The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I would like to start a discussion for Trade Management AFTER entry.

Al has many trade management ideas.

Alot of the time I like to compare what I did to what Al possibility WOULD have done. This is where I get confused.

Once in a position... Is it a swing? What if it stalls half way. What if it turn into a trading range between your original stop and target?

Is your plan to hold or to give your self ability to stop out sooner. Was that a good idea?

Is a swing only a scalp till proven otherwise?

Do you let scalps turn into swings and vice versa?

In a swing do you exit after some bars against you even though you were holding for a swing.

Ever hold for plus 2X.

Ever NOT use trailing stops.

Do you move limit orders closer or farther away depending on PA?

If your position misses your MM by a few points and retreats do you exit or wait?

At what point do you move your stop to break even.

Are you active or passive as far as trade management?

I am willing to answer any questions as far as my trading as well.

Thanks all!

Hi SandPaddict,

Glad to see you opened your own thread where you can share all your concerns about BTC.

I look forward to some constructive discussions, as well as, criticism.

Now, when it comes to trade management, for me number one thing is staying objective once you place a trade, since plans change as price action changes.

And for a trader to be objective and make good decisions, he needs to trade small and not think about money while in a trade. So, good trade management is possible if a trader stays objective. That is, he trades small. He trades the "i-don't-care size"

All other things related to trade management are technical and could be learned easily.

As Al says we all trade a lot bigger than we think and should reduce our position sizes.

My trade management improved when I cut my position size in half. And before reducing my position size, I already thought I was trading small. So even though I thought I was trading an "i-don't-care size", I started trading even smaller and after that was able to manage my trades a lot better.

That was my experience that I can share.

Thank you for your reply.

I couldn't agree more. Al does say that quite often.

The introduction of the mirco S&P probably aloud me to keep trading through the learning curve as everytime I'd switch from SIM to LIVE I'd get crushed. Which is I think the norm for most people at first.

The psychology of trading real money can't be discounted and that's why it's great advice.

In the past I've tried scaling in lower, higher, scaling out ect. I've never been able to make it work.

The micros allow you to really control risk as the are super liquid so it has the same benefits of full size contracts (except comms in % terms). But this allows me to trade very small. And just scale up size.

Thanks again for your post.

Ok so this was my day.

I feel like I traded fantastic. Took LOTS of small losses. Held on to winners till support/resistance. Gave one trade room with the expectation that that was the bet either way as if it kept going up it could keep going giving me a great R/R. I was lucky in that it went my way on that one.

Seems I also broke almost ever rule Al teaches. SELLING at the top of MASSIVE bull bars... BUYING at the bottom of MASSIVE bear bars. Getting out to early on almost every trade... if not every trade. Every single entry that day was a limit order! I've done EXACTLY the opposite of what I should have done.

I've posted these as well as trending days in the past to show this is how I trade them. These are limit order markets in my mind. Looking back sure you could have entered using stops but that would have just made it harder to make/keep money.

I got kicked out of alot of trades. So not Al's style. He always says stop at the bottom of range. Even for a scalp he says it's better.

Maybe he would say this is for intermediate to advanced? But he'll probably have these as swing trades marked on BTC but they never went 2X or for a MM. Maybe that's my bad interpretation? Don't know well see.

Anyway I think my style is maybe just incompatible. Again I dont know. Confusing.

Hi SandPaddict,

I think you ask a lot of great questions about trade management. Obviously, Al teaches multiple methods for managing losses and taking profits. Personally, I have had to find ways that are consistent with my trading temperament. So here are a few "rules" I follow to help me make trade management decisions:

- I look for stop-entry swing trades almost exclusively. If the market opens the first few hours in a limit order market, I will place limit orders at the high or lows of trading ranges. (much like you did today!)

- I use wide stops, almost always at the bottom or top of entire ranges or channels. It is not necessarily the most profitable place, but if I use tighter stops I find I "hope" too much that a trade will go in the direction I want and I stop actually reading the price action.

- I give swing entries two chances to move the direction I expect. To help with this, I try to watch the market only around the close of bars. Because I use stop entries, the market typically moves in my expected direction - at first. I let it move against me once, and pick up again. If a bar closes against my direction again after resuming in a positive direction I will close my position. Now, sometimes the market needs three tries to decide where to go - I often find that it will provide a solid signal bar on a third try and I will renter. Occasionally it will not and will eventually move in my original prediction and I will miss out - but those instances are rare and I just accept that I was right to begin with but it is best to be safe than sorry!

