The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi all.

There must be something which I misunderstand. Can someone please point out what I'm missing?

I'm watching video 51A, the first of a series on "Losing Because of Mistakes".

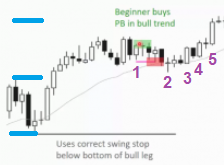

Al mentions that one mistake is taking a swing trade but managing it as a scalp. By having too tight a stop, for instance. He then gives an example, showing a possible good entry and showing that the proper stop should be about (I'm guessing, here) 20 points lower (last major swing down, I guess). Here's a snapshot taken from the video:

Of course, this shows a range, going slightly higher than the entry.

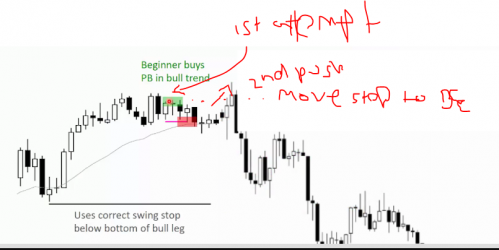

But what if the market had behaved differently? What if prices had dropped, instead? I trafficked the snapshot to illustrate what might (50% probability?) have happened:

What if this had happened?

Would the trader really be expected to stay in this trade all the way down to his 20-pt stop??? I mean, in the ES, 20 points of one contract is worth $1,000 USD. Real dollars!

So this is my problem.

Are traders really expected to wait until the stop is hit? Or are they supposed to do something else??? Here's another way to look at it:

All help is welcome!

When swing trading you have to use many times wide stops so, first of all, if you are not able to bear the risk better to wait for a lower risk trade. It will come.

@ludopuig so why even have a STOP? It seems that in a Bull Trend you are always looking for a reason to BUY, per Al. If the premise changes, you don't need to have a STOP. you are going to get out of the position and not ever test the STOP.

Plus in that scenario above, it seems, the chance of getting 2x risk/reward, is slim to none. Should it not say, don't take that trade?

so why even have a STOP?

Exactly!

Personally, I view that stop as protection against a catastrophic drop. Given that when I'm in the market, I'm watching it, I certainly would have reacted way before prices ever reached such a low level; probably right after the medium-length down bar that is highlighted in red. Honestly, looking at that chart, that's probably where my stop would have been anyway.

so why even have a STOP?

Ups, that sounds pretty much like a heresy in the PA world!

If the premise changes, you don't need to have a STOP.

You always have a stop, you choose to make it relatively big but maneagable, 20 points in this case, or huge and unmaneagable, your account size 🙂

you are going to get out of the position and not ever test the STOP.

This is not true quite often and this is the reason why you need the stop. In the chart that you traffiked the MKT went AIS but in many other times there is going to be a deep PB without the MKT going AIS, so you have to hold because your premise is still valid. Also, managing the stop loss placement while you are underwater is much more difficult in real-time than when looking in hindsight, so as Michel points out, having a catastrophic stop in the MKT is a must. Yet...

I certainly would have reacted way before prices ever reached such a low level;

No offense, Michel, but this not true (many times). When you are starting out, the most times you change your stop is for doing a stupid thing out of emotions, not a good trade management. The beginner will probably see the three strong bear bars and rationalize why the trade is still sound instead of exiting with a loss straight away. Or, after buying, he will see several sideways bars and will get out with a small loss although the premise didn't change, only his mind (this trade was actually a winner, not a loser).

This small difference requires a lot of experience and dollars lost (because you can't train management under emotions in paper trading). It is just part of the journey but it is much easier to focus only in the strongest trades (that, many times, look after themselves alone) than trying to manage a weak trade (that buy was not good).

To sum up, always always always have a stop in the MKT... once you are skilled enough you happily won't allow it to be hit, so why don't have it? and, in the mean time, it will save your account!

Plus in that scenario above, it seems, the chance of getting 2x risk/reward, is slim to none. Should it not say, don't take that trade?

