The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I couldn't find a section to discuss bonus videos, so I'm putting this under the "general" category.

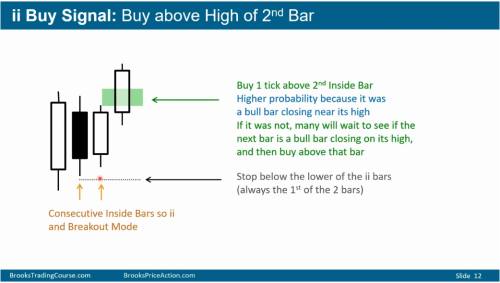

At around 18:30, Al says: If the market breaks above the II pattern, it's a buy. If it breaks below, it's a sell".

I am confused about this. Are we ignoring the context here and taking a trade simply because of the fact that it's an II pattern and it broke? If the market is not supposed to break upside here (eg very strong bear trend), would we still buy if the pattern broke upside?

I couldn't find a section to discuss bonus videos, so I'm putting this under the "general" category.

At around 18:30, Al says: If the market breaks above the II pattern, it's a buy. If it breaks below, it's a sell".

I am confused about this. Are we ignoring the context here and taking a trade simply because of the fact that it's an II pattern and it broke? If the market is not supposed to break upside here (eg very strong bear trend), would we still buy if the pattern broke upside?

Hi P B,

These ii's are useful to be taken as either continuations or reversals in whatever overarching context is present at the time. In a bear trend this could be a reversal attempt, but whether you'd take it or not will depend on whether a reversal at that moment is reasonable (e.g. MTR at HTF support after trend break and enough prior bullish pressure?). Or in a strong SPBL this could be a pause/flag/PB for a chance at more up.

Context is king.

Hope this helped!

CH

______________________________

BPA Telegram Group

I thought so too, Carpet, but Al says again something quite un-contexty if you listen to the same video from 21:02 to 21:41.

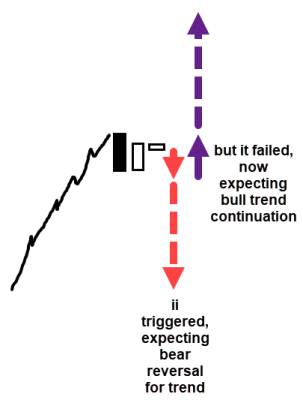

II, market went below the last bar of the II, triggering a sale. The entry bar ended up a strong bull bar, taking out your stop. At which point Al says, reverse and go long. The context hasn't changed. How can you reverse based simply on which way the II broke?

And the same again from 31:01 to 31:20.

Yes, it's true, Al does talk about immediately reversing on such as early as 00:31 "and if it goes one way and then the other way, theoretically, a trader would take both trades"

However, he also mentions at 10:28 "these are breakout mode patterns - traders want to trade them in trends". Basically, an environment where stop entries work, not limit order market like in TRs.

Later he mentions more context rules:

12:04 - these are trend patterns either for trend reversal or trend continuation, they are not limit order patterns

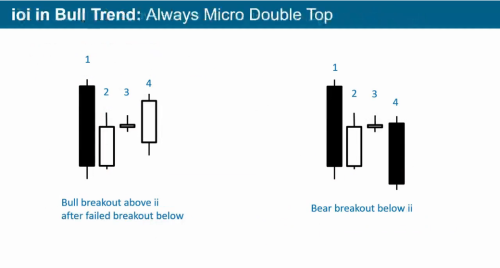

27:00 - these patterns are triangles and late in trends they are often final flags

So context is very important. First, there needs to be a trend, then one of these patterns comes along and acts as a flag. The flag then either continues the trend, reverses the trend, or attempts to continue the trend (triggers) and fails which makes it ok to take for trend reversal. Or maybe it triggers for reversal first which then fails (as a deeper PB) and resumes prior trend.

Whichever combination happens, these formations are critical areas on a chart (except in TRs) so it's important to train the eyes to spot them when they happen.