The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi, I am aware this question has been asked before, but somehow I have not get it

Based on https://www.brookstradingcourse.com/price-action-trading-terms-glossary/

Statement 1)

high 1, 2, 3, or 4

A high 1 is a bar with a high above the prior bar in a bull flag or near the bottom of a trading range. If there is then a bar with a lower high (it can occur one or several bars later), the next bar in this correction whose high is above the prior bar’s high is a high 2. Third and fourth occurrences are a high 3 and 4. A high 3 is a wedge bull flag variant.

Statement 2)

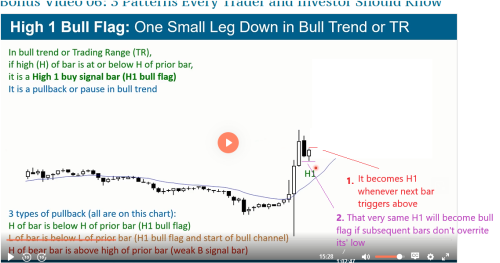

However, based on bonus video 06 (Minute 15:08)

It mentioned that if High (H) of bar is at or below H of prior bar,

it is a High 1 buy signal bar (H1 bull Flag)

It seems that Statement 1 and Statement 2 are contradictory

Can someone kindly help it to clarify ?

Thanks

Hi Wei,

A bar with a high at or below the high of the prior bar is a H1 signal, It does not mean that this signal is going to trigger. If the next bar doesn't go above the signal, then it becomes the new H1 signal, and it only becomes an actual H1 when the market finally goes above the prior bar.

H1, H2, etc. and L1, L2, etc. are simply attempts to resume the trend after a pause or PB. That's why they are a good setup in a strong trend. Most attempts to reverse trends fail and become with trend flags. Normally you can see it but sometimes it might only be visible on a smaller time frame. For example in a PB in a bull trend, you might see two bear bars, a doji then two more bear bars. That doji might be the first attempt to resume the bull trend even if it doesn't go above the prior bear bar. On a smaller TF, the tails on the doji might be seen as up-down price action.