The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

There are some days where you don't have errors and you are doing fine, so why do you feel struck?

Yet, it is difficult to help if you just throw a bunch of charts with no other comment that: help, please. So, why don't you just send one (maybe, two) at a time and discuss the mistakes you see on it so we can try to help? It would also be great if you added bar numbers on those charts, otherwise it is very difficult to comment the PA.

I agree with Ludopuig. I am sure a lot of people would be happy to give you feedback but sharing so many chart without any commentary will cause people to ignore this post just because it can be hard to follow.

I like what Ludopuig said, share one maybe two charts with markups of what you did and what your frustration is. Also, it would be helpful if you provide the timeframe, the date, and the market so people can see the overall picture.

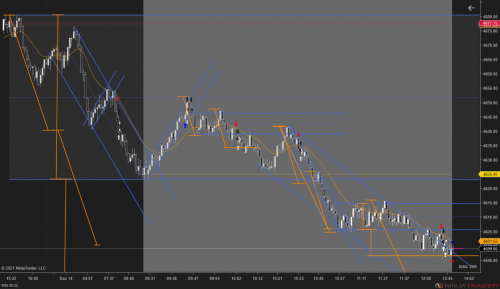

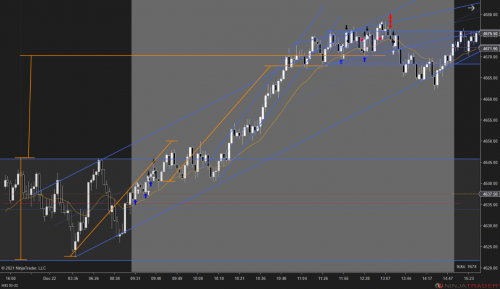

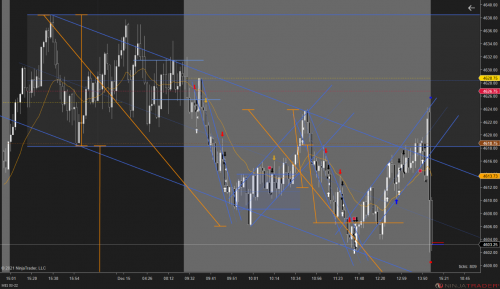

Micro E-mini Futures 12-30-21 2K tick chart - Market open yellow dashed line/ prior day close purple dashed line

Long error Bar 47 - Stop went below bar 40, target is above bar 43.

I got out early because the market was 1 tick away from stop and bars 48,49 were consecutively bearish closing near low.

I got in because of a second attempt to go long off support from a gap (close of bar 37 to high of bar 36). At the time I was playing off the smaller trend channel, looking for a new high after the break of trend. Looked like a good signal bar as well.

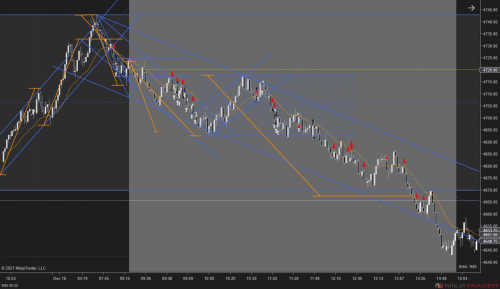

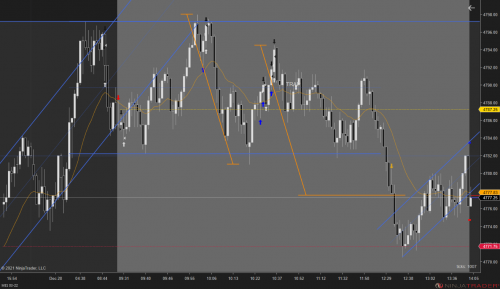

Short error Bar 123 - Stop went above bar 121, target is prior day close 4785.75

I got out early because the market was 2 ticks away from stop and bars 127,128 were consecutively bullish closing near high.

I got in because bar 123 closed below range low and market open, the high of bar 123 is off of trendline and the low of the range so I'm thinking what was support is now acting as resistance. there's also a gap (close of bar 122 to low of bar 121) although it was yet to be tested, I was thinking it wouldn't get tested so soon. I also liked the signal bar 123.

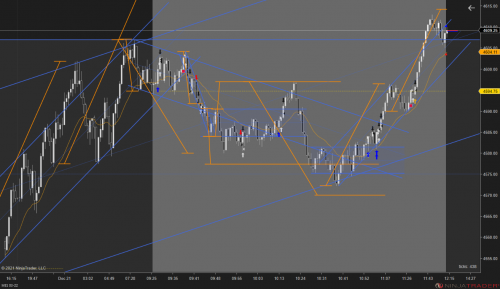

I'm frustrated because in the moment they looked like good trades and its hard to understand what I am missing when analyzing the chart.

When my trades are good they never come that close to my stop, usually hit my scalp target of 4 ticks by the next 2 bars.

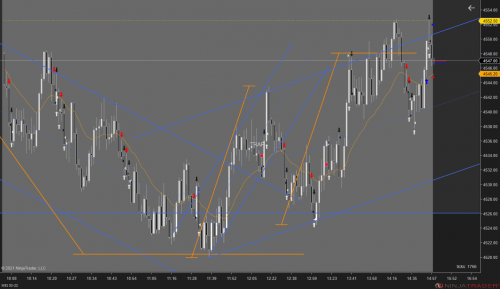

I would take a hard look at if you should trade the 2000 tick chart. When I created a 2000 tick chart, I came up with 194 bars for the day session of the emini on 12/30/21. That is a ton of information to process. Think about it a 5-minute chart is 81 bars, so you are trading a chart with more than 2.3x times the amount of bars in a day which is a ton of information to have to process. If you feel frustrated, I would keep things simple and go to a higher timeframe chart like a 5 or 10-minute chart. Take a look at the same day on a 5-minute chart or a 10-minute chart and ask yourself if you would have taken the same trades you took on the 2000 tick chart.

Your right, is there anything else you see such as going into resistance/support that I could be missing?

I have provided an update, could you give me your opinion as well?

Hi Michael,

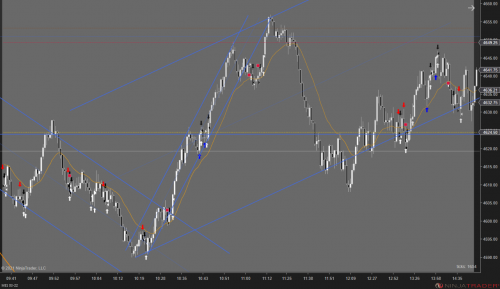

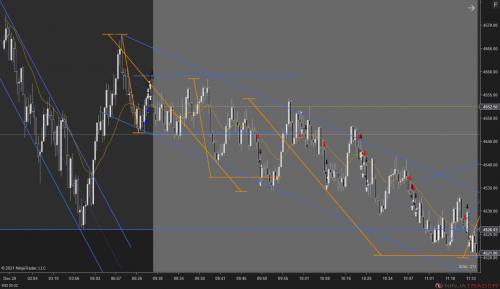

I just briefly went over the last chart you posted since it was a bit difficult for me to follow the chart but all I can say is that you are entering on weak signal bars and you are using incorrect stops. So those two things automatically lower the probability of your trades. I would say you tend to take swing setups that have something like 30% probability of success.

You can trade that way but you should expect to loose most of the time and you should manage your winners extremely well.