The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I have been trading the ES full-time for 8 months and I am a profitable trader with most months being positive and an increasing equity curve. I am currently up 20% on my account.

Yes, I know 20% in 8 months is a laughable return to many traders here, but for me it's very hard work. This is the first time I have been profitable in my many years (decades?) of struggle. So for that I have to thank Al, because without his material I simply had no hope.

One thing I'd desperately like to improve is my horrific trade management.

I am a firm believer of pressing when things are going my way. So, let's say in the first half, when things can move really quickly either way, I enter with a small position. Then if I have 2, 3, 4 bars in my favour, I keep adding. I then take profit on the whole position once my target is reached. These are not swing trades, but not scalps either. I probably hold for 6 to 10 points depending on how strong the move is.

In the second half when the context is much clearer, I hold for swings, but those are not a problem. The problem is managing these 6-10 point trades in the first half.

The problem that I have in the first half is, quite often the market gives me 2, 3 bars in my favour, then one bar against, 2 bars against, etc. I have already added let's say, twice, and now I'm in a quandarry. Do I keep my stop as it is? Do I get out of it all? Do I reduce my position? In most cases I find myself unable to decide and relying on the stop, but I really don't like trading this way because I end up losing more than I need to.

Yes, I could exit all on the second bar against me, but very often the first 2 bars against would be quite small - almost dojis, and I'd think, it's probably OK to give it a bit more time, then the third bar is suddenly a scary big bar against me!

Which means a) I read the market wrong, and/or my timing was off, and b) institutional traders that took the same trade as I did gave up on it (bar 3 was their give-up bar), and now I have to give up, but much later than they did and at a bigger loss.

I cannot not add to my winners. So I'd like to know from other profitable traders who do add to their positions, how you manage your added position when you have a pullback against you that keeps growing.

Thanks in advance.

Commenting without data is like shooting in the dark and hoping to hit bullseye.

The primary thing I would need to know, or if I were in your position, I'd analyse - are you overall profitable on your opening trades?(the ones you are struggling with?) Are you consistently profitable on those or are you simply breaking even or perhaps even taking losses?

I’d say overall I am profitable in the first half trades, but once a week I take more damage than I should and have to rely on the swing trade in the second half to repair the damage. If there is no such opportunity (eg the day becomes a TR day), I end the day with a loss.

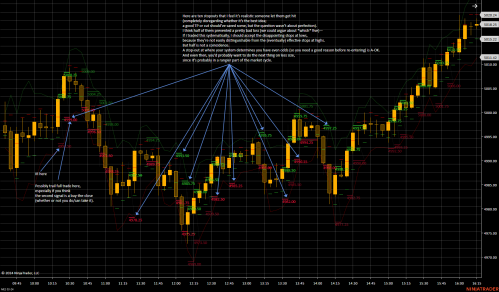

A typical example was Feb 14. The trade involves buying above 10 and adding above 11.

I don’t buy so far above the MA without seeing some kind of a flag, a bounce or a (micro) DB / wedge. Bar 3 is that bounce – a strong outside up bar telling me institutions are buying well above the MA. I didn’t buy as I wanted more evidence. B10 was that evidence and I bought. B11 was confirmation in my direction, so I added. In 9 times out of 10 after bars like B3, B10, B11 you’d get an MM up in the size of the opening range.

I then got B12, a bear doji. Bar 13, an even smaller bear doji. At that point I was thinking “Heh, tiny little pullback – I’ll sit through it”.

Then B14 and B15… and I was like “Whaaat is happening?” My stop was below B10. At this point I just closed the trade without waiting for the stop to get hit, but it made little difference anyway.

I had to wait till the bar 32 swing long to make up for the loss. (I was too shocked at this point to take the short trade. But I also knew after strong bull bars like B3, B10 and B11, the market was going to come back up to these levels again and probably higher.)

The question is should I have got out after B13 knowing I’ve only had two bear dojis against me?

