The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I always confuse about the tails, when I see a long tail in the direction of trade I usually do not enter the trade.

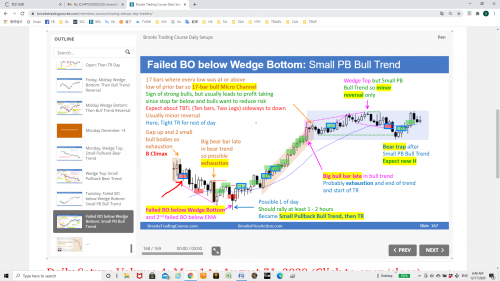

In the above example on Tuesday (slide 167), on the fourth bar (the red arrow marked), I have the following questions:

1. The follow through bar is a doji with a long tail, the close is just below the close of the prior's bar. It was marked as a swing trade entry.

- Since this is just a L1, a fail break out of low, and a weak follow bar with tail, why a swing entry? Just because if is a B climax?

- Is this swing trade entered after the close of the bar? If it is, the low of the bar is a 1 tick (?) failure break out of low, should we enter then?

- If it is a limit order or stop order on the low of prior bar, should you wait for the follow through bar to enter?

2. Whenever I see tails greater than 1/3 of the bar, I usually wait and many times will miss the trade. How do you interpret the tail or judge if it is a good entry bar?

Thanks.

I always confuse about the tails, when I see a long tail in the direction of trade I usually do not enter the trade.

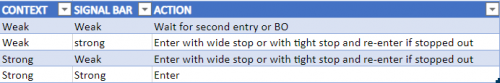

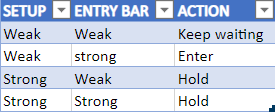

The signal and entry bars many times are weak (= have a tail) but if the context is good you should still take the trade.

In the above example on Tuesday (slide 167), on the fourth bar (the red arrow marked), I have the following questions:

Actually, the marked arrow (the signal bar) is the third, the fourth is the entry bar (which happens to be also a signal bar for the bulls).

1. The follow through bar is a doji with a long tail, the close is just below the close of the prior's bar. It was marked as a swing trade entry.

For the bears: 3 is the signal bar, 4 is the entry bar and 5 the follow-through. You enter with a stop below 3.

For the bulls: 4 is the signal bar and 5 is the entry bar. They enter above 4.

- Since this is just a L1, a fail break out of low, and a weak follow bar with tail, why a swing entry? Just because if is a B climax?

3 is a decent setup for the bears (buy climax and bear bar closing on the low). Then, bar 4 is a weak entry bar but, simultanously, an even weaker signal bar for the bulls (DB 1) so bears can stay short expecting the MKT to go closer to the EMA.

- Is this swing trade entered after the close of the bar? If it is, the low of the bar is a 1 tick (?) failure break out of low, should we enter then?

As I said, the stop entry is one tick below 3 and, alternatively, you can sell using a limit order entry above 4 because it is a bull setup expected to fail.

- If it is a limit order or stop order on the low of prior bar, should you wait for the follow through bar to enter?

Nop, tho you can if you want and you will get higher probability in exchange of higher risk (not here).

2. Whenever I see tails greater than 1/3 of the bar, I usually wait and many times will miss the trade. How do you interpret the tail or judge if it is a good entry bar?

It depends on the context: the better the context, the less important the signal bar.

Here, the bear case (buy climax and L1) was stronger than the bull case (DB 1 4 above EMA, with dojis for signal bars), so the MKT was likely to drift closer to the EMA. Once 3 closed on the low and swing bears entered, bulls tried to create a strong setup (DB with 1 at 4) trying to trap bears, but they got a doji, then they tried to get a strong entry bar (5) but they ended up with a small bull bar so, as soon as it closed and having failed twice, bulls exited and 6 plunged.

Thanks very much for the analysis.

It's SB, EB then FT bar. I guess I was confused with the time of entry somehow after studying the videos, many cases Al's mentioned waiting for at least a second bar to confirm, and in some cases, it was mentioned weak or no follow through bar therefore no entry was make. Sometimes on breakout, Al's will wait for a second bar (follow through?) to confirm.

So it depend on the context, strong context can be entered with a stop over/below the SB. Weak context, then wait for 2nd or more bars?

Thanks.