The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

The general guideline is:

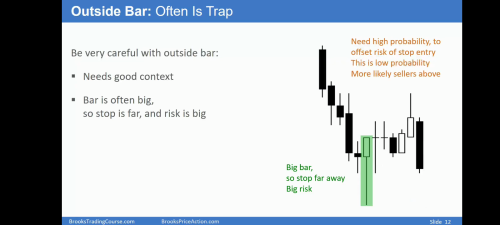

Good context + Good signal bar = pretty good setup

Good context + Ok signal bar = decent setup

Good context + Bad signal bar = ok setup

Bad context + great signal bar = ok setup(maybe a decent scalp but usually not great swing)

Bad context + bad signal bar = avoid

So, you see - bad signal bars can be acceptable if premise permits. However, good signal usually can not compensate for bad premise.

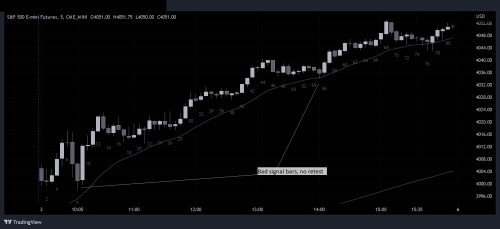

Keeping this in mind, let's discuss the 3 scenarios you posted.

Case 1 - pretty good buying pressure on the open, so strong bear trend not likely. Strong bear BO followed and got spike and channel bear trend. Day is probably going to turn out to be a broad bear channel. Okay to take decent swing buy setups near the low. Coming to the signal, wedge, first entry failed and getting a second entry, both entries had strong bull bars, probably going to test the start of bear channel. So good context, and although the first buy signal generated above a bear bar, there aren't many eager bears waiting to sell above said bar. With good size bull bar COH, bears will step aside and wait for TBTL by the Bulls before entering again. Even if there were some bears who sold above bears bars, market later tested down and let these bears get out BE on these sells.

Case 2 - gap up open and doji bars. So bulls not eager to buy far above 20 EMA. So, not likely bulls present below waiting to buy using limit orders. Sometimes, a single bar can create good enough context for a swing. Here, after gap up, low 2 with the 2nd entry also being a big BO bar and a surprise, so good enough context for a swing short. However, bad signal bars often get tested later in the day, which it did eventually.

Case 3 - 5 bar bear MC, 3 bars COL, 3 with decent bear bodies and compared to that, the bull bar was weak and not enough to reverse the damage the bears did. So, despite strong bull bar, not strong buy as bad context. Bulls at best got TR and then resumption for a 2LSD.