The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello all, hope you are trading well! I came across article in Financial Times talking about liquidity in ES, does anyone have opinion on this article?

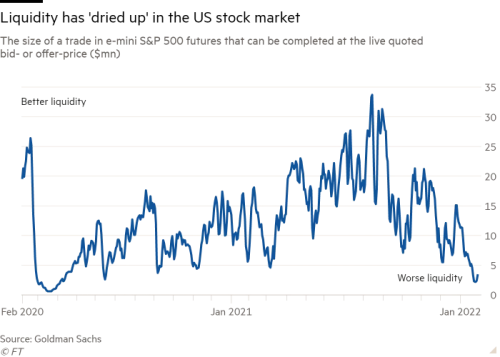

Below is chart from article showing liquidity reduction in ES, one thing I noticed on this chart is that the last time it showed low liquidity based on this chart we where at a major bottom, Feb 2020, LOL

https://www.ft.com/content/e4e33332-544b-4633-8b3b-a9594837baf1

Quote from the article that sticks out to me:

"Weak liquidity . . . leaves the potential for outsized market moves"

Sounds like a good thing for day traders, but I'm still working my way through the course and not very active at the moment. Hopefully, some heck will break loose in about a month when I'm ready to jump back in 😎

There will always be a trade, its never ending, my concern is can we scale up in the ES in the future, They stopped trading the Big contract at the CME last September. What is the maximum number of contracts we can day trade? Can the market handle 300 contracts or more on a day trade?

I would not worry about if the Emini can handle 300 or more contracts on a trade.

There was a podcast where Al mentioned that when you trade for a long time, you end up opening many accounts with many brokerage firms to help spread your money around. The reason for this is to keep your money protected from getting stolen or if the broker firm when bankrupt.

My point for mentioning the above is if you get to where you are trading 300 complete emini contracts, you would likely find yourself using multiple brokers to fill the order. There are several technology platforms (bloomer terminals are probably one) that would allow you to place a trade for 300 contracts and have the trade get filled by multiple brokers.

Also, if you were trading that many contracts, you would likely find yourself scaling in and out of positions more rather than buying a complete 300 contracts at once.

Overall, I would not stress too much over this topic.