- Now when taking profits, Once I earn 1x my risk I simply look for opposite swing signals. If it moves beyond those signals I get out and take my profit and look for another entry in the original direction. This removes the need to hope. I find if I hold and hold I end up at the end of the day looking at clear exit signals that were ignored and small and medium size profits end up at BE or even losses.

- When reversing position, I usually only take 2nd entries (often MTR of some sort) or very obvious climactic finishes with really strong reversal bars. I don't like reversal trades very much because I find I am very conflicted emotionally and that makes me mistrust my price action reading and delays my decision making.

I hope some of these "rules" are helpful or thought provoking. I welcome any thoughts or suggested refinements from anybody!

Good Hunting!

...

- I look for stop-entry swing trades almost exclusively. If the market opens the first few hours in a limit order market, I will place limit orders at the high or lows of trading ranges. (much like you did today!)

Ya I pretty much watch previous support and resistance more than anything and trade depending on how the markets acting.

- I use wide stops, almost always at the bottom or top of entire ranges or channels. It is not necessarily the most profitable place, but if I use tighter stops I find I "hope" too much that a trade will go in the direction I want and I stop actually reading the price action.

Personally I usually use tight stops but like you if I'm at the bottom/top where support/resistance is likely I'll give It room for a "trap".

- I give swing entries two chances to move the direction I expect. To help with this, I try to watch the market only around the close of bars. Because I use stop entries, the market typically moves in my expected direction - at first. I let it move against me once, and pick up again. If a bar closes against my direction again after resuming in a positive direction I will close my position. Now, sometimes the market needs three tries to decide where to go - I often find that it will provide a solid signal bar on a third try and I will renter. Occasionally it will not and will eventually move in my original prediction and I will miss out - but those instances are rare and I just accept that I was right to begin with but it is best to be safe than sorry!

Gotcha. Nice. I think Al trades a form of this.

I more often wait and move stop in trade direction. If stopped out like you I will re-enter if it makes sense or just plain miss out and that's fine too.

- Now when taking profits, Once I earn 1x my risk I simply look for opposite swing signals. If it moves beyond those signals I get out and take my profit and look for another entry in the original direction. This removes the need to hope. I find if I hold and hold I end up at the end of the day looking at clear exit signals that were ignored and small and medium size profits end up at BE or even losses.

Yes I find that too. Exiting at a reasonable point of profits or after an extended trend, let's say, enables you to get out before the pullback... retest, if it retests!

- When reversing position, I usually only take 2nd entries (often MTR of some sort) or very obvious climactic finishes with really strong reversal bars. I don't like reversal trades very much because I find I am very conflicted emotionally and that makes me mistrust my price action reading and delays my decision making.

I am completely agnostic in most cases to long/short. To me a MTR in real time could just as easily be a flag for a continuation against the MTR. Basically a failed MTR.

Al says most traders, including him don't like to reverse.

I reverse all the time. Maybe I'm missing something there.

I hope some of these "rules" are helpful or thought provoking. I welcome any thoughts or suggested refinements from anybody!

Good Hunting!

Yeup! Great post. All thought provoking and makes total sense.

Cheers Paul!

I'm not sure of your marked trades were entered as swing entries or scalps. If they were swings it looks like you favour reversals, usually reversals against the "always in" status. Perhaps you are rather risk-averse?, if so thats a common psychological glitch.

One of Al's early swing exit methods is the AIBRE4 AIBLE4 exit (refer his accronyms list) which might interest you. This method can also comfort you if you are rather risk averse.

SandPaddict,

Regarding your first post asking Trade management:

Perhaps you are having a "lightbulb" moment with studying Al's course. I know recently you have been saying that price action does not matter; only trade management matters. I understand what you are implying; however, allow me to suggest a different way to think about it.

You may be realizing that most of the time, you can buy or sell and make money with proper trade management for that given condition. This is why Al often says 90% of the market is in a Trading Range of a Channel, so you can generally make money or avoid a loss with proper trade management. Al is not always the clearest with it because of how easy one can lose money trade this way, and that is due to the Trader's equation. When you have a high probability of anything, you must have a bad risk/reward, meaning your risk will generally be poor. This could lead to somebody thinking they may have a 60-70% chance of being willing if they take that trade; however, what if it is only a 55% chance of being willing? That little difference could make or break an account if you took 100 trades.

