The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

I have a question about the maths of entering late when the early entry is missed, and I will use an example provided in the screenshot to clarify my question.

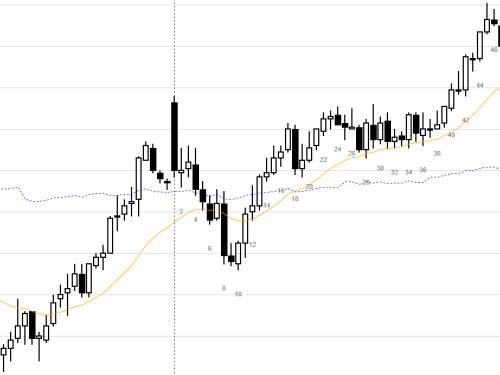

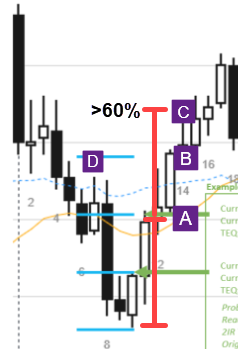

If a trader buys above B10 since it is a parabolic wedge bottom, opening reversal, climactic behavior, and a 50 percent pullback from yesterday's rally going into the close, he enters early at the start of the possible bull swing. He can take half profit at twice the initial risk (tight stop below B10) and hold the remainder for an opposite signal. This means he can hold the remainder for quite some time in this case. If the trader did not buy above B10 but realized at the close of B15 (random bar) that the remainder of his position would still be open, had he taken the early entry above B10, does he really enter at the market with the size of the remainder and put a stop below B10 or B11? In other words, is the math really calculated from the early entry in this entire really, or perhaps calculated from where the tightest, reasonable stop is at the moment?

Basically what I am asking is possibly better asked like this: If the trader did not buy above B10, but realizes at the close of B11 that his entire position would still be open had he taken the early entry above B10, does he enter at the market and still use the initial risk of the early entry above B10 to create the profit target of twice the initial risk, or does he use the larger initial risk (stop is still below B10) created by B11 to create the profit target of twice the initial risk?

Thank you,

Andreas

Hi Andreas,

I think you've described a fine strategy and it definitely makes sense to pay attention to profit target areas of early traders. When bulls from B10 reach some multiple of their risk we can expect profit taking. In this case they took it at 3R. Those who enter between 10-22 will probably all put their initial stoploss below B10 (can tighten when breaks higher after PBs).

So if the market surges past their 2R and you anticipate them reaching 3R next, and you buy somewhere between their 2R and 3R with stoploss below B10, then the only thing to consider is whether the Trader's Equation at that moment makes sense. What is your estimate of the probability of reaching a few points higher? And does it work with the wide stop and small profit target? If TE is positive, go for it.

Whether you do the above or ignore everyone else and set your own 2R targets, it's still important to consider the context to the left. It's low probability to expect the market to surge above B1 for huge MMU so probably it's not reasonable to use wide targets that go far above HOD. Another consideration is big down big up so probably this is a developing TR. Buying with stops in the middle to upper 3rd is iffy because of likelyhood of overlaps and deep PBs. I think traders who still want to buy high in TR after a strong move might use a strategy of fading PBs instead of entering with stops.

Hope that helped!

CH

_______________________

BPA Telegram Group

Hello Mr. Carpet,

Thank you for the detailed reply. 👍

So if the market surges past their 2R and you anticipate them reaching 3R next, and you buy somewhere between their 2R and 3R with stoploss below B10, then the only thing to consider is whether the Trader's Equation at that moment makes sense. What is your estimate of the probability of reaching a few points higher? And does it work with the wide stop and small profit target? If TE is positive, go for it.

Good point, the only thing I need to consider is if the Trader's Equation makes sense, but that is difficult for me to do. I understand that estimating probabilities is done analyzing all the information on the chart, but it seems so difficult to connect all the information without a lot of experience.

For example, how much does the B12 bull doji lower the probability of reaching a the 3R target, and what if the micro grap between the B14 low and B12 high had closed instead? Do they each lower the probability about 5 percent perhaps, as a rule of thumb? What about the sheer size of B1 showing strength by the bears, does this also lower the probability about 5 percent? I believe I need to know factors like these, otherwise I cannot really assess what the probability is - of course, it will still be a gray fog, but it would be a much more systematic approach.

I am looking for logical framework I can use in everyday trading to quickly estimate probabilities in a more systematic way, do you have any pointers?

