The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

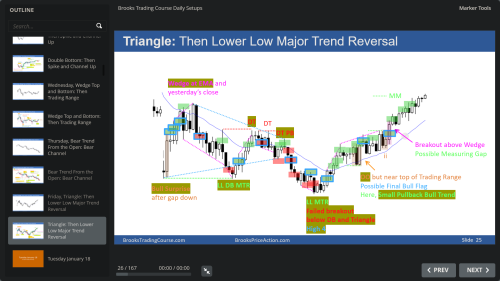

what makes this setup not a recommended short ?

also taking into account the prior similar setup which was stronger for the bulls

Because the sell stop order wouldn't have filled because the following 1 or 2 bars didn't fall below the low of the signal bar. Al doesnt mark entries which wouldnt have filled.

Great, thank you. I have been paper trading with market orders because they are quicker. In this example I sold the close.

How do you deal with the situation when you are setting up a stop order and the next bar passes by before you can place the order?

Is it the same thing to just wait until the next bar goes beyond your entry price and do a quick market order?

If price is moving really fast downwards then it's going to be tricky. On the one hand, yes, take at-market entries, so you'll have more risk but on the other hand you've got the increased confirmation (greater probability) that you're on the right side of the trade. Alternatively you could just play safe and only take stop order entries (where price didnt move so quickly after the signal bar).

As you are probably aware, Al is happy with at-market swing entries if he really doesnt want to miss out on the trade (you might search this in the 'Fundamental' videos in his course).