Take a look at the trades you posted on 10/12/2021. Al would frequently take a lot of those trades that you took. It may not be in the exact location, but he would not be opposed to selling strong bull closes at the top of the range and buying strong bear closes at the bottom. Remember Trading Ranges; you expect Breakouts to fail and for support and resistance to hold. So if Al often takes the kind of setups you showed in your chart, why is he such an advocate of stop entries, especially for people starting? This is due to how easy it can be to lose money with limited orders and scale in.

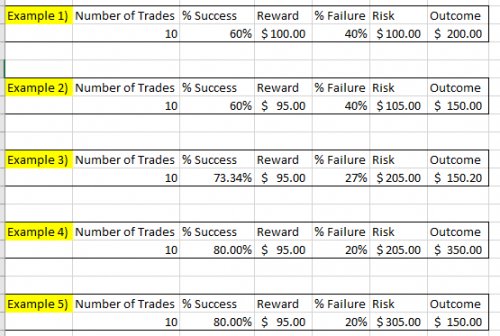

Take a look at the chart above:

Looking at example 1, notice if you risk $100 to make $100 and are right 60% of the time, you will net $200 after ten trades. This seems like decent math, right? Well, it's marginal. Take a look at example 2; notice if you assume this is the emini and factor in commission, you will probably pay around $5 per contract. This means your reward will be $95, and your risk will be $105. When you add in a commission of $5, your net profit suddenly becomes $150 after ten trades. That comes out to $15 a trade, which is 1.2 ticks in the emini. Ask yourself, does netting 1.2 ticks per trade sound like a good idea?

Now, let's look at a scenario where one risks $200 to make $100 (2:1 Risk/Reward). In example 3, let's again assume this is the emini, and we are paying $5 per contract in commission. Suppose you risk $200 to make $100 (not we have to factor commission, so it risks $205 to make $95). To net $150 after ten trades, you have to be 73.34% profitable. Again this means that to have the same situation as example 2, you have to be 73.34% to average $15 a trade, equivalent to 1.2 ticks per trade in the emini. This means one small error can wipe out all the gains of 10 trades, and we are not even factoring in slippage into this scenario. So if 73.34% is marginal, what percent profitability do you need to risk twice your reward? That is where trading becomes subjective, but I would argue you need 80% or higher. Ask yourself, are you capable of being 80% profitable when risking twice your risk? What about risking 3x your reward. I will save the details, but one would have to be right 80% to be profitable. (see example 5 above for more information).

I say all of this not to doubt your abilities or anyone's abilities on this forum. I bring this up to make sure we are genuinely thinking about the Trader's equation and to make the point about why Al is such an advocate for people swing trading instead of scalping.

As far as trade management goes, I would suggest getting very comfortable with Always In swing trading. Also, I would focus on making sure you are paying attention to the market cycle and having a suitable trading style for that given market cycle. There are so many trading styles, and you have to select one that fits your personality.

I hope this helps.

Brad

I'm not sure of your marked trades were entered as swing entries or scalps. If they were swings it looks like you favour reversals, usually reversals against the "always in" status. Perhaps you are rather risk-averse?, if so thats a common psychological glitch.

I don't trade like that. The more I post the more I answer my own questions. But I love the feedback!

Yes you are correct I was trying to catch reversals ON THAT PARTICULAR DAY. And yes I'm VERY risk adverse in those situations.

In the middle of the day I took probably half a dozen or more trades trying to catch a drop. I caught one that paid for the small losses then I caught the big one. That was the plan and I was lucky it worked. Otherwise I would have had a handful of small losses.

There was one day last week where I posted where I did NOTHING but buy the trend all day. So it depends on the market. I was trying to fade this day and luckily successfully. They aren't all that nice.

One of Al's early swing exit methods is the AIBRE4 AIBLE4 exit (refer his accronyms list) which might interest you. This method can also comfort you if you are rather risk averse.

Naw. I totally appreciate that but I generally keep very tight stops unless buying/selling bottom/top of a trading ranges, fading MTRs, ect.

Almost the exact opposite of Al.

I have super respect for Al just can't make it work.

P.S. Ive been studying Al for years and have no idea what AIBRE4 or AIBLE4 is. Lol.

SandPaddict,

Regarding your first post asking Trade management:

Perhaps you are having a "lightbulb" moment with studying Al's course. I know recently you have been saying that price action does not matter; only trade management matters. I understand what you are implying; however, allow me to suggest a different way to think about it.