If you think no chance to reach 2 x Risk/reward, yes, you don't take the trade but have in mind that you use the actual risk (AR), not the initial risk in the equation (in Al's chart, 2AR wasn't reached so you had to exit with aroun 1AR when the bears created a credible Wedge top).

If you think no chance to reach 2 x Risk/reward, yes, you don't take the trade but have in mind that you use the actual risk (AR), not the initial risk in the equation (in Al's chart, 2AR wasn't reached so you had to exit with aroun 1AR when the bears created a credible Wedge top).

At what point do you recommend switching from using initial risk to actual risk? In this case, 2x initial risk was unlikely given the size of the spike up and the entry was relatively high in a trading range. I agree that this wasn't a particularly good buy setup. So how would you choose a target in this case, if it were taken, since actual risk won't be known until the trade is entered and the likelihood of 2x initial risk is low (given the spike up 1x IR could be reasonable as well)?

If you are using a wide stop, do you enter your trades with the intention of getting out at a fixed number of points (like at a potential MM target, S/R level, etc.) even if the initial risk is quite a bit larger and the actual risk isn't known yet? If you do take such a trade and the market trades against your position, will you then modify your target according to the actual risk?

in many other times there is going to be a deep PB without the MKT going AIS, so you have to hold because your premise is still valid

Dr. Brooks typically recommends getting out of a trade if there are three consecutive closes against the always in direction. In saying this do you mean that the deep pullback has nonconsecutive bars against the trade, they're weak bars with poor follow through, etc.?

At what point do you recommend switching from using initial risk to actual risk?

You need to see the MKT resuming so you can wait for either a bar COH after a decent setup or consecutive bull bars.

So in Al's chart you have a decent DB 2 at EMA so I would trail my stop below it after 3 or 4 COH, so 1H-2L would be the Actual risk. Had 2 been a better signal bar (SB), you can put the stop below at the price of losing some probability, but in my experience is a good thing to do. Here the SB was a doji so you can't do it.

The traffiked chart brought by Michel is a good example of what I said above, you can't place the stop just below the doji. Here the MKT created a Wedge 1 2 3 and broke to a new high with consecutive bull bars 3 and 4, so when 4 broke out above you could trail you stop and then 1H-3L was the AR.

So how would you choose a target in this case, if it were taken, since actual risk won't be known until the trade is entered and the likelihood of 2x initial risk is low (given the spike up 1x IR could be reasonable as well)?

Bear in mind that most trades do not reach 2xInitial Risk but for the trader's equation to work you just need the 2 x actual risk. When you have a TR open Al mostly uses its range for the MM.

If you are using a wide stop, do you enter your trades with the intention of getting out at a fixed number of points (like at a potential MM target, S/R level, etc.) even if the initial risk is quite a bit larger and the actual risk isn't known yet?

In this case, no matter where I entered I would be trying to exit around the MM but instead of adjusting to the tick I rely on defaults, so depending on the day's range I exit at 4, 8 or 10 points. I would choose the number of points that is closer to the MM target. The point is that the less moving parts the better because thinking about many things after the fact is the way to learn, but during the trade the less decissions you have to make, the better so if, here, say the MM is 13 points away, I would still exit at 10 points. Regarding the trader's equation, same thing, I would not not be checking if 10 points in this case is higher than 2AR because I would intuitively know that, in my example, exiting with 10 points should be Ok. In the case of trade 1, the math is not really good because you are half way to the MM target in a TTR a little away from the EMA so I think it was too early to buy. Rather, bar 2 is a second test of the BO point and at EMA, so this is a better setup. If you don't like the doji, you wait for a bull bar closing on the high.

Dr. Brooks typically recommends getting out of a trade if there are three consecutive closes against the always in direction.

The number and size of consecutive bars that flip the Always-in direction depends on the context. In the traffiked chart you have consecutive bear bars that are bigger than the bull bars preceeding them, so the MKT went AIS.

In saying this do you mean that the deep pullback has nonconsecutive bars against the trade, they're weak bars with poor follow through, etc.?

