The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi. I traded UK100 today, and below are the setups I thought were reasonable. I flipped many trades, knowing that it's not good but did that anyway saying to myself I was trading small.

The results turned out to be terrible, and most of the trades resulted in a small loss.

What is the problem with all these trades?

1. Are the entries valid? Here are the reasons for the entries.

A.Big down,up,down on open so expected TR,

HL DB, DB, H1 after reversal up from bear leg

B.wedge bear flag, expected the bear leg to continue

C.failed bear BO of a bull channel, DB

D,MTR(looking good when I'm posting this, but I don't know if this will be a win or a loss)

2. Al recommends getting out early, scaling in, or simply relying on your stop. On this kind of chart, what should I have done? I just kept getting out early flipping my position and ended up with 3 papercuts. I'm at a loss. I had this kind of problem for so long and can't find how to fix it.

Could anyone give me some advice.

Thank you in advance.

I'll be honest, not my favorite entries. I think I would be looking only for shorts as it broke above resistance but I could also see it breaking out and vaccuum testing near the double top of the day so would probably try buying near support. This is all BS really though because I don't know what I'd really do real time.

2. Al recommends getting out early, scaling in, or simply relying on your stop. On this kind of chart, what should I have done? I just kept getting out early flipping my position and ended up with 3 papercuts. I'm at a loss. I had this kind of problem for so long and can't find how to fix it.

Could anyone give me some advice.

Thank you in advance.

I think emotional management has alot to do with it. Al NEVER says this but sometimes when you just can't get a read maybe it's better to just wait till things seem more clear to you.

Again my guess is they will say you should have bought near bottom and scaled in and got out even on first trade and profit on next but that is just for experienced traders so don't do that.

Or possibly That you should have waited for the wedge and then sold at "C" for a swing stop above most recent high.

But personally I dont likea of that advice because you cant unsee a chart once you've seen it.

My suggestion as this is what I do. Take your entries (nothing you could have done with those) and analyze your exits. Always check to see if you could have broke even. Next if you could have made a profit. And last look for any that could have gone terribly wrong and the best way to of handled that.

Now take THAT information to ask your questions to yourself about these trades.

But remember setups are like snowflakes, no two are ever going to be exactly the same.

Hi YY, let me share a few thoughts on this chart. As with everything related to trading, there usually is no right or wrong, so these are just my takes on the PA. Hopefully, a more advanced trader could correct me, or add other insights that I might leave unaddressed.

- The day opened with a huge bear spike. Everytime I see such a climactic movement in the open I raise the possibility of a vacuum test of SUP/RES. We don't know what's to the left of the chart, but given the big up that followed, that is very likely a good support area.

- After a big down, big up leaving a LH DT followed by another big down, this time leaving a HL DB, I immediately think the market is in a triangle. That means I'll not bet on any BO's of that triangle until I see very good reasons to do so.

- Given this TRI context, I'd look for H2/L2 on it's extremes, and try to swing trade on them.

- Now to your entries:

- (A) looks like a valid entry to me if you structured it for a swing. I don't think it's a great entry, but a valid one. The reason is that the last bear leg (second big down) was too strong, and I'd would expect another bear attempt after that. That means that I see that trade as a low prob trade, and therefore, it needs a good R:R profile to compensate that fact.

- (B) is bad because it's very close to the TRI line. The previous bar, the small inside bear bar, is a great SB for a bear swing. Entering on (B) would be a late entry of that trade, and probably where the bears who did sold the good SB would take their profits.

- (C) is also bad because at that point the market was in the middle third of the TR/TRI (no edge on that area), high on a possible wedge bear flag, in a RES area (50% of the last big down leg), and no good position for stops, which means you'd have to aim for a very unlikely profit target in order to make a mathematical valid trader equation. Your prob here is very low.

- (D) is a valid entry, a wedge bear flag followed by a LH DT on 50% of the last bear swing. It's not a great entry, because whether or not it broke out the TRI is arguable, and it left a conspicuous tail. Also, it's a big bar, and that forces you to put your stop further away. These points make me think it's not a sell the close bar, and, therefore, I'd rather wait for a PB test of the break out and a good sell SB (which came as the third bear bar from right to the left).

Well, that was a longer answer than I expected, but I hope it raises some interesting points for your studies.

Let me know if something wasn't clear.