I’d say overall I am profitable in the first half trades, but once a week I take more damage than I should and have to rely on the swing trade in the second half to repair the damage. If there is no such opportunity (eg the day becomes a TR day), I end the day with a loss.

Okay. In that case, my question would be - is it contributing a significant part to the 20% ROC you mentioned? If not, then it might just be a good idea to simply avoid it. Like Al says, trading should be enjoyable and from the way you're talking - it feels to me like you're stressed and might even be above your risk tolerance which is forcing you to not take rational decisions.

In 9 times out of 10 after bars like B3, B10, B11 you’d get an MM up in the size of the opening range.

Okay, not going to challenge your estimate but generally as per Al's estimates - 50% opening trends reverse and 80% have at least minor reversal attempts. So, I always stay wary of riding any opening trend whatsoever. On top of that, the TR full of dojis after bar 3 would have been a warning signal(FF or possible 2nd leg bull trap) to me that the day might turn out to be a TR day. Which would also mean, there might be sellers above 1 high just as there were buyers below 2 low.

Honestly, there won't be any one size fits all management. It varies from day to day depending on the PA. In this case, I'd consider exiting below a decent bear bear(B14, as is marked in the EOD setup) after the strong bull bars - even more so because the previous day was a big bear day(barring the late BTC) and also like you mentioned, so far away from the EMA.

Oh also, 2 more things to add. First of all - I think I saw Richard mention repeatedly at places that scaling into winning trades is highly risky. Even more so, when trading the open IMO. On top of that, you're a stop order trader(as am I). You're not getting significantly better probability but significantly higher risk. Does not make all that much sense to me, mathematically.

Furthermore, Al mentioned at several places in the course - if a decent setup on the open fails, it's likely that if you reverse, you're gonna more than make up your losses and then make some. Although, you'll be beaten badly if you misjudge and the day turns out to be a TR day. So, it's imperative that you don't get emotional and take your trades at the right places so you can optimise your trader's equation.

Thanks for taking the time to write you answer Abir. Very much appreciated.

I thought about trading only the second half once a reversal situation occurs. There are two problems.

On days when you have a trend from the open, especially a small pullback trend, my only option left is then entering late and hoping the trend doesn’t reverse on me, which I absolutely hate. Other days a strong trend enters a TR in the second half and stays there. I am not a TR trader and the last thing I need is getting trapped in a bad position late in the day.

The second problem is more emotional. Many of my most memorable and best days were because of trades taken in the open and adding. Just makes me sad not being able to trade that way.

I agree with you that it’s not one size fits all. Writing this post has actually clarified a few things in my mind. So here’s what I’m currently thinking about managing the first-half trades:

Tighten stop after close of every bar to scalp size away from that bar.

Tighten stop after one strong bar against or 2 small bars against, AND also tighten limit to breakeven.

Reset count after each bar in favour.

There is no perfect scheme, and with this also I’d exit some trades unnecessarily with small losses, sometimes with added positions! But that’s still emotionally better than taking the occasional big hit.

Also another rule I forgot to add:

Do not add any further if the market has given at least one bar against at any time during the trade.

Okay, since the rules you are suggesting isn't how I trade - I cannot say anything about how helpful they would be to you. Furthermore, I would not recommend repairing something that is working for you so far without proper testing.

So, my suggestion to you would be to extensively test the efficacy of your suggested changes. Preferably, over all 8 months you have been trading.

I would also suggest you to go through the 'Trading the Open' section of the encyclopaedia over and over.

The second suggestion is something that I have followed myself, and it has helped me extensively and I hope it does for you as well.

All the best!

Thanks. Most of those rules are actually what Al advocates, for example get out scalp size below / above any bar, get out below / above a strong bar against, and consider getting out if get 2 small bars against.

By the way did you mean "Trading in the open" section of the course or the encyclopaedia? There is no section in the encyclopaedia called just that.

