The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

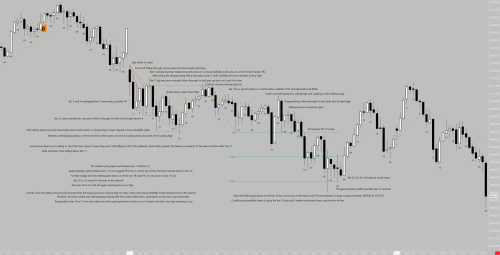

In green I marked trades that I would take but all wouldn't. Obviously, they all failed.

Trade 1: The market opens with a sell climax, forms a double bottom with a good signal bar.

Trade 2: Failed BO below TR, wedge bottom, good signal bar. I absolutely cannot see how you can still hold short after this bar.

Trade 3: Wedge bottom, higher low MTR, good signal bar

What is wrong with my thinking? How do I not take these trades?

Days like these are probably the most frustrating for me to trade. Tons of wedges, all gaps closed, good looking buy bars, market constantly look like it is reversing... and yet everything fails.

Trade 1: The market opens with a sell climax, forms a double bottom with a good signal bar.

I bought the bull bar two bars before on the same basis and also lost. I would have bought again had your bar been smaller but by going above the previous bear bar made you buy high in what was a TTR, so very low probability.

Trade 2: Failed BO below TR, wedge bottom, good signal bar. I absolutely cannot see how you can still hold short after this bar.

It is a wedge but the two previous bear bars were kind of a surprise, so you needed to wait for a second leg down.

Trade 3: Wedge bottom, higher low MTR, good signal bar

The signal bar is the doji before and you bought a strong bull close near the EMA in what could be a bear trend. Bears will sell that close. I bought instead the next bull bar, which had some room to the EMA and exited with 1 point when I was dissapointed.

Days like these are probably the most frustrating for me to trade. Tons of wedges, all gaps closed, good looking buy bars, market constantly look like it is reversing... and yet everything fails.

Even though a broad bear channel is a kind of TR, and you can buy and sell, it is easier to make money selling but for doing so you have to have the broad bear channel premise in your mind, or you will keep trying to buy for a swing up that never comes (bulls kept trying all day long and failed).

The reason why the broad bear channel premise is not in the head is because those days are rare in the emini, so don't get too upset, try to learn what you can and wait for the next day!

Thank you! Especially the comment about the signal bar of trade 3 has been most helpful. So far I have treated a reversal consisting doji+strong bull bar the same as a reversal with just a bull reversal bar because Al says in one of his videos that they are the same on a _higher_ time frame. But now that I think about it, it is actually weaker because on a lower time frame the two bars are already two legs up, and I am buying a third one.

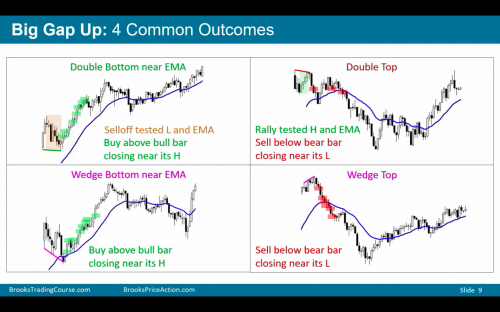

Just adding to this... since the first wedge down was below the EMA I believe it has less probability of being a good wedge bottom, so better to wait for it to break above the EMA with some strength and then test the EMA and reverses back up with some follow-through. (Referring to Al's Video 48A Trading the Open - Opening Reversals: 4 Common Outcomes Slides 7 & 8)

BUT if it was a Wedge bottom above the EMA then I believe the probability is better of it being a strong bottom and a place to go long especially on a second entry.

Plus throughout the day (at least the first hour or two) most of the bear bars were bigger than the bull bars and there were a few more bears than bulls. And the bull rallies were pretty small bars.

And the 2 strong bull bars that broke the EMA still didn't get above the prior rally before then having an immediate bear bar. So really hard to go long after that.

Al even says (basically) that bear channels can make several wedge bottoms so you can't be too eager to go long. And especially since there are so many bars below the EMA, for most of the start of the day.

I think most wedge bottoms are below the MA, unless they are pullbacks from bull spikes or in bull trends. The example on slide 8 you were referring to is also below the MA.

Totally agree with the second half of your post though. Now that you wrote it, it seems so obvious that I just cannot fathom how I missed it.

@gimmemailgmx-de Yes, i forgot to mention slide 9, which shows how in the morning you can have a wedge bottom testing the EMA... So yeah generally just pointing out that section on wedges or patterns on the open. It is tough in the morning though since the swings can be big and pretty fast, so increased risk.

Hi. Please excuse my question, I'm a newbie...

Am I reading the chart properly: you are Buying in a market that is trending DOWN (at least to my eyes)???

Thanks.

At times it is okay to buy in a market that is moving down, particularly when the activity is relatively two-sided, as it was during a lot of this session. As a beginner it is much better to only trade in the direction that has more pressure, and for the most part that was to the short side on this day (mainly focus on pullback entries and shorts from the top third of the range). There were numerous reasonable long trades on this chart, but many of them required limit order entries.

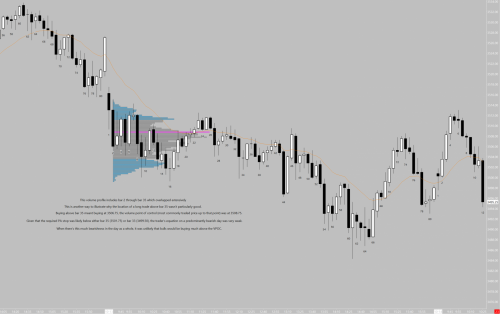

I've attached a couple charts of my interpretation of the session, focusing primarily on the areas of the chart that N H was asking about:

By the way, on the chart that shows the volume profile, the volume point of control is the bright pink line.