The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

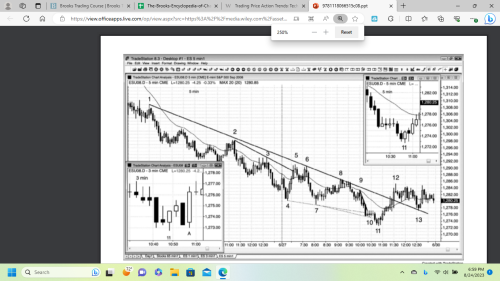

hello can someone explain this to me, page 171 in trading price action trends, it looks to me like whether or not you entered on the three or five minute chart, you would not be stopped out either way, wouldnt my stop loss be one tick below the signal bar 11 on both time frames? from what i took from Als explanation is that the stop would be right below the entry bar on the three minute chart (next bar after 11) then yes you would be stopped out, but wouldnt your stop loss be below the 11 signal bar for both time frames? tia

Hi Deron,

This is what I understand, on the 3 min chart you could be tempted to put the stop below the entry bar (if you were going for actual risk stop and were overly optimistic) and it would be hit. On the 5 min chart it would be below 11 and would not have been hit. More opportunities may be available on smaller time-frames but stops (such as the major lower low here) are clearer in higher time-frames. In the beginning we tend to try to minimize risk and take tighter stops but risk is not the only factor for a good trade setup or traders equation, probability is higher on the 5min tf with stop below 11 and you pay for that higher probability with higher risk.