Andreas

If you started with a high probability trade then it's important for it to remain high until the end of the trade so the trader's equation remains valid. Any adversarial action that lowers it even a little bit puts the trade in jeopardy and traders are quick to exit for a scalp. This is another reason why Al recommends taking lower probability trades for swings, a trader can enter with 40% chance of success and still be profitable over time.

So let's say you're long, then some adversarial price action to look for could be:

- are the pullbacks against you deep? 3 or more cc bear bars or multi-legged pullbacks?

- are the pullbacks strong? bear bars closing below midpoints or on their lows

- are these pullbacks frequent indicating that bear pressure is building up over time possibly leading to wedges forming against you?

- are bears able to close any gaps that bulls create?

- are limit bears making the minimum scalp of the day selling at prior swing highs

- are bears making the minimum scalp of day selling with stops?

In the books Al has excellent lists of various signs of strength and you can check if these are present either for bulls or bears:

Trading Ranges:

- Introduction: Signs of Strength

- Chapter 2: Signs Of Strength in Breakout

Reversals:

- Chapter 2: Signs of Strength in Reversal

Trends:

- Chapter 19: Signs of Strength in Trends

Hope that helped!

CH

If you started with a high probability trade then it's important for it to remain high until the end of the trade so the trader's equation remains valid. Any adversarial action that lowers it even a little bit puts the trade in jeopardy and traders are quick to exit for a scalp.

Very good point. I am not taking high probability trades because I usually cannot successfully put a specific number on the probability of a trade, even initially, and also when it changes during the trade.

- are the pullbacks against you deep? 3 or more cc bear bars or multi-legged pullbacks?

- are the pullbacks strong? bear bars closing below midpoints or on their lows

- are these pullbacks frequent indicating that bear pressure is building up over time possibly leading to wedges forming against you?

- are bears able to close any gaps that bulls create?

- are limit bears making the minimum scalp of the day selling at prior swing highs

- are bears making the minimum scalp of day selling with stops?

I am aware of these signs, as I have studied the books, and the lists are truly excellent. However, I find it difficult to assess their significance in relation to putting a specific number on the probability. In the trade room recordings, I have heard Al say "Right now, I think the probability of x is 50 percent". He is good at putting a specific number on the probability.

If I always have the trader's equation in mind, I should be able to put a number on what I believe the probability is - a specific number. So if I take that reversal trade above B10 and my assessment of the initial probability of 2IR puts it at 40 percent, what is the probability of 2IR when B11 closes on its high, is it now 45 percent, 50 percent, 55 percent etc.? And what is it when B12 closes as a bull doji?

I really appreciate it,

Andreas

The probabilities are just estimates -- we'll never know the exact numbers but also it's not necessary to know them exactly. We just assume it fluctuates somewhere between 40-60% with occasional breakouts that make it much higher in one direction and much lower in the other.

It's safe to assume a low probability swing like B10 starts with 40% chance of success. This just tells you to set at least a reasonable 2IR. A good FT will raise the probability a bit, maybe 45%? Maybe 50%? A doji would lower it a bit, maybe 43%. It doesn't matter as long as something doesn't happen that suddenly makes it seem like 20%? and makes you want to sell rather than stay long.

A good way to gauge the probability is also by looking at the Risk to Reward. Al always says, if you have a good Risk to Reward then that means one thing is off, because there are no perfect trades, its the probability. So when you take a swing I dont think its necessarily important to try and constantly be changing the probability of the trade, more just watching for a sign that the Always In direction has changed. Whenever I feel confident in a trade, like a strong move (I like spikes), I just always assume Becuase the probability is High, the RR of the trade will likely be less. Especially because buying a spike usually requires a large stop, RR is commonly 1-1 in this scenario.

Referring to the posted chart and question, if you bought about 10, you could assume its 40% with a 1:2 RR required for a positive equation. But buying above 11 is a big increase in probability, two bars both closing on the high and big is enough to the change the Always In direction. So buying above 11 you'd have a positive equation taking profit at just 1x your risk below with a stop below 10. And if you notice the 1-1 RR for the buy above 11 is around the same price as the 3x TP for the swing above 10.

A good FT will raise the probability a bit, maybe 45%? Maybe 50%? A doji would lower it a bit, maybe 43%.

