't be managed as a walmart trade. For example, if you sell below B12 and then B14 breaks below the B13 range, you then know there is a 70 percent chance your stop is not going to get hit above HOD, and you can rely on the OCO order or close the position early if very disappointed after a couple of hours. The market is probably AIS short here also. When you're going for a walmart trade, it also involves looking for at least twice the initial risk, which is reasonable in this case, since there has not yet been an opening swing - and the opening swing is probably going to be to in this direction.

That usage pertains to context. In this case, my read on reasonable is that there was a wedge bottom, as Abir mentioned a TR where bears hoped / wanted to see momentum, and then a good buy signal bar. Reasonable to exit shorts, reasonable to enter long, reasonable to hold a short swing.

I do see those reasons, but it is a low probability trade. Also, Al did not mark B16 as a buy. He did mark the sell below B12.

Perhaps you can give an example of a walmart trade involving probabilities, risk, and reward from your perspective?

but I also saw the consecutive failed bear BO attempts, so I held long

When the market is AIS, the onus is on the bulls to change the AI direction. The bears did their part to show which direction the market is headed. It becomes fairly even only after a protracted TR, which is not the case here.

Can you explain you why you say it is reasonable, is this not a very low probability trade?

If that was a failed bear BO and the market was actually still in a TR, the bull bar was just slightly above the bottom third of the supposed TR. So, reasonable trade to take. Do note, Reasonable does not equate to something one should do. Not sure what you mean by very low probability, the bear BO was surely not strong enough for a 70% probability of making money.

I am not attempting to argue against anyone of you, I just want to have a good discussion to get better at understanding these opening reversals. 😀

It is not an issue for me even if you are. I am here to discuss, with an open mind that I might learn something. As long as it is civil and respectful, it's fine for me.

if you sell below B12 and then B14 breaks below the B13 range, you then know there is a 70 percent chance your stop is not going to get hit above HOD,

I think there is a slight misunderstanding on your part. The opening range probability is a standard distribution over a huge span of time, and you can't say on any day, when the 12 bar range breaks that the other extreme won't be breached with a 70% surety. A 70% probability arises only with a very strong BO, not otherwise. I would like to show you a chart proving my point but I'm answering this from my phone. Kindly go through the trouble of opening the chart of 'BANKNIFTY1!', today's chart. It not only broke above the 12 bar range, but also the 18 bar range.

Your version of interpretation renders the midday MTRs pointless, but I think many will appreciate how profitable those trades often turn out to be.

Hello traders,

If a trader sells for a swing down below bar 12 for these reasons:

- Possible opening reversal since triple top.

- Bear bar closing on its low.

- Top of trading range - both the top of the current opening range but also the top of the bear channel from yesterday.

- Around a 50 percent pullback from yesterday's bear swing.

- Probably trapped in bears below from yesterday's bear swing that will drive the market down again.

- If the possible bear breakout goes below LOD, 70 percent chance HOD will stay the same.

Does he get out or reverse to long above bar 16, bar 23 or anywhere in that tight trading range? The buy above bar 16 is a possible opening reversal with a good bull bar closing on its high and failed breakout below a double bottom in a trading range. It is also a wedge with bar 4 and bar 8 and still a higher low in a bull trend.

I sold below bar 12 for a 20 point swing down and reversed to long above 16, which was a bad decision in hindsight. I want to take walmart trades and leave the trade on, but it is very difficult when I see setups in the opposite direction. Please correct me about anything.

I was looking for an opening reversal as well. Sold below 7, reversed to long above 9, got stopped out below 1. Sold the close of 14, was viewing it as bear surprise, got out above 18.

Thank you for the detailed response.

The opening range probability is a standard distribution over a huge span of time, and you can't say on any day, when the 12 bar range breaks that the other extreme won't be breached with a 70% surety.

Okay - I see. This helps a lot. I have thought about a lot of about this in the past couple of days and this is probably the final piece of the puzzle. If I understand correctly it can be explained like this in other words: For example, if B14 breaks below the opening range, in this case there is not a 70 percent probability of B3 staying HOD because of a tight trading range and a not strong breakout. There is then increased probability of this particular day not being part of 70 percent of days where HOD or LOD forms at the close of B12. This means increased probability this will be part of the 30 percent of days where the HOD or LOD does not form at the close of B12.

Is this correctly understood?

The day also started out as a trending trading range day and turned into a reversal day. And a trending trading range day has increased probability of becoming a reversal day (as it did), so it also makes sense here that there is increased probability of this particular day being part of the 30 percent of days where HOD or LOD does not form at the close of B12.

Your version of interpretation renders the midday MTRs pointless, but I think many will appreciate how profitable those trades often turn out to be.

Understood. For example, when a MTR forms midday, the probability of either HOD or LOD is formed at the close of B12 can decrease because of this midday reversal setup. So when you see this setup, there is now increased probability of this day being part of the 30 percent of days where the HOD or LOD does not form at the close of B12. Is this correctly understood, and how the concept of "opening range probability is a standard distribution over a huge span of time" works?

I have never studied probabilities or statistics in math, so I should definently look into this.

Is this correctly understood?

Yes, you got it this time.

Is this correctly understood, and how the concept of "opening range probability is a standard distribution over a huge span of time" works?

Yes, but an MTR alone does not affect the probability all that much. With experience, you'll understand better which MTRs have a better chance of working. Buying/selling pressure comes into play in deciding that. With a good looking MTR or some other midday reversal setup, and excellent premise in the form of required buying/selling pressure, yes, sure.

I have never studied probabilities or statistics in math, so I should definently look into this.

In my opinion, your knowledge of probability or statistics won't determine how consistently good trader you are. Being able to estimate the probability for bulls and bears at any point of time, and being able to structure mathematically sound trades with positive trader's equation would. That comes only through live practice.