The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

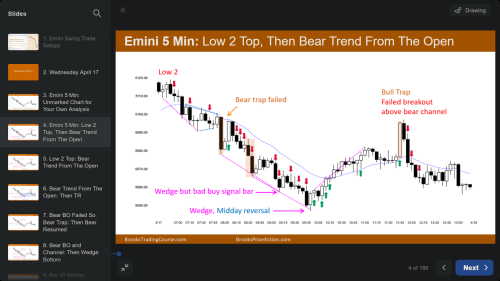

why is the mid-day reversal / wedge reversal recommended here? This is a very tight bear channel with actual gaps. BTC fundamentals say do not attempt to reverse this.

It was a strong bear trend but difficult to hold short with many strong bull bars and many bear dojis, frequent pauses. Bars 18-19 were unusually strong bull bars after an unusually big sell climax. The day wasn't an average bear trend day, with many unusual things going on. For example bars 63-65 were like FOMC bars, but there was no news!

Bars 18-19 weren't simple bull traps. Institutional bulls aggressively bought there, which you can see from the fact that they bought more lower and with bar 64 they managed to take the market up to the bar 19 highs in order to get out BE of their first buy.

Bar 40 is a very strong bull reversal bar, and the strongest bull bar all day apart from bar 19. Bar 40 came after two TTRs (26-30 and 33-38), and happened to conincide with the midday. It was a V-reversal, which are rare and especially tricky to enter, and there was always a chance that the midday reversal might fail.

If you don't look too closely, it was also sort of a H4 after the strong bar 17 BO.

I can understand why this is a possible buy, but I only see this as a good place to take partial or full profits.