The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi Andreas,

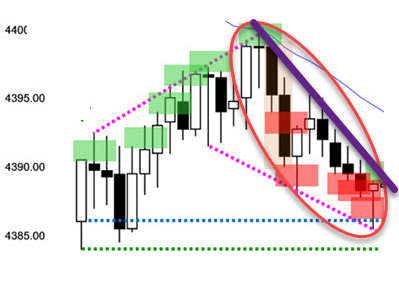

In the Encyclopedia GD section and searching for "MTR" there are many more such examples of gap on the open and an MTR label soon thereafter so I believe that yes, a gap down does count as a bear "trend" attempt.

Hello Mr. Carpet,

Got it, that makes sense. Thanks

Hello

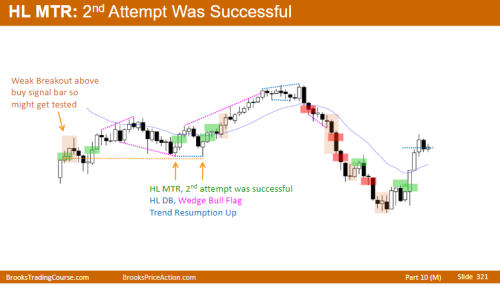

Mr. Carpet, can you help clarify why this is not considered a HL MTR? It is a test of the bear low after a large gap down with reasonable buying pressure on the break of the "trendline"

Perhaps it is because of the small signal bar after the tight bear leg down testing the low, which possibly makes it more minor than major?

Thank you,

Andreas

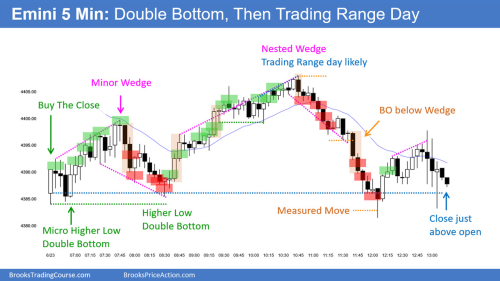

This picture is last Friday of Emini. There was a big gap down confirming failed wedge bottom in the bear channel (Tuesday to Thursday). Big gap down is a sell climax or climatic behavior, so Friday was a wedge pullback after sell climax. The second half of the day was the bulls taking profit after wedge top (Big low 2 short) from the first half of the day or you could say "Midday reversal". You could see there is no "HL MTR" in Al's explanation.

When there is a strong bear after wedge top like this, you should not be too eager to buy soon because when there is a breaking below the bear channel, there should be at least two clear legs down in couple days. Yes, it could have a bounce along the way down, but you should be aware of buying too soon.

MTR is a low probability trade. You have low risk and low probability.

Hope it helps.

Hi Andreas,

Video 22A gives some good hints on the requirements for something to be an MTR:

- TL break of tight leg or CH

- First such break created by a minor reversal.

- Resumption attempt that retraces at least 33% PB of the minor reversal (22A 05:00)

- a 1/3rd retrace provides an adequate test of the prior extreme

- A 2nd reversal attempt with very strong bars suggesting major reversal coming next.

- Must see countertrend pressure building with strong bar attempts (5-10 bars at least)

So perhaps in this move down there wasn't yet a TL break and not enough bull pressure yet due to so many bear bars.

Hope this helps,

CH

______________________

BPA Telegram Group