Yes, in Al's chart, the MKT never went clearly AIS even tho it had seversal streaks with 3 bear bars. You could argue it was still AIL and the bear channel was likely to be a bull flag that reversed with a higher low.

@ludopuig Thank you very much for your detailed response!

In regards to your default targets based on the daily range, are those minimum targets for all of your contracts or will you scale out at all before they're reached?

Also does your potential target have to be proportional to the size of the initial risk in any way? For example, if you need to use a 10 point stop and there's a MM target 5 points above where the market is and the premise is strong, will you take the long entry even if you're theoretically risking 10 points to try to make 4 points?

In the second chart that you posted, if there was a large bear surprise bar forming after bar 4, would you exit as it was forming, wait to get out 1 tick below it, or rely on your trailed stop below bar 3?

Do your default targets change if the market is in a trading range or limit order market where the follow-through is more likely to be disappointing?

Thank you very much for your detailed response!

Happy to help!

In regards to your default targets based on the daily range, are those minimum targets for all of your contracts or will you scale out at all before they're reached?

I currently trade singles so is all in and out. Check the related videos for different managements with more contracts.

Also does your potential target have to be proportional to the size of the initial risk in any way? For example, if you need to use a 10 point stop and there's a MM target 5 points above where the market is and the premise is strong, will you take the long entry even if you're theoretically risking 10 points to try to make 4 points?

Yes, this is the example I gave before. In a bull trend the prior HL is always far so the initial stop is wide, you can't avoid that (unless the SB is pretty good, then you can risk with a tight stop and if the trend is healthy, it will work) if you want to trade it. Yet, as I said, the AR is always well smaller (if the trade is going to work) so if you end up having a 2.5 points AR you can exit at 5 points and the trader's equation will be happy. If you get, say a 4 points AR you will need 8 so you place your exit order at 8 points and exit once it is filled or when the bears create a decent setup, which was the case in Al's chart where you should have exited with around 1AR.

In the second chart that you posted, if there was a large bear surprise bar forming after bar 4, would you exit as it was forming, wait to get out 1 tick below it, or rely on your trailed stop below bar 3?

For exiting as is forming correctly you need your surname to start with Bro and to end with oks. If you don't comply that and you didn't become extremely rich trading neither, don't try. In real-time, those movements are fast so, in the traffiked chart, the MKT would hit your stop before you can think what to do. You get the looser and go for the next trade.

Do your default targets change if the market is in a trading range or limit order market where the follow-through is more likely to be disappointing?

Yes, you need to change your style of trading accrodingly. Check the how to trade videos for the details in trading each part of the MKT cycle.

As for trade management, I give a swing entries two tries to move in my desired direction, and then try to get out BE. There are other mathematical methods which perhaps make more sense, but this helps me keep a level head. If I have waited hours for a solid swing setup, once I enter I often find myself "hoping" the market moves in my direction and stop actually reading the PA. Most solid swings - which happen at least once a day most days, often more - move quickly off a good signal bar.

Difficult to comment because context of the up move is unknown......I have seen many times 3 to 5 consecutive moderate to big bear bars in a correction in a bull breakout/trend to well below 5 min 20 ema to turn on a dime and rocket up to new highs.Maybe thats where the power of order flow comes in......I don't know.But these strong big bear bar corrections always fascinate me and I am trying to figure them out.......any comments will be helpful in this regard.

@watermalbtinternet-com Those bars are a surprise and therefore they can't be foreseen but, once they switch the AI direction, you know there are trapped traders and there will be a second leg down. If it doesn't flip, then the countertrend traders are the ones trapped, which is more likely. In short, those bars always trap one side, you need to analyze correctly to jump on the winner side.

In the bar brought by Michel the AI direction flipped and the trapped bulls had to exit, but here you have other emini examples where the withtrend traders trapped countertrend traders:

24 Feb: at bar 43 there were 5 consecutive bear bars, so probably sellers above, yet it was still AIL and the bull closing on the high trapped the bears.

26 Feb: at bar 23 there were 4 consecutive bear bars, so probably sellers above, yet again AIL and bears were trapped at 25.