You have a much better demeanor than I. I have a way of waxing ecstatic then sounding like I'm only one sided.

Of course price action matters. But it's just a framework. It's a necessary part but to me it's only a part of the whole.

You may be realizing that most of the time, you can buy or sell and make money with proper trade management for that given condition. This is why Al often says 90% of the market is in a Trading Range of a Channel, so you can generally make money or avoid a loss with proper trade management. Al is not always the clearest with it because of how easy one can lose money trade this way, and that is due to the Trader's equation. When you have a high probability of anything, you must have a bad risk/reward, meaning your risk will generally be poor. This could lead to somebody thinking they may have a 60-70% chance of being willing if they take that trade; however, what if it is only a 55% chance of being willing? That little difference could make or break an account if you took 100 trades.

Yeup. Again you get it. Trade management is key. Not that entry means nothing, just it's the link between the entry and exit thats key and the exit is where the profit is made or lost.

If you are swinging and scaling in (I don't do this, I'd rather double my stop for the same risk and try to get out break even) then you believe you are gaining probability but you never really know the odds and can get destroyed pretty easily that way.

Take a look at the trades you posted on 10/12/2021. Al would frequently take a lot of those trades that you took. It may not be in the exact location, but he would not be opposed to selling strong bull closes at the top of the range and buying strong bear closes at the bottom. Remember Trading Ranges; you expect Breakouts to fail and for support and resistance to hold. So if Al often takes the kind of setups you showed in your chart, why is he such an advocate of stop entries, especially for people starting? This is due to how easy it can be to lose money with limited orders and scale in.

Oh my dog ya! Its easy even for experienced traders to get trapped that way. (I try to get trapped on the right side of the trap, not easy but I try).

I looked at Al's markups after I posted that. He pretty much did what I said. Buy above bull bars just above swing lows and sell below top of range. Well to me that's a stupid strategy for that day. I guess you exit on opposite signals? I don't know. And I used NOTHING but limit orders that day.

Take a look at the chart above:

Looking at example 1, notice if you risk $100 to make $100 and are right 60% of the time, you will net $200 after ten trades. This seems like decent math, right? Well, it's marginal. Take a look at example 2; notice if you assume this is the emini and factor in commission, you will probably pay around $5 per contract. This means your reward will be $95, and your risk will be $105. When you add in a commission of $5, your net profit suddenly becomes $150 after ten trades. That comes out to $15 a trade, which is 1.2 ticks in the emini. Ask yourself, does netting 1.2 ticks per trade sound like a good idea?

EXACTLY!!! My win rate is NEVER that high and I certainly don't care! My win rate is much closer to 50%. Sometimes much lower. And that's the way I like it. It means I'm taking smaller losses than wins (when profitable). But of course your win/loss ratio has to be high.1.2 plus at the very, VERY least.

In the above picture replace the word "example" with the word "sample" and that's how I think of it. Just change the numbers a bit to fit.

Now, let's look at a scenario where one risks $200 to make $100 (2:1 Risk/Reward). In example 3, let's again assume this is the emini, and we are paying $5 per contract in commission. Suppose you risk $200 to make $100 (not we have to factor commission, so it risks $205 to make $95). To net $150 after ten trades, you have to be 73.34% profitable. Again this means that to have the same situation as example 2, you have to be 73.34% to average $15 a trade, equivalent to 1.2 ticks per trade in the emini. This means one small error can wipe out all the gains of 10 trades, and we are not even factoring in slippage into this scenario. So if 73.34% is marginal, what percent profitability do you need to risk twice your reward? That is where trading becomes subjective, but I would argue you need 80% or higher. Ask yourself, are you capable of being 80% profitable when risking twice your risk? What about risking 3x your reward. I will save the details, but one would have to be right 80% to be profitable. (see example 5 above for more information).

Yeup and this is what makes trading Al's style SOoooo hard. You have to be really good at picking entries or you take low probability swing trades.

I say all of this not to doubt your abilities or anyone's abilities on this forum. I bring this up to make sure we are genuinely thinking about the Trader's equation and to make the point about why Al is such an advocate for people swing trading instead of scalping.

Scalping is just something I do when the market is not acting quite right or I can see a vaccuum trade coming. But generally I don't think about trades as swings or scalps. If I do, I borrow the belief from Mike Reed, and that's every trade starts as a scalp.