Best,

Again my guess is they will say you should have bought near bottom and scaled in and got out even on first trade and profit on next but that is just for experienced traders so don't do that.

I ment sold near top and be ready to scale in higher. Not lower. And get out even on first with profit on second.

Personally I like the idea of all in sale out vs average in but that's just me.

Thank you guys! I never expected such detailed answers. I appreciate them!

SandPaddict, I've been having a sort of losing streak since last week, and I fail to take only best setups. And losing streak brings more streak... I'll review these trades and learn more about how to manage my trades, but actually all my entries are probably really not that good. I hope to learn to scale in etc, but I think I will get in one time with a tight stop, and get out all in one time for now. That's actually comfortable to me.

Mr. Berald, I try to take only "blue box" best setup , but have a hard time differentiating good swings from bad setups, let alone scalp setups. Your reply helped me know why my trades won't have blue boxes on it, or it might not even be marked on the chart as scalps if they were in the daily setup. (Without reasons like the ones you gave me, I just can't deny a trade that I find sufficient reasons to take but that somehow feels bad, especially when having a losing streak) And I missed the trade you correctly pointed out, DT after D(BO test PB ) . It actually went a little below today's low.

Glad to know that helped, Y Y.

It takes long hours of study and chart analysis before you start to get a better sense on what's a good setup and what's a bad one. But that eventually comes if you put in the hard work. It's important to be patient with the process though.

Regarding scalps, remember that they require a high probability setup, so, if you are not sure whether a setup is high prob or not, it probably means it's not and you should try to structure a swing trade.

Also, regading scaling in, I'll tell you the same thing that @ludopuig said to me previously in this forum and which I agree: if you are not making money consistently without scaling in, that means you should not be scaling in. That is one of the last steps in a trader's journey, so better forget that it exists for now, until you get more confident with your abilities and results.

Best,

Thanks for the advice again, Mr.Beraldo. ( I noticed I misspelled your name last time, sorry.)

It takes long hours of study and chart analysis before you start to get a better sense on what's a good setup and what's a bad one. But that eventually comes if you put in the hard work. It's important to be patient with the process though.

Yes, hard work. It's sometimes hard to keep myself motivated but if I quit, I'm sure I would regret that in the future... Like you said, I'll put in the effort to try to get better, just like Al did for an unbelievable number of years.

Also, regading scaling in, I'll tell you the same thing that @ludopuig said to me previously in this forum and which I agree: if you are not making money consistently without scaling in, that means you should not be scaling in. That is one of the last steps in a trader's journey, so better forget that it exists for now, until you get more confident with your abilities and results.

I actually didn't know that... Thanks so much for telling me that. For now, as you suggest, I will concentrate only on finding where to enter for a swing trade with a good risk reward. And, when I lose, I will no longer blame my management style. I'll blame my entry or exit and try to work on those.

Here's a post I made last week. I thought it would fit what your saying. All trades were In-out. No scaling.

As you can see I took only sells and cut lots of losses quickly BUT I held for the swings which is key to gaining over the many small losses.

Not so much about entry as trade management.

Yes picking bad entries isn't good but if you take a small loss your not stuck in any trade.

The problem comes when you take only small losses and small wins. Slippage, commissions and fees will getcha.

You need to catch and hold those winners!

Other times I'll use a wider stop and I'll be holding for 5, 8 or 10 plus points. But the point is your wins are larger than your losses not necessarily good entries.

Not that entries are not important but they are the LEAST important part of the equation. Very few traders can maintain a high win ratio but many can hold for bigger wins.

Thanks for giving me an actual example of yours, @SandPaddict. Yeah, it seems the problem with me is failing to hold onto the best swings, getting out too early. The problem is, I just can't tell when I should get out or keep holding onto the position. When I see an opposite setup, I just can't hold. And if you take too many trades in a short period of time, just like I did yesterday, I will just keep losing. So, I think I'll try to reduce the number of trades, especially by picking the best-looking setups. Al says you can make money buying or selling on the same bar, but since I can't scale in correctly now, I'll try to only get great swings and hold on it as you say.

you must, MUST, M-U-S-T... hold on to those winners!!!

Hello SandPaddict,

Al Brooks have stated before that he scalps all day long.

So I respectfully disagree with your comment of "Must hold those winners".