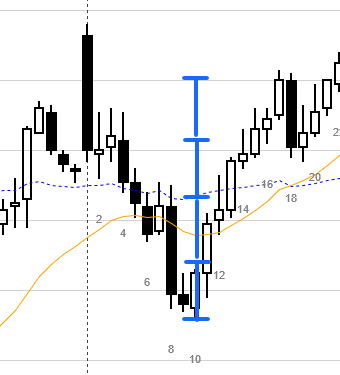

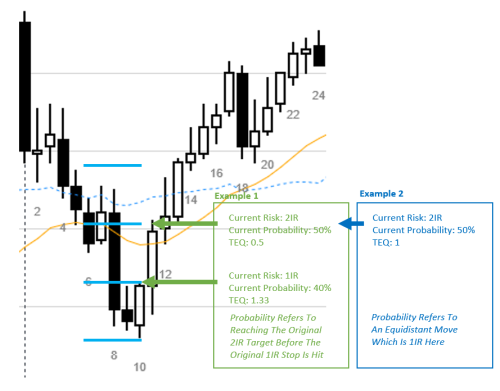

I see. I have one last question - is this probability refering to the target being hit before the stop is hit, or is this the probability for an equidistant move? If there is 50 percent probability of the 2IR target being hit before the stop is hit once the market has created a good entry bar and moved to 1IR, the trader's equation no longer makes sense, as far as I understand. This would be risking twice as much as the reward potential is with a probability of 50 percent.

And even if it is the probability of an equidistant move, the trader's equation still doesn't make sense.

I know I am wrong in my understanding of something. Please see the examples below where I have tried to illustrate my confusion:

It doesn't matter as long as something doesn't happen that suddenly makes it seem like 20%? and makes you want to sell rather than stay long.

When the risk gets greater as the successful trade progesses, shouldn't the probability of reaching the target before the the stop is hit (or probability of an equidistant move?) follow along by getting significantly higher, otherwise the trader's equation would get negative?

The 40% -> 50% improvement (fuzzy numbers anyways) is for the traders who bought B10.

When you get two strong consecutive bulls like 10,11, the probability of reaching MM of the bodies (red lines) (A-C) may be much higher than 60% assuming no strong resistance above. So for someone who bought at (A) to reach (B) would be even higher than that. Whether they take that trade depends if the TE is still ok given the distance to risk below.

Also may be a good idea to be aware of various resistances above to adjust the probabilities up/down (usually down). For example, at (D) level you can see quite a few bulls took profits causing a tail, but ultimately they did break higher.

I'd like to add one more thought because I keep thinking about this thread. You seem very intellectually bright, there is no doubt. But you must be careful, Al always says he thinks forest gump would make more money as a trader than Einstein. When you are taking a trade, you need to gauge the probability to either 40% or 60% in order to know where your stop and take profit is. But after that constantly gauging the probability of a swing trade while managing it is not necessary. You know what the probability was when you took the trade, therefore you know where to take profit and where your stop needs to be.

Think of it like this, if you are swing trading, is the risk small and reward big? Assume 40%. 1-2 RR. Is the risk big? Assume 60% and go for 1-1 RR.

Do not worry about 45% 50% back down to 45% up to 55%, its over analysis and will result in overtrading or management mistakes. so even though the probability might actually be 53.4% at one instance, you must remember trading is different than chart analysis.

You don't need anything else in order to be profitable besides 40% 1-2 and 60% 1-1. Once you start getting into high probability trades (70-80%) You're scalping, and your reward is usually always smaller than your risk and you are usually scaling in as well. Not good for beginners and neither is low probability trading because no one likes losing all the time even if its small. View the market as either 40% or 60%. Then somtimes 50% when market is in breakout mode.

I agree with you on everything, and I think it is an exceptionally good way of thinking for fully discretionary traders. I do use this logic for my discretionary trading.

However, I do not wish to be a fully discretionary trader in the very long run, and I'd like to program and systematize as much as I possibly can (similar to Ali Moin Afshari, friend of Al). This includes attempting to assign values, and even if not possible, I want to do everything I can to make a valid attempt first.

I am only 21 years old so I have plenty of time to research, and I will also be starting on a degree in data science next year to help achieve my goal.

Thank you for the reply,

Andreas

Thats so awesome to hear and inspiring to see others who share the same passion as we all do here on the brooks website. Best to luck to you, I have no doubt you'll be successful. I enjoyed our discussions.

Thank you, best of luck to you too! I enjoy the price action discussions as well. If you have discord and want to stay in touch to discuss price action, this is my username: Andreas Gade#1044