As far as trade management goes, I would suggest getting very comfortable with Always In swing trading. Also, I would focus on making sure you are paying attention to the market cycle and having a suitable trading style for that given market cycle. There are so many trading styles, and you have to select one that fits your personality.

This one paragraph is worth the price of admission.

1. Always-in. You probably can't tell but that is my style. I exit quite often giving the impression that I'm not but I try to stay in the market as long as possible. I like to take profits often as well as it clears my mind and I'll pay to get back in if it looks right. (A purely psychological thing).

2. Market cycle and support and resistance is pretty much all I trade. I don't draw trendlines or angled lines. Not because I don't know them but because I've abandoned them.

3. This is the one idea that the Great Jack Schwager always mentions throughout all his works... You MUST find a style that fits your personality! Period. Otherwise you'll forever be fighting yourself.

I hope this helps.

Brad

It sure did!!!

Thanks a ton Brad!!!!

Good trading to you and all!

Glad this helps. Overall I agree with you, SandPaddict.

The point you are making is valid, though. Price action is essential; however, trade management is just as important if not more important.

Hi SandPaddict,

I think you ask a lot of great questions about trade management. Obviously, Al teaches multiple methods for managing losses and taking profits. Personally, I have had to find ways that are consistent with my trading temperament. So here are a few "rules" I follow to help me make trade management decisions:

- I look for stop-entry swing trades almost exclusively. If the market opens the first few hours in a limit order market, I will place limit orders at the high or lows of trading ranges. (much like you did today!)

- I use wide stops, almost always at the bottom or top of entire ranges or channels. It is not necessarily the most profitable place, but if I use tighter stops I find I "hope" too much that a trade will go in the direction I want and I stop actually reading the price action.

- I give swing entries two chances to move the direction I expect. To help with this, I try to watch the market only around the close of bars. Because I use stop entries, the market typically moves in my expected direction - at first. I let it move against me once, and pick up again. If a bar closes against my direction again after resuming in a positive direction I will close my position. Now, sometimes the market needs three tries to decide where to go - I often find that it will provide a solid signal bar on a third try and I will renter. Occasionally it will not and will eventually move in my original prediction and I will miss out - but those instances are rare and I just accept that I was right to begin with but it is best to be safe than sorry!

- Now when taking profits, Once I earn 1x my risk I simply look for opposite swing signals. If it moves beyond those signals I get out and take my profit and look for another entry in the original direction. This removes the need to hope. I find if I hold and hold I end up at the end of the day looking at clear exit signals that were ignored and small and medium size profits end up at BE or even losses.

- When reversing position, I usually only take 2nd entries (often MTR of some sort) or very obvious climactic finishes with really strong reversal bars. I don't like reversal trades very much because I find I am very conflicted emotionally and that makes me mistrust my price action reading and delays my decision making.

I hope some of these "rules" are helpful or thought provoking. I welcome any thoughts or suggested refinements from anybody!

Good Hunting!

Paul - This was GOLD. Thank you for this. I would find it very interesting to see Al post something similar. Very helpful, well explained, and definitely relatable. Cheers!

I think you ask a lot of great questions about trade management. Obviously, Al teaches multiple methods for managing losses and taking profits. Personally, I have had to find ways that are consistent with my trading temperament. So here are a few "rules" I follow to help me make trade management decisions:

-

I look for stop-entry swing trades almost exclusively. If the market opens the first few hours in a limit order market, I will place limit orders at the high or lows of trading ranges. (much like you did today!)

-

I use wide stops, almost always at the bottom or top of entire ranges or channels. It is not necessarily the most profitable place, but if I use tighter stops I find I "hope" too much that a trade will go in the direction I want and I stop actually reading the price action.

-

I give swing entries two chances to move the direction I expect. To help with this, I try to watch the market only around the close of bars. Because I use stop entries, the market typically moves in my expected direction - at first. I let it move against me once, and pick up again. If a bar closes against my direction again after resuming in a positive direction I will close my position. Now, sometimes the market needs three tries to decide where to go - I often find that it will provide a solid signal bar on a third try and I will renter. Occasionally it will not and will eventually move in my original prediction and I will miss out - but those instances are rare and I just accept that I was right to begin with but it is best to be safe than sorry!

