The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Something I always struggle with.

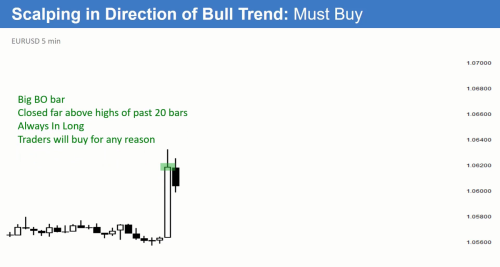

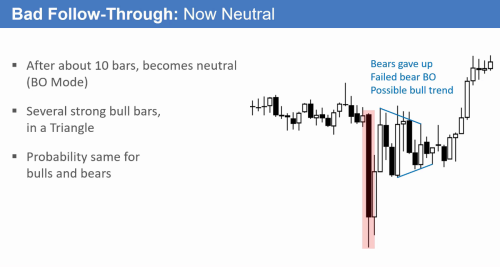

Below are two screenshots from the course. The first is from 13C at 13:14, the second from 15F at 14:29.

All else being equal, why would we buy in the first case but not sell in the second case? Both BO bars have a little bit of tail at the wrong end. Both were followed by an inside bar of the wrong colour. Both were gigantic bars taking out the closes of many prior bars.

I just got off the market. So, really tired and not thinking straight, so if necessary, I will expand on my answer later. For now, let me try and give you something to work with.

Make no mistake, both are BOs and Climax. The bars are huge, so if you want to trade, you still need to control your risk. Al hasn't given much of what's happened on the left.

It is usual for even such huge BOs to fail, if it is following a protracted TR. If the day was a TR day, 50-60 bars in, the odds of any BO failing increase significantly. This isn't relevant in this case since we don't know what's happened on the left but something to keep in mind.

The next thing is, it is always a good practice to enter above the high of a bull bar and below the low of a bear bar. If you do, you can escape the loss of selling the close in the second case. You can see examples in the encyclopedia where you'll see Al mentioning that, despite BTC or STC after 2 bull or bear bars, the trade didn't trigger as the market didn't break the high or the low.

Then you need to keep in mind the probability. Once you get bars like these, probability rises to 60-70% of getting a swing in the direction of BO(unless following a protracted TR). However, with a FT like the 2nd case, the probability drops to around 50%(say 53-55%). To me, at that point, the trade stops making sense since, I have to risk a lot of points but, the reward is not enough to offset the risk. I'm barely breaking even if things go well.

There are also a few other things. In the second case, the bull FT was huge compared to the first one. Visually it seems like the bull bar probably retraced 2/3rd of the bear bar's range. That's not something which should be happening if it is indeed a strong BO. At this point, the risk of it being a failed BO has increased significantly that one shouldn't be able to ignore it.

Since, the risk of a failed BO has increased, you can see there's a reasonable DB/H2 buy setup before the sell climax. Since, there's a 60% chance that those traders can avoid a loss without scaling in, that point becomes a magnet. You can see, the market did infact react from there, it also being the sell climax high.

Hope that helps?

Hi PB,

Good catch finding such similar setups. The second slide is also a sell after AIS big bar. My guess is Al didn't mark it because the slide is about bad FT and what to watch for after. The focus is just on price action a bit later.

Hope that helped,

CH

__________________________

BPA Telegram Group