The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

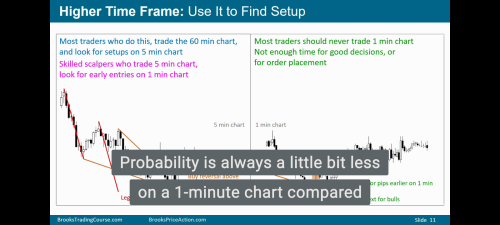

My understanding of the Brooks Trading Course is that traders can apply its price action strategies similarly on all time frames.

In the slide above, Dr. Brooks points out a slight exception to that general idea.

I wonder why traders would feel less certain about price action probabilities on a 1-minute chart?

Some thoughts.

In mathematical terms, the probability is always of something.

So here, what is that something? The answer seems to me: making a significant continuation trade off a buy or sell signal.

One way of thinking about stop entry trading is thinking about how much serious money got lost how quickly by people on the wrong side of a trade (a stop entry is basically a wager that they must exit). If it happened in three seconds, probably nothing of real value has been gained or lost on either side (those to whom it is significant presumably know their risks). But three down days in a row in stocks can make investors quite upset (despite knowing better), and triggers “sky is falling” news articles (despite context).

When anyone makes the assertion that price is fractal, bear in mind that the root of this idea comes from the analysis of Benoit Mandelbrot (The Misbehavior of Markets is worth a read IMO and is written for the intellectually curious rather than jargon-understanding mathematicians). He clarified that it appears multifractal like a coastline,* and not a simple monofractal like you might have seen in school.

So, motions on lower time frames do not reflect big market pain, and have a small-potatoes ranging context most of the time anyway. And context, for that matter, is what discretionary traders call that which mathematicians would call “conditional probability”. When Al says you should have at least two reasons to enter a trade, he’s essentially saying two “probablys” that line up make a “very probably” (and never “absolutely”). Having a context that’s more frequently fifty-fifty on always-in direction is therefore problematic for trend traders.

* A coastline map that turned on one inch intervals would be always changing with the waves and tides. A map based on one kilometer intervals would be more steady, and it would look slightly different from a map based on one mile intervals. And yet each map would at any interval appear to be following the same sort of logic, as if there were something defining what the collision of land and sea ought to look like.

Smaller timeframes are more easily 'overwritten' by larger timeframes, so the lower you go, the lower probability setups will have.

Besides that, the probability of consistently making profits really depletes very fast on timeframes of 1m and smaller. That is because the overhead of commissions plays a big role on this timeframe. Also, you will make much more mistakes because of the requirement to make a lot of fast decisions and that is incredibly hard to do well. The mistakes will start to add up and eat away your profits very quickly.

I respectfully disagree with the other statements in this thread. I think Al simply refers to the increased randomness on lower time frames. E.g. a lower time frame is more easily affected by a large order that is not nearly as significant on a higher time frame. Therefore, these so called low probability events occur more frequently on lower time frames.

Andreas

Dear Andreas,

I appreciate your addition to this thread. However, it sounds like you agree with the statements in it more than disagree with them.

To sort this out, I wanted to start at the beginning of this thread where w asks if "lower time frame = lower probability".

It sounds like you answer that question in the affirmative and give the reason that, "a lower time frame is more easily affected by a large order that is not nearly as significant on a higher time frame."

That reasoning seems to agree with the other statements in the thread.

For example, near the end of his posting, A. P. seems to answer the question like this:

"So, motions on lower time frames do not reflect big market pain, and have a small-potatoes ranging context most of the time anyway."

The "small potatoes ranging context" in A. P.'s answer reflects the part of your reasoning that says how large orders can have an improbable influence on smaller time frames:

"E.g. a lower time frame is more easily affected by a large order that is not nearly as significant on a higher time frame."

And, Tim seems to say the same thing you do, only with different words:

"Smaller timeframes are more easily 'overwritten' by larger timeframes, so the lower you go, the lower probability setups will have."

Tim uses the word "overwritten", whereas you say that "a lower time frame is more easily affected by a large order...". That sounds like the same line of reasoning.

Finally, I may be incorrect, but you all seem to be saying that price action probabilities are less certain on lower time frames because large orders or high volume can push prices in an improbable direction.

I hope you found this helpful and wish you luck with your trading!

I think one of the biggest differences is just the buy/sell signals will fail much more often on the 1 minute versus the 5 or 15. It doesn't take much to recognize this. I just think a strong buy signal stands for much more on the 5 or 15. So to make up for this you have to have a much better understanding of everything taking place on the 1 minute and have more confluence that line up in your favor. The 1 minute tends to be very bipolar.

I like the way the 1 minute chart makes the chart look. I have no price levels, indicators, emas or anything on my 1 minute chart. Sometimes i can just see the markets behavior a little better. Shapes and patterns stand out more. reactionary levels and aggressiveness, etc.

I know some guys that are insanely good trading the 1 minute. I think it's all just screen time.

Do lower time frames have lower probability?

I think this is Video 37A @ 30:33

Al says the probability is a little less. Just a little. The main issue isn't probability, he says the biggest problem is that humans don't have enough time to react correctly on 1M charts.

My personal take is that there are less humans there and more computers. And computers for the most part like to scalp (at least in my experience building trading algos for many clients over the years). If they weren't trying to optimize their scalping they'd be on higher timeframes doing swings. But instead they go to lower TFs like 1M, 30s and sub-second tick charts like high-frequency algos do to scalp as many high probability setups in as short time as possible. The issue is high probability setups don't go far before getting a deep PB or reversal. And human traders are notoriously bad at exiting early or reversing in opposite direction soon after taking a trade so it usually ends up a disaster for the human player trying to jump in and out very frequently. Only very few pro scalpers live on 1M charts. Usually those who want to be trading 1M charts are doing so out of greed.

Hope this helped!

CH

___________________

BPA Telegram Group