The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

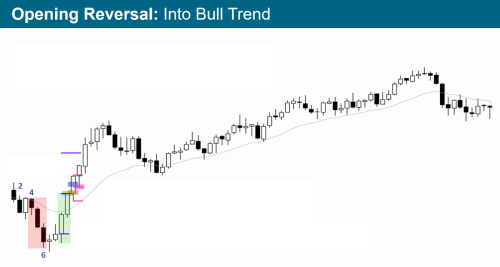

This chart is from BTC video 49A, from around 03:55. I have removed the text commentaries, because I'd like to focus on what happened before the opening reversal itself.

We don't know the context, ie what happened the day before, etc. But all else being equal, after bars 1 and 2 we're always in short, and as per BTC we would be short, hoping for a trend from the open. Then we have a really strong bull reversal bar 3. At this point most traders would exit, because we know that the market can reverse really fast after open.

If we indeed sold at the close of 2 or on downside break of 2, then we'd exit on close of 3 with a loss that is roughly half our risk if our initial stop was just above 1.

Question: Is there any way to avoid this loss and get out with a smaller loss / to scratch the trade / to not take the short in the first place? With the benefit of hindsight you might say, "Well yes, keep holding and get out at 6 or 7", but in real time it's not that simple. You were not to know that the reversal will eventually occur at 7. In fact although 3 didn't reverse the market, it was a good enough clue of what was coming.

Hi a possibility to look at it...

We don't know the context, ie what happened the day before, etc. But all else being equal, after bars 1 and 2 we're always in short, and as per BTC we would be short, hoping for a trend from the open. Then we have a really strong bull reversal bar 3. At this point most traders would exit, because we know that the market can reverse really fast after open.

Taking your assumptions that we are AIS we should be clear about our SL before taking the trade. So even if the BL RB looks scary you should stick to your assumption which also could include that the 1st PB in a BRT is always minor and as long your SL is not triggered your assumption is still valid.

A possible different approach to take the trade is to wait for the 1st PB and take the 2nd leg after B3 with the same SL at B1 or B3/B4, which depends on your perspective at that moment.

Hi, as I recall, Al's training (similar to Mr Carpet's comment above) is exit a bear trend (or AIS) either 1 tick or 1/2 a bar above a good bull bar; either way you would not have exited your short. 🏖

I understand Al's AIS entries/exits use buy/sell-stop orders (not at-market or limit orders).

True, but there will be cases where the market takes out your stop loss before reversing.

My conclusion is that some losses are simply unavoidable (at least for someone like me).

Certainly there will be some losses. No trader or trading teacher expects or proposes that their trading strategy will have a 100% win rate (there are too many unknowns).

For example, Al is upfront in the first "Fundamentals" part of his videos course about each person discovering their own positive "traders equation" from a combination of 1. risk, 2. reward and 3. probability that they are comfortable with.

The goal is to be sufficiently profitable by identifying repeating patterns, not have a 100% winrate.