The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi, this topic is related to trading the open but also trade management and decision making so I decided to put it in general discussion.

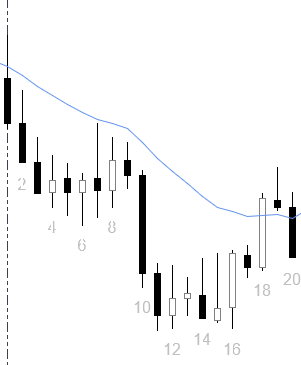

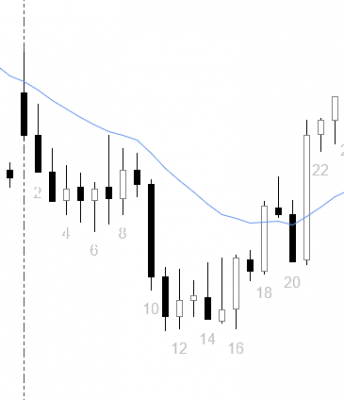

I went long on bar 16, with a buy stop order. Market seems like it could be making a new low of the day (close to bar 18), good buy signal bar. Bar 18 is a strong bull bar closing near lows and the follow-through bar is a bear 19 doji. Is it reasonable to get out of longs on bar 19 potentially a double top or would traders wait one more bar on bar 20. I decided to wait one more bar and when I saw bar 20, I moved my stop below bar 20.

My stop gets hit on bar 21 and I see a huge bull surprise bar. At this point, I think the market is AIL. Probably 90% of the time we've seen our high or low of the day so I'm looking to get long. I decide to get long with a stop order above the big bull surprise bar, assuming that bears are trapped and at least we'll see a second leg up.

Is there anything you would have done differently to stay in this trade given context of these bars? And I didn't sell the close on bar 10, because as strong as the selloff is on the open, 50% of a reversal. Is this a valid thought process, especially since stop would be far away?

I'm pulled into the trade and hold long.

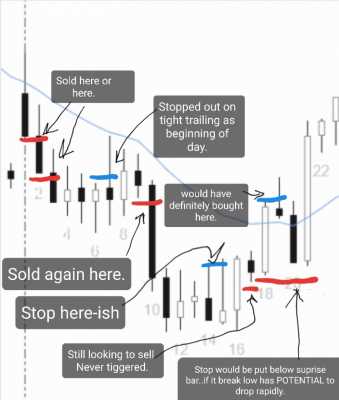

Here are my thoughts on the trades you took.

Buying above Bar 16 for a swing up is reasonable. You are buying above an OO pattern, which in this case is a variation of a failed L2.

Then bar 17, your entry bar is a bear bar so that is disappointing and you have to consider whether to exit below Bar 17 since it could be setting up an Expending Triangle short below the MA.

Bar 18 is a bull breakout above the MA. It is a good breakout bar but bulls need follow through.

Bar 19 is a bear reversal bar. It traded above the Bar 10 high and it reversed down.

And since Bar 10 is a climax bar then we might be at the top of a large trading range between the Bar 10 high and the Bar 16 low. Also Bar 19 is a short setup for a failed bull breakout above the MA.

If I was a bull, I would get out below bar 19.

It is also ok to wait for one more bar and see what the bar after 19 will look like, as you did.

So up until now I think you managed the trade well. You could debate if it is better to exit below 19 or wait for one more bar and what is optimal. I think you could do both and it is a matter of style and consistency.

However, I do have an issue with you buying above 21. I would have re-entered the swing above the Bar 19 high while bar 20 was forming. I would have NOT bought the Bar 20 close or above its high.

You have a 2nd attempt by the bulls to break above the MA and Bar 20 is also a bull breakout above a Double Top Bear Flag - 7,19.But it could also be a buy vacuum test of the the Bar 7 high and form a larger trading range with Bar 7. So you might be at the top of a trading range. In addition, Bar 21 is near the Open of the Day. You are near resistance - Open of the Day, Bar 7 high, and buying at or near resistance is not good.

So Bar 20 could simply be a 2nd leg bull trap. I would have waited to see what the follow through after Bar 20 would be and if it is good, I would have looked to buy a pullback or if it becomes a buy-the-close rally, then buy closes.

Also, swing traders who would buy above Bar 20 would have also shorted below Bar 10.

So you didn't short below Bar 10 but you bought above Bar 20. There is no consistency and it sounds like you got lucky with the buy above 20.

Thank you for your response, it's insightful and thorough as I did not consider style and consistency. I also did not know that OO was a variant of a failed L2 short but I think I see it now (maybe I had missed this in the fundamentals course).

I would have re-entered the swing above the Bar 19 high while bar 20 was forming.

I don't know if I understand this technique fully but let me try to elaborate this. While bar 20 is forming, there is still a chance that bulls can get a potential third push up, that did not happen and so once bar 20 closes, buying above the bear bar or buying the close didn't make sense, for reasons you stated. Hope I understood this correctly.

I don't know if I understand this technique fully but let me try to elaborate this. While bar 20 is forming, there is still a chance that bulls can get a potential third push up, that did not happen and so once bar 20 closes, buying above the bear bar or buying the close didn't make sense, for reasons you stated. Hope I understood this correctly.

Bar 21 was a surprise bar. It traded 1 tick below 20 and started reversing up and becoming outside up. Since Bar 19 was a setup for Double Top Bear Flag short with Bar 7, if Bar 21 trades above the high of Bar 19, then you have a Failed Double Top Bear Flag. And since it is a failure and a surprise we should get 2 pushes up. But the 2nd push, the push after Bar 21, could be small.

So it is better to buy on a stop above Bar 19 for a Failed Double Top Bear Flag or wait to buy a pullback after Bar 21 for a 2nd push up after the surprise.

Take a look at The Encyclopedia of Chart Patterns for examples of Failed Double Top Bear Flags

They are under Part 3 - Section 20 - Double Top Bear Flag but Bull BO