Holding winners and trade management is not for everyone. The disadvantage of holding winners is you constantly contradicting your reason for exiting the position rather too early or too late.

There is more than one way to make money trading price action.

Al recommends getting out early, scaling in, or simply relying on your stop. On this kind of chart, what should I have done? I just kept getting out early flipping my position and ended up with 3 papercuts. I'm at a loss. I had this kind of problem for so long and can't find how to fix it.

I keep coming back because I struggled/struggle with this as well.

After looking again at the chart after Brunos fantastic advice I don't see why you would have exited?

I don't like saying I would have done something after the fact but I'm not sure I would have exited ANY of those individual trades on their own given the chart.

Maybe it's not your entries or exits but your emotional response to the drawdown?

This is what emotional trading looks like after the fact. Once you get into the fear-the-risk mentality its hard to shake the fear of another loss.

Al always has the same response to this... = Trade the I don't care size.

I don't know about you but the ONLY I don't care size is SIM.

I can lose small and still get pissed off if I can't ever win. Or the wins I have never seem to add up enough to cover losses and expenses.

I have found the confidence (not the patience) to hold for longer wins.

Another problem is whenever you take what you think is a small loss but are just exiting because you are afraid it will keep going, you are guaranteeing you cannot get a large win out of that trade. And maybe that was the one you needed to catch and hold to pay for all the small losses.

You can take all the right entries and easily loose if you manage your trade incorrectly. And I don't mean scaling.

Waiting, sometimes, in the right situation to get out even is the best thing to do.

Either way if you take smaller stops or below major swings like Al suggests you need to have a positive traders equation and if stop below major swing you have to hold for a massive win. (At least 2XR)

I know this is not Al speak but just giving a different perspective.

Hope you get a grain of something out of that as I'm not sure how far along you are along in your trading.

Good trading to you my friend!

Thank you for your response.

Al Brooks have stated before that he scalps all day long.

Yes, he has. He also says most traders, even experienced traders, should only swing.

So I respectfully disagree with your comment of "Must hold those winners".

Oh for sure this is just my opinion.

I do respectfully disagree as well though from my point of view

The way I see it, and Al says this, is that if you are going to scalp (AKA go for only 1 times risk) you need to have a very high win rate. Like a consistently high win rate. And that is very very hard.

It's easier to try to have larger win/loss ratio then a high win rate.

But I'll get out and reassess at certain support/resistance areas, sometimes multiple times if I dont like the price action. But I'm looking to swing

Holding winners and trade management is not for everyone. The disadvantage of holding winners is you constantly contradicting your reason for exiting the position rather too early or too late.

Yeup! Making money in the market isn't for everyone either.

There is more than one way to make money trading price action.

I agree %100. There really is. Although there is the traders equation and everyone has one of those too.

My friend this IS tradings dilemma! And what a fine explanation of it to boot!

I think that's great advice. Even the best setups are never a guarantee but they sure give you a nice structure work with.

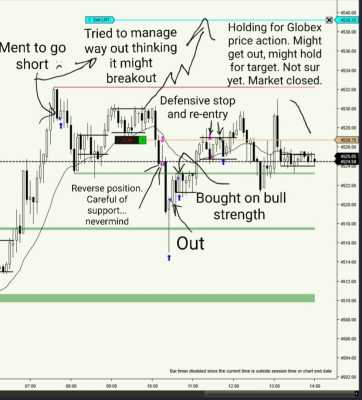

Here is my day today. Not looking for any advice because given the same day I definitely would have traded it differently, but that's my homework.

It's a good example as I was totally confident taking that first buy. (Which was supposed to be a short.) I had also missed the first hour or so. So much for confidence.

I could have bounced in and out but that usually isn't the best idea. Managing the trade your in is.

I ended the day just above break even after commissions.

Now I could have done better, sure. But I could have done worse too I think if I was jumping in and out. Which I did a few times anyway but like I said before I like to be defensive.

As always hope you can find a nugget in there.

Hi Sandpaddict

I have been reading many of your comments in this forum in the past 2 weeks.

It seems to me you have been exerting a lot of energy debating, in your own mind, all manner of possibilities about how you can be a better trader. And you have bounced a very extensive range of trading approaches and trading styles with many al brooks subscribers.

So, here we are, 2 weeks later, what do you conclude from your various recent comments in this forum. Have you arrived at some insights? Can you share the insights?

Good trading.