-

Now when taking profits, Once I earn 1x my risk I simply look for opposite swing signals. If it moves beyond those signals I get out and take my profit and look for another entry in the original direction. This removes the need to hope. I find if I hold and hold I end up at the end of the day looking at clear exit signals that were ignored and small and medium size profits end up at BE or even losses.

-

When reversing position, I usually only take 2nd entries (often MTR of some sort) or very obvious climactic finishes with really strong reversal bars. I don't like reversal trades very much because I find I am very conflicted emotionally and that makes me mistrust my price action reading and delays my decision making.

I hope some of these "rules" are helpful or thought provoking. I welcome any thoughts or suggested refinements from anybody!

Good Hunting!

Man it's sooo good!

But that's not why I came here.

I wanted to ask anyone that would care to respond if anyone uses a DAILY STOPLOSS or a DAILY TARGET?

Here's why. I have in the past been obsessed with trading as much as possible. Not trading frequency, but just being there, watching, learning, trading.

Now that I'm becoming more comfortable trading, (this is a new feeling this year. I've never had that before.) I'm trying to get to a comfortable state to finish each day and walk away.

I don't need to push any more to learn every second of every day. I need to learn to relax and go with the flow now. AKA don't argue with myself.

So back to the question.

1. I DON'T use a DAILY LIMIT for a daily stoploss. I'll just stop trading based on each case and on price action.

2. I am testing quiting for the day after last trade ends above %2 gain in account. If not, my aim is between %1-2 percent.

Of course it doesn't always happen, and I don't expect it to, but it saves me from trying for those crazy outlier days where I'm getting 20 plus points in a day... but of course theres always a trade off and for me thats lots of small losing days and some really nasty ones. Looking ONLY for base hits now.

Way, way, waaay, to early to tell but so far it's been great.

It feels like practicing with a ten pound bat then playing with a two and a half pounder.

I allow myself to trade till the end of the day but even if I reach %2 in the first hour I switch to SIM for the rest of the day.

I have reached 2% a few times. Between %1-2 a few times. Broke even one day. (Ended with just under %1 in Globex that evening).

So... stupid good. I don't expect it to last at this rate but if I keep tight controls this will definitely stop me from over-trading at the very least, especially because it's a hell of a lot easier to go for 5-10 points or less and scale size and never really try for a ten-bagger R/R situation only to give it all back.

I'm always evolving though.

Anyone have any experience with this or do you do this?

Or a version of it?

Maybe you tried and abandoned in the past?

Any thoughts would be appreciated.

Good trading All!!!

I would like to start a discussion for Trade Management AFTER entry.

Al has many trade management ideas.

Alot of the time I like to compare what I did to what Al possibility WOULD have done. This is where I get confused.

Once in a position... Is it a swing? What if it stalls half way. What if it turn into a trading range between your original stop and target?

Is your plan to hold or to give your self ability to stop out sooner. Was that a good idea?

Is a swing only a scalp till proven otherwise?

Do you let scalps turn into swings and vice versa?

In a swing do you exit after some bars against you even though you were holding for a swing.

Ever hold for plus 2X.

Ever NOT use trailing stops.

Do you move limit orders closer or farther away depending on PA?

If your position misses your MM by a few points and retreats do you exit or wait?

At what point do you move your stop to break even.

Are you active or passive as far as trade management?

I am willing to answer any questions as far as my trading as well.

Thanks all!

Hello SandPaddict,

Your post is a quality and important challenge.

Trade Management after Entry is the MOST important thing about trading Discretionary Price Action.

That word Discretionary is vital important. Why is it important? It is important because you have NO edge. You have NO statistical proof if your Trade Management after Entry makes consistently money with low drawdown over a sample of 200 trades. You do not have any proof and neither does Al Brooks. Al Brooks only talks about trade entry. Well that is easy to discuss, right? I respect Al Brooks fully for what he teaches, but he not going to show you how to make money per trade. You have to prove that to yourself.

Moving on...

You are a Discretionary Price Action Trader, how you choose to manage the trade is based on your skill set at the current moment in your trading journey. How do you know if your Trade management after Entry is working, well after XXX amount of trades with your trade management your account balance goes up, it works, if it goes down it does not work.

So the question to you is:

How do YOU exactly want to manage EVERY single trade you take after entry?

It is not about what Brooks says, we already know what Brooks says. He says hold the position until "your premise changes". He says hold for a swing trade. All this vague and not specific.

So again:

How do YOU exactly want to manage EVERY single trade you take after entry?