In 9 times out of 10 after bars like B3, B10, B11 you’d get an MM up in the size of the opening range.

Thats no correct

the occasions where the probability is 9 out of 10 is a dream...The MM from a BO TR or from a Trading Range rupture is 60-70 %. and thats a possible plan de trading...

where the probability is 9 out of 10 are very difficult to see

Hi,

well, I exited my longs at close of the second bear doji. I found the PA before was "suspicious" and thought, we would retest those bad buy signals - at least.

I played some similar strategy of adding agressively to winners for a while. But I found out, if I do not read well, it`s even a loosing strategy for me. But if I read PA well, I don`t need to be that agressive.

So this particular day: if a trader sells 14 - failed bull bo, and holds his position cause there was no reason to exit - he could add for a 2nd leg. But patience.

But if you buy 22 cause its some kind of DB and micro DB and you add on agressively on 23 you have to be quick to exit cause 23 could be trap of bears wanting another strong leg!

Hope this helped! Good luck and I´d be happy to hear from you soon when you found out more about your strategy and how you can improve it..

Thanks Hardy, I'll tinker with my rules and report back in a few months.

Regarding adding to my winners, it's something I've always done and enjoyed doing, and hopefully with better management I'll be able to increase its efficacy. My conviction was strengthened further recently when I read The Phantom of the Pits.

Occasionally I have found Al talking about adding on each of those signal bars he marks on the daily reports, but I'm not sure I can find a specific link. I think I heard this in some of his interviews.

Part 1: stops

So, this isn’t meant to show exemplary management of 2/14, and the entries are just a copy of Al’s, but I wanted to illustrate a principle you should consider if you want to trail, add, or enter late. Actually, it’s a little embarrassing, because my indicator is a work in progress (although the day in question treats it favorably). And in truth, there are many indicators that are doing something similar already (these are just classic pivots reinvented for continuous). Anyhow, because you’re not actually swinging, it might be better for you to apply quantitative analysis to some sort of scalping stop.

Most price action traders could eyeball something like this, or would get similar results with about 30–60% extra stopping distance behind a signal bar. And that’s roughly what the guideline of a scalp size behind a bar does, too.

Well, to finally get to the point: I consider these stops reasonable losses for me (and not something I’m looking to buy back; losses). I can’t be trusted with the sort of swing stop or the always-in techniques the way they’re discussed in the course, other than as a mental stop on a trend that’s far, far past my real stops. I just don’t judge them right, and I let things run against me too easily. And yet the swing stop has the same principle: it’s reasonable to expect you don’t know if it will rebound or reverse, and you can’t let the rebounds upset you.

And then there’s the reason besides my unreliability…

Part 2: leverage

Your account has to be so big to use that kind of wide stop appropriately, and mine is most emphatically not. Doing this kind of stop not only makes the additions possible for me, but keeps the sizing a bit more consistent—when I double the position’s size, I am not adding more dollar risk than I did on the first entry.

Yes, it’s a closer stop that loses more often. But the price point is carefully calculated, and like you, I’m not too keen on just waiting for purer swing setups like I should, because (again) I just don’t seem to judge ’em right. And that’s okay, as long as I keep in mind that my edge has mainly to do with my understanding of spreadsheets, not my (mostly unattested) wisdom.

Hope that helps.

Thanks. Most of those rules are actually what Al advocates, for example get out scalp size below / above any bar, get out below / above a strong bar against, and consider getting out if get 2 small bars against.

Sorry for the late reply. I try to avoid seeing the weekly NIFTY report so, I do what I can. I see. All the best with whatever you deem fit for yourself.

By the way did you mean "Trading in the open" section of the course or the encyclopaedia? There is no section in the encyclopaedia called just that.

Sorry if I used quotations in my response. I meant any section of the encyclopaedia that pertains to the open. For example, if I go by the index - part 6 contains all the gap up gap down scenarios